The Payment Business

The major headline this month is Global Payments’ proposed acquisition of Worldpay, a deal that would create the world’s largest merchant acquirer. The combined company would handle approximately $3.5 trillion in annual merchant payments across six million clients.

This is the latest twist in Worldpay’s eventful journey. Spun out of Royal Bank of Scotland in 2010, it passed through the hands of Bain Capital and Advent International before going public in London. It was then acquired by US-based Vantiv, which later merged with banking technology firm FIS. The latter eventually admitted it had overreached and sold a majority stake to private equity group GTCR in 2023.

Both FIS and GTCR emerge well-positioned. FIS is set to exchange its remaining interest in Worldpay for Global’s issuer processing business—a relatively low-risk move that enhances its scale in a less competitive part of the payments ecosystem. GTCR, meanwhile, exits at a $24 billion valuation after entering at $18 billion. Nice work.

For Global Payments, the outlook is riskier. On the upside, it buys $2.5 trillion in payment volume, 500,000 enterprise clients, a strong e-commerce footprint, and a market-leading ISV platform, all at an attractive 8.5x EBITDA. Theoretically, there’s significant potential for cross-selling as you can see from this slide from Global’s investor deck.

But execution will be complex. Realising the promised $600 million in annual savings, equivalent to 18% of Worldpay’s cost base, will demand ruthless platform integration and the political skills of Machiavelli. The first steps may be the hardest as sources suggest Worldpay’s senior leadership resisted the deal.

Completion isn’t expected for another 12 months, reflecting multi-jurisdictional regulatory hurdles and competition concerns. With US antitrust policy becoming increasingly transactional, Global may regret not contributing to Trump’s inauguration committee (see below). And in the UK, a combined market share of well over 30% could well trigger a full CMA investigation.

Wall Street gave a snap verdict, and it wasn’t pretty. Global’s shares dropped 22%, touching their lowest level since 2016. Jefferies, an investment bank, wrote “It is clear that scale-driven deals in merchant acquiring are unlikely to work.” One former Worldpay exec posted on LinkedIn: “Global just gave itself epic generational indigestion in order to swallow a business still scarred from being eaten and then, well let's just say, 'ejected' by FIS.”

Less urgent but equally important is that the combined business will need a brand name. What should the world’s largest merchant acquirer be called? Here are a few suggestions—some plausible, some less so, and one that only UK readers will fully appreciate. Take your pick.

Barclays has finalised its long-anticipated deal with Brookfield to overhaul Barclaycard Payments, the UK’s second-largest merchant acquirer, which processes approximately £300 billion annually. The business has struggled with legacy technology, outdated products, and sluggish decision-making, steadily losing share to challengers such as Adyen, Checkout.com and Stripe in the enterprise space, and to modern POS players like Dojo and SumUp in the SME market. Change was overdue but the structure of the Brookfield partnership is highly unconventional.

Initially, Barclays retains ownership and will inject £400 million into the business. Brookfield, a Canadian private equity group, will contribute “expertise” and earn a performance-based incentive. From year three onwards, Brookfield will have the option to acquire up to 70% of the business at market value, with its incentive potentially converting into a further 10% stake. Barclays plans to retain a 20% holding long-term, and the Barclaycard Payments brand will remain in use.

Brookfield’s efforts will be led by Sir Ron Kalifa, with several former colleagues from his days steering Worldpay’s separation from RBS expected to join. One of the partnership’s key tasks is a full-scale technology overhaul. Veterans of Worldpay will remember this as a complex, costly endeavour—close to £1 billion and nearly a decade in the making.

Brookfield’s turnaround efforts won’t be helped by news that myPOS, the Advent-backed acquirer, has snapped up UTP Group, a key Barclaycard ISO partner. UTP’s latest accounts show a 15% drop in revenue to £10 million, with business impacted by new regulations banning excessively long rental contracts for payment devices. Nevertheless, UTP still boasts 68,000 terminals under management today.

This is the second major partner Barclaycard has lost to a competitor, after takepayments was acquired by Global Payments last year. For Brookfield, it underscores the urgency of stabilising the distribution network as it embarks on a sweeping technology and product overhaul.

myPOS, meanwhile, continues its European expansion, having recently acquired LAVEGO AG, a German network operator, and Toporder, a French retail software vendor. Integrating these disparate assets and turning scale into strategy will test the new myPOS leadership.

