The summer’s results season showed a mixed picture from Europe’s three leading payment businesses.

Adyen stood out once again. Revenue grew 24% in the first half of the year as its omni-channel strategy helped drive volumes on both sides of the Atlantic. Adyen now boasts 357 “unified commerce” merchants processing over $10m in eCommerce and POS transactions. The in-store retail business is growing swiftly and Adyen now has almost 500K terminals in the field.

Nexi reassured investors with a solid 6% sales increase accompanied by a positive outlook for the rest of 2024. This comes despite ongoing delays concluding the JV with Sabadell.

Worldline disappointed once again. Revenue was up just 3% and EBITDA fell 1% with management blaming Europe’s slowing economy and bad spring weather. It’s never a good sign when a payment business complains about rain.

Worldline needs to cut costs. Hundreds of staff will exit in the remaining months of 2024 including 170 at PayOne, the troubled joint venture with German savings banks. You’ll find more details about Worldline’s H1 results on the Business of Payments blog.

More results news at Business of Payments:

Merchant revenue growth drops to 7% for Global Payments Europe

PagoNxt – cost of closing German operations masks a positive underlying performance

The major Greek banks sold most or all of their merchant services units to international players during 2022/3 for a total of almost €1bn. Haris Karonis, founder of Viva Wallet, has predicted the banks will regret divesting these businesses but, so far, it’s hard to say they were wrong. Only Cardlink (Worldline) is making a profit and not a big one at that.

Greece should be a good market for payments. The domestic cash to card switch has a long way to run and there are plenty of high-margin cross-border transactions from tourists. Less positively, the new government in Athens has made it clear that it will legislate to reduce merchant services fees for SMEs if the acquirers don’t voluntarily take action.

Large or small, all merchant acquirers eagerly await the annual Nilson rankings which list the European players by transactions and payment volume. The 2023 numbers give a top ten of Worldpay, Nexi, Barclays, Fiserv, Adyen, Worldline, Global Payments, JP Morgan, Credit Agricole and Elavon but some observers have questioned the methodology. Several of the fast-growing digital acquirers such as Stripe, Nuvei, Paysafe and Checkout don’t even figure in the top 45 according to Nilson.

Wherever a business sits in Nilson’s league tables, competition is getting hotter as domestic champions in Asia move westwards. For example, two market leaders from India have announced European expansion plans in response to tougher market conditions at home.

Juspay, a payment orchestrator backed by Softbank, has hired James Lloyd, ex Citibank, to boost its European presence from a new base in Dublin. Juspay claims 300 processor connections and $500bn volume from 500 enterprise customers.

Pine Labs, a POS-focused PSP under some valuation pressure, has hired Dounia Jouron, ex Adyen, to spearhead its international growth.

In corporate activity, Shift4 is buying Givex for C$200m (€132m) at a very generous c.30x EBITDA. Givex is most famous for its gift cards but has grown its retail POS portfolio to 1.900 merchant locations following the acquisition of Counter Solutions in the UK. Software accounts for 10% of worldwide revenue. Givex Pay (provided by Adyen) provides an extra 20%. Moving this volume to its own products will be an early win for Shift4.

Dejavoo, a US POS technology vendor offering white label solutions to PSPs (primarily with Castles hardware) has acquired Z-Credit, an Israeli equivalent. But we already knew this.

DNA Payments, a London based acquirer/PSP owned by two Kazakh former bankers, is reported to be considering purchasing the acquiring business of Card Complete, the largest player in Austria. Card Complete is losing money and needs significant technology investment. Unicredit, the Italian bank, is Card Complete’s largest shareholder and has been trying to sell its stake for some time.

Turning to fundraising, two start-ups targeting the complicated but fast-growing world of marketplace payments have secured new money.

Revenew, founded by two former Checkout execs, has raised $4.5m to help marketplaces and other merchants with complex payment needs to manage their costs, including reconciling IC++ pricing from multiple acquirers.

Trustap, based in Cork, Ireland, which offers escrow payments built on Stripe’s APIs for marketplaces, has raised a total of $9m.

In regulatory news VR Payment, the merchant services arm of the Volksbanken Raiffeisenbanken, was fined €40,000 for poor record keeping related to its anti-money laundering obligations. And Lemonway, a French marketplace payment specialist has been banned by the Bank of Italy from taking on new customers. This action presents real concerns for the local crowdfunding industry which is heavily reliant on Lemonway as a supplier.

Scheming

Visa and Mastercard continue to prosper in Europe. The two schemes’ combined payment volume rose 11% in Q2. You can read more at Business of Payments.

Visa is very pleased with its sponsorship of the Paris Olympic Games which, it claims, saw a significant increase in foreign card spend in France, notably with visitors from US, Brazil and Japan. Theatres and museums saw the largest boost. Adyen also published statistics from its merchants in France which highlighted that 25% of US spending used dynamic currency conversion to pay in dollars, not euros. Good news for merchants and for Adyen that together share a 3% mark-up on each sale.

Payments at the Olympics were caught in the culture wars as Twitter posts falsely claimed that Paris was empty because the games were “cash free.” In fact, vendors did generally accept cash. The friction was mainly caused when visitors discovered the Olympics were “Mastercard free.” This is a long-standing condition of Visa’s sponsorship but annoying, nonetheless.