In other corporate news, Nexi is set to acquire a majority stake in Banca Popolare di Sondrio’s merchant services business for €100 million. Pop Sondrio is seeking to bolster its financial position amid a potential hostile takeover, while Nexi aims to safeguard its existing partnership with the bank.

Rapyd’s acquisition of PayU’s Global Payment Operations (GPO) business now appears less transformative than originally anticipated. The deal will now focus solely on Latin America and Africa, with fast-growing markets in Turkey, India, and Poland remaining under PayU’s control. Separately, Israel-based Rapyd is reportedly raising $300 million at a $3.5 billion valuation, significantly lower than the $9 billion valuation claimed during its 2021 funding round.

Rapyd is a key player in Iceland and sponsors the country’s handball federation. However, the company’s involvement has become more contentious amid the ongoing Gaza conflict. After their recent victory over Israel in the World Cup qualifiers, the Icelandic women’s handball team protested by covering Rapyd’s logo with their hands during a publicity shot.

Figure 1 Photo credit: Visir

According to Finanz-Szene, DZ Bank, the umbrella organisation for Germany’s 700 co-operative banks, has bought out the minority investors in VR Payment, its merchant services arm. This move clears the path for further investment in VR Payment, which acquired Swiss payment gateway Wallee last year. In 2023, VR Payment, which focuses on POS solutions, reported €3 million in operating profit on €147 million revenue.

Fiserv has acquired CCV, the Netherlands-based POS gateway, for an undisclosed sum. A family business founded 65 years ago, CCV was one of the last independent gateways in Europe and holds a strong position in unattended payments, particularly in car parking, EV charging, and vending. Fiserv stated that CCV’s capabilities will help accelerate the distribution of its Clover platform across Europe. In addition, CCV brings a 30% stake in Rubean, the Munich-listed SoftPOS vendor.

With CCV now under the ownership of a major acquirer, merchants will need to look further for truly independent gateways, with options now limited to providers like Freedom Pay, AEVI, Bluecode, and Nepthing.

The US payments sector played a notable role in Donald Trump’s record-breaking $240 million inaugural committee fundraising. Jared Isaacman, founder of Shift4 and the President’s pick to run NASA, contributed $2 million. The Electronic Payment Coalition, an industry group lobbying for high interchange rates, donated $1 million. PayPal gave $250,000, Mastercard $200,000, and Visa, whose heart clearly wasn’t in it, pledged a measly $50,000.

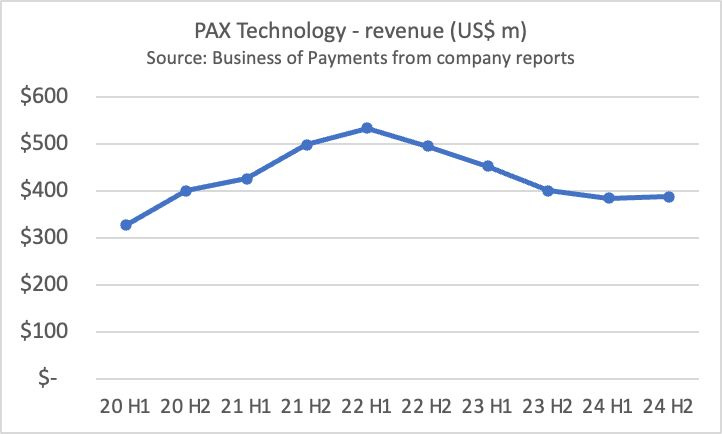

2024 has been a tough year for payment hardware, with the three largest vendors all reporting declining sales, primarily due to weakness in North America.

PAX, a Bermuda-registered, Hong Kong-listed company based in China, saw global revenues fall 3% in H2 2024, with operating profit dropping 43% to $41 million. On a positive note, 60% of terminals sold are now running Android, with the A920 Pro performing particularly well. SaaS revenues from the 14 million devices connected to PAX Store grew 33% to $10 million. Every little helps. EMEA was the only region to show any growth, with sales edging up to $150 million. Management cited "volatile" demand in Germany and Spain, but reported strong sales in the UK, France, Italy, and southeastern Europe.

PAX’s main rivals, Verifone and Ingenico, are both owned by private equity and were late to the Android market. Analysts expect Verifone's revenues to have fallen in 2024, though a rebound is anticipated in 2025. Verifone has raised $235 million from existing investors to reduce its leverage from a hefty 7.7x EBITDA to more sustainable levels. Ingenico's owners also recently refinanced and took a $100 million dividend. Verifone generates 50% of its revenue from services, compared to Ingenico’s 23% and PAX’s just 6%.

MPE 2025

The MPE 25 conference and exhibition held last month at the Berlin Intercontinental showed the European payment industry in good form. Delegate numbers were buoyant, sponsorship strong and there was plenty of innovation on display. MPE remains my favourite conference. The organisers understand their audience and consistently delivery high quality, relevant content. It’s also a friendly event where people are happy to chat to strangers or take a meeting from a cold contact. The networking is unparalleled and vendors I spoke to were very happy with the volume of new sales leads.

Yet several elephants stalked the Berlin Intercontinental during last month’s Merchant Payments Ecosystem conference, notably Europe's need for strategic autonomy, the relevance of stable coins for selling products to Europeans and the continent's underperforming digital platforms. There was plenty of product focused discussion too - notably on payment infrastructure, open banking and smart payment terminals. Make a cup of tea and read my report.

Figure 2 Geoffrey Barraclough at MPE 2025

The new world

While Trump’s tariffs hog the headlines, the worsening geopolitical situation also has significant implications for the European payment industry. Visa and Mastercard dominate merchant payments, with 13 of the 20 eurozone markets relying on international cards at the point of sale. These two American schemes are also the primary means of cross-border consumer transactions. And in the UK, Mastercard even powers the domestic inter-bank system, adding further risk.

This poses a challenge if the US decides to use its influence over merchant payments. Could Visa and Mastercard be instructed to cut off entire countries or merchants that the US administration disapproves of?

As the unthinkable becomes thinkable, Europe is realizing the need for a domestic alternative. And fast.

While the European Central Bank sees the digital euro as a potential solution, this Central Bank Digital Currency (CBDC) remains years away from launch. Europe’s best hope for a domestic rival to Visa and Mastercard lies in the European Payments Initiative (EPI) and its wero scheme. Wero, backed by northern European banks and supported by Nexi and Worldline, will first consolidate domestic products from Belgium, the Netherlands, and France. For example, iDEAL will be co-branded with wero in Q1 2026. By the end of 2026, wero aims to cover eCommerce, POS, and P2P transactions in these markets and in Germany too.

Sensibly, wero plans to cooperate with existing market players rather than compete against them. Acquirers like Nexi/Computop and PPRO will distribute the product to merchants, and consumers will be able to add domestic schemes to their wallets as an alternative funding source.

For wero to compete with cards, it must secure interoperability across European markets. The EPI has issued an open letter calling for European strategic autonomy in payments and inviting other domestic schemes and banks to join as shareholders.

While this move has strong political and consumer support, there are risks that competition will result in fragmentation, and confusion. For example, an alternative coalition of Italy’s Bancomat Pay, Spain’s Bizum, and Portugal’s MB Way plan to launch interoperability between their schemes by June. And Poland’s Blik, which has Mastercard on its share register, aims to expand independently and will only join others for P2P transactions, not merchant payments.

Scheming

Visa has shaken up the acceptance world with the launch of its Acquiring Monitoring Programme (VAMP), significantly increasing pressure on acquirers to reduce fraudulent transactions. VAMP is expected to lead to more stringent underwriting checks, particularly for merchants with high dispute volumes or those in high-risk industries like subscriptions. As a result, these merchants may face fewer acquirer options and higher costs. Solidgate, a PSP specializing in high-risk categories, has published a helpful paper explaining the background.

Mastercard, Visa and Revolut have challenged the UK Payment Systems Regulator’s decision to impose a price-cap on cross-border interchange applied to British cardholders buying from EU merchants. The ability to raise these fees from 0.3% to 1.6% was an unexpected Brexit bonus for UK issuers but one that the competition authorities have finally caught up with.