The UK’s Payment Systems Regulator is proposing to cap Interchange on eCommerce transactions from EU cardholders at UK merchants at the pre-Brexit levels of 0.2% or 0.3%. This is likely to save British businesses £150-£200m each year, a sum which ultimately finds its way to European banks today. Unsurprisingly, these banks are objecting.

In more good news for merchants, Visa and Mastercard have agreed to maintain the 0.2%/0.3% cap on inter-regional Interchange at POS in the EU until at least 2029.

Visa and Mastercard pass interchange to the issuing banks. The two schemes make their own cross-border profits from additional fees and foreign exchange commissions. For example, Visa’s USD/EUR mark-up is 0.21%. The ex-CEO of Wise (who knows something about FX) explains how it works.

There is a threat looming. Visa and Mastercard’s dominance of cross-border consumer payments will be challenged by increased inter-operability of the new wave of mobile-centric domestic payment schemes and standards. This will allow people to spend money abroad without needing a credit card.

Alipay, the very popular payment method in China, is a good example. Alipay is now interoperable with 30 other Asian QR based wallets and 14 of these are already connected to its European platform. This means Alipay’s 400,000 European merchants can accept payments from the most popular wallets used by visitors from Philippines, Indonesia and elsewhere.

Alipay is rapidly expanding its acceptance footprint in Europe. BNP Paribas will offer Alipay to its merchants and DNA Payments announced it would add Alipay to 50.000 POS terminals in the UK. Freenow, the taxi service, has enabled Alipay in seven countries including France, Germany and Italy. Find out more in this interview with Alipay’s European CEO.

ISV

The emergence of software vendors as a key distribution channel is the biggest shake-up the payment industry has seen for many years. Who is winning? Nick Dunse from Shuttle, a business that connects shopping carts and payment processors, counts 1986 software platforms of which a remarkable 59% use Stripe.

Shuttle’s figures refer to number of connections rather than payment volume. Adyen has relatively few ISVs but is signing the large ones. Latest examples include One Iota, a UK in-store ePOS vendor which counts Hugo Boss among its clients.

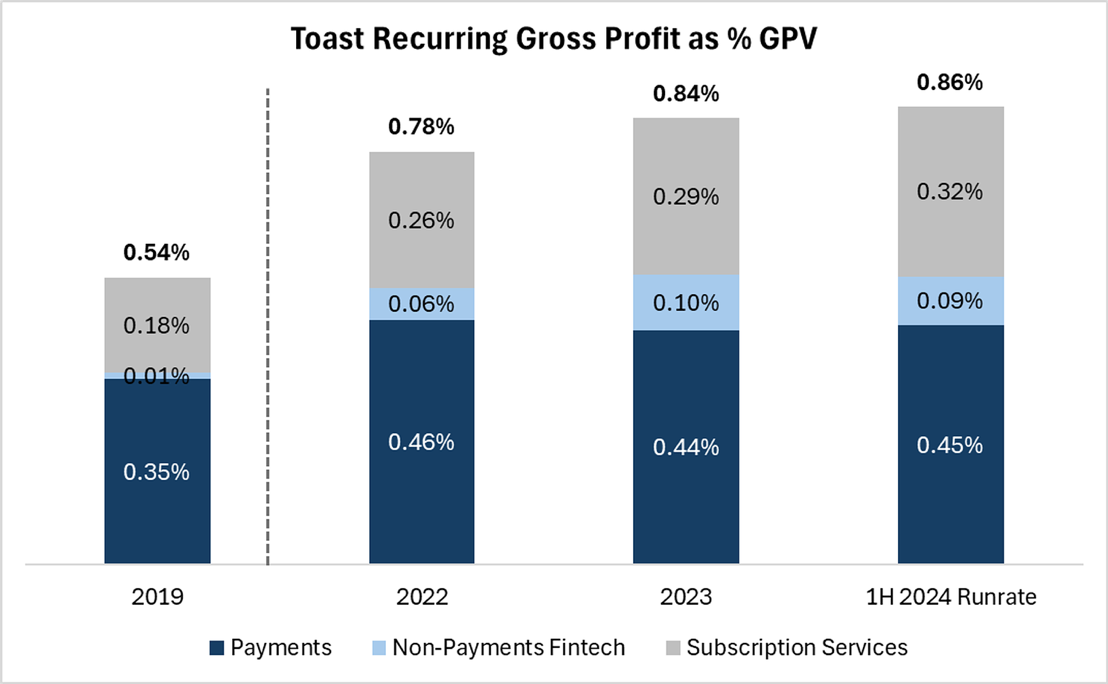

ISVs can more than double their revenue from their core business of selling software by adding payments and other financial services to the merchant bundle. Toast, a US restaurant software provider is a textbook example (see chart below). Alexandre Dewez explains the economics.

Acquirers need to buy, build or partner with ISVs to secure this new distribution channel. A good example is Swedbank, which participated in a €20m funding round for Yabie, a Swedish ePOS start-up focused on small retailers and cafes. The investment is paying off. Yabie generated €12m sales in 2023 from 11,000 merchant customers processing with Swedbank although it will partner with Adyen to support clients outside