ISV

We’re seeing the convergence of software and payments, with PSPs either partnering with independent software vendors (ISVS) or commercialising their own software. Selling stand-alone payments to small businesses at scale is getting harder but Europe still lags behind North America in integrating payments and software. A new study from EY Parthenon reveals that 40% of ISVs serving merchants have never integrated payments into their offerings showing that there is plenty of the market left to attack.

Join me at “Embedded Advantage: Unlocking Growth with Payments and AI” hosted by Unipaas, a PF-as-a-service vendor, in London on the evening of 13 May. I’ll be moderating a panel discussion featuring two software vendors that have put payments at the heart of their strategy. If you’d like a ticket, please get in touch with the organisers.

Ryft, a London-based embedded payments vendor targeting eCommerce ISVs and marketplaces, has raised £5.7m. The company claims to serve 1,500 merchants via its partners and offers significant savings compared to Stripe, its key competitor. Ryft is also targeting banks and acquirers that lack their own ISV propositions. One such partner is Clearhaus, a Danish acquirer, using Ryft to reach UK marketplace customers.

Following Shift4’s launch of Skytab in the UK, Worldpay has started distributing Yabie, a Swedish retail and restaurant software product. The solution is branded “Worldpay 360” and looks cool. Given recent news, Worldpay’s sales team may soon also need training on Global Payments POS. Which looks less cool.

Lightspeed, a Canadian ISV earning 60% of its revenue from payment processing, is scaling its field sales and marketing teams across Germany, the UK, France, Switzerland, and Benelux (see chart below). The company sees a major opportunity to serve full-service restaurants with its integrated offering of software, hardware, and payments. In Europe, Lightspeed partners with Molle, Adyen, and Worldline.

Convergence in Italy will get a boost from a new law which mandates ECR/payment integration from January 2026, primarily to automate the transmission of tax information. This provides the perfect opportunity for ISVs and SmartPOS vendors to start customer conversations.

Finally, Paddle, the London-HQ’D merchant-of-record vendor for 5,000 software-as-a-service vendors worldwide, reported £44m losses in 2023 on revenues of £57m in its delayed accounts filed at UK Companies House.

New shopping

Consumers are quickly getting used to asking AI for help with product searches, and it’s only a small step to asking bots to act as your agent to confirm purchases and pay for goods and services. McKinsey has a useful paper explaining what AI agents are and how they might work, while Dave Birch explores the implications for payments. One key question remains: will bots prefer paying with stablecoins for efficiency or with American Express for the rewards?

So far, most innovation has focused on the buy-side. Several vendors have launched products or started companies to help agents become commerce agents, though it’s still unclear what problem we’re aiming to solve. After all, my printer has been automatically ordering and paying for ink on my behalf for years.

We’re waiting to see what innovation arrives on the merchant-side and much of this will need to be about revenue protection. As AI agents arrive at checkout pages with virtual cards or stablecoin wallets, they present both sales opportunities and increased fraud risks. How do you know that the agent represents who it says it does? How can you be sure the agent has authority to agree to your terms and conditions? I’m hoping the industry provides answers soon.

Product

In the UK, Hull-based thankyü offers a fresh approach to tipping. Customers tap a wristband worn by the server, with money flowing directly to the employee—no ePOS integration needed, and it avoids payroll taxes.

Merchant cash advance (MCA), is a fast-growing embedded finance product. Deeper integration with commerce platforms has made distribution easier, and merchants appreciate the flexible terms. Prague-based Flowpay has raised €30m in debt financing and claims to be on track to become the next Czech unicorn. Meanwhile, UK-based Liberis has partnered with Teya to lend to SMEs in the Czech Republic and Slovakia.

In the UK, regulators have been told to promote economic growth. The Financial Conduct Authority has responded with a proposal to remove the £100 cap on contactless transactions. I’d be surprised if this lifts GDP much, especially as PSPs may still set voluntary limits.

Open invoice, the original buy now, pay later approach used by Germans since the dawn of the internet, is under threat from new regulations.

Keep an eye on Revolut. The bank’s full-service SME merchant services, already available in the UK, Ireland, and Italy, have now launched in Spain. The company is highlighting the value of on-us transactions in which it processes transactions from Revolut cards itself. Revolut Pay users earn double loyalty points, while merchants enjoy low fees of 0.5% + 2c per transaction. If Revolut can successfully cross-sell to its large SME customer base, it could capture significant market share from incumbents. While the Revolut POS terminal is sleek, its new ATM is even cooler—though people standing 100 meters away may see your balance.

Figure 3 Photo from Marcel van Oost

Openbanking

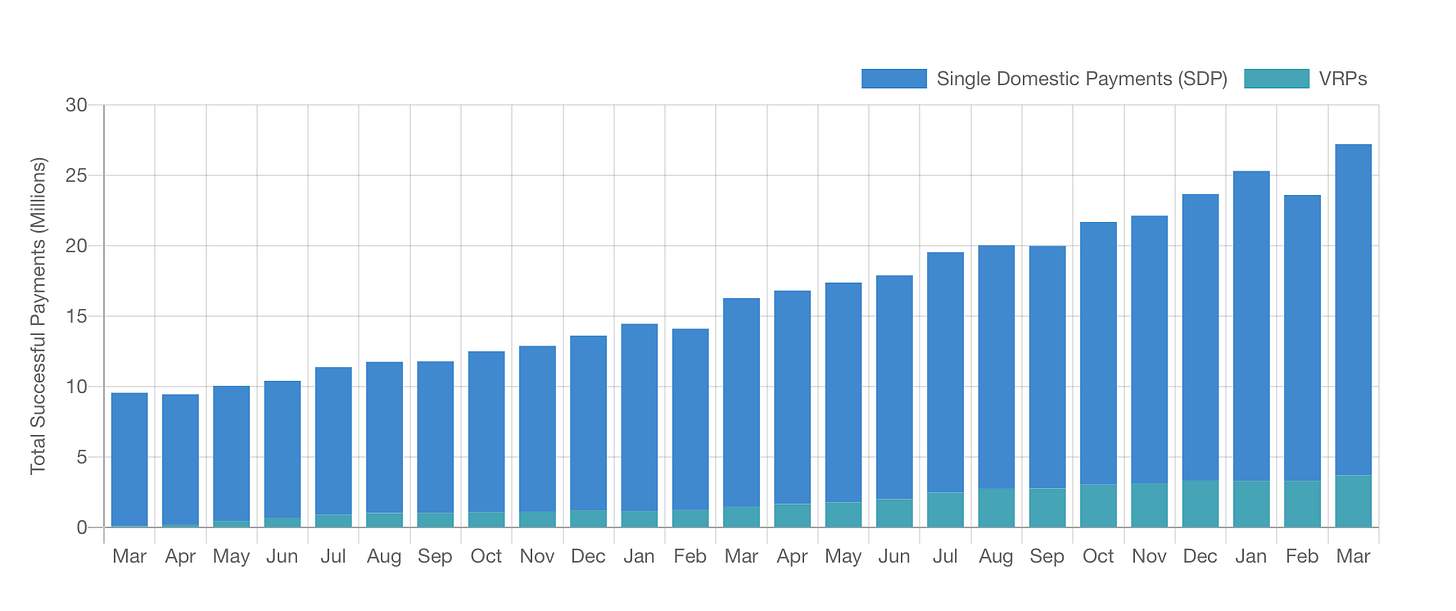

UK open banking payments grew 67% in March, reaching 27m transactions. While positive, this isn’t yet the exponential growth many vendors’ business plans were based on.

Figure 4 Source: Openbanking.org

The Financial Conduct Authority (FCA) has announced it will prioritise putting UK open banking on “a commercially sustainable footing.” While standard APIs will remain free, banks will be encouraged to offer premium services, such as providing merchants with address details.

Although this is a step in the right direction, it’s not enough. For open banking to rival card payments, there needs to be a scheme with a widely recognized brand and a clear set of rules for authorizations, refunds, and dispute management. And we need to accept that the 0.2% debit card interchange fee is a reasonable benchmark.

Instead of marketing themselves as cheaper than debit, open banking vendors should focus on delivering a better customer experience. Trustly, for instance, uses the technology to reduce onboarding times for new users on gambling websites to just 20 seconds. Whether or not you think this is a good for society, it’s no surprise that Trustly is one of the few consistently profitable A2A providers in Europe.

PSE consulting has looked whether Britain could spin-up a domestic scheme based on open banking. Their conclusion: more work is needed. For example, there’s no authorisation messaging, and we lack systems to provide real-time confirmation to merchants’ POS systems. Simply showing a confirmation screen on a banking app won’t be enough, scammers can already fake these.

The long-anticipated consolidation of loss-making open banking start-ups is underway. Banked has acquired VibePay, a London-based company that offers SMEs free open banking transactions, monetised with a rather complex loyalty program tied to conversational commerce. The combined entity is valued at "over $100m," according to reports.

Banked should be one of the open banking winners. It has global reach and financial backing from bluechip investors such as Citi, NAB, and Bank of America. However, if the combined entity is valued at just $100m valuation, this may suggest that investor enthusiasm in the sector is cooling.

Lastly, Tink, the Stockholm-based provider owned by Visa, announced 10,000 merchants are using its Pay by Bank solution and reached a new peak of €100m processed in a single day.

Cash

Worldpay’s latest global payment survey shows that cash substitution is nearing its end in many markets, with cash use at point of sale declining just 2% per year. This suggests we may have reached the core group of people who either can't or won’t use electronic payments.

There’s also strong resilience argument for keeping some level of cash payments in any country. Sweden’s central bank has urged it Government to mandate cash acceptance in key product categories.

Retailers, now accepting the persistence of cash, are updating their infrastructure. At this month’s Retail Technology Show in London, I was surprised to see so much cash handling technology on display. However, the same can’t be said for banknote printers. De La Rue, which supplies cash to half the world’s central banks, saw its revenues drop 18% to £207m in 2024.

Crypto Corner

Stablecoins are making an impact in international treasury and money remittances, but these fall outside the scope of this newsletter. Merchants remain largely indifferent, with crypto hardly mentioned at the MPE conference in Berlin. For now, neither Bitcoin nor stablecoins are expected to play a significant role in enabling mainstream European merchants to sell to other Europeans.

Of course, crypto is still useful for gambling, money laundering and crime. The FT reports that crypto casinos generated $80bn of gross gaming revenue last year. These operators, incorporated legally in the usual locations such as Gibraltar and Malta, are accessed through “VPN, mirror links or URL directions” by punters looking to evade local prohibitions.

In the UK, a man received four years in prison for facilitating money laundering through the operation of 12 crypto ATMs. Officials said he was marking up transactions 30%-60%.

In other news

The secret of Flatpay’s phenomenal growth is at the top of the sales funnel, according to its management. The marketing team use an AI solution from Kernel that filters hundreds of thousands of merchants into a manageable target list for its sales team.

The German payment industry has set up a new initiative called “Deutschland bezhalt digital inspired by the successful Cashfree Poland project. It offers a free terminal and free processing of €50,000 of transactions to merchants that don’t yet accept electronic money. This lines up with speculation that the new German government will make digital payment acceptance mandatory.

Worldline’s new management has ordered staff back to the office. According to its trade union, the CEO explained “It’s very important for all of us to be much more present in the offices, to fill the purse of the company…. And that’s something we can’t do when we are working from home.”

Adyen suffered a major denial of service attack that “generated millions of requests per minute, originating from a globally distributed and constantly shifting set of IP addresses.”

An unexpected bonus of the increasingly cash free economy is fewer kids hospitalised after swallowing coins. “Historically, coins accounted for over 75% of objects swallowed by children under six years old,” explained a doctor.

And finally

A reminder to product teams to always make it clear where customers should tap their cards.

Figure 5 Photo: Simon Kemp

Where to find me

I’ll be at Money 20/20 in Amsterdam on 3/4 June and ePay Summit in London on 28 October.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com

A bumper issue this month, Geoff. Always a banger of a read. Thanks

Most mergers end up destroying value for shareholders. As you point out, integrating both operations is easier said than done! Time will tell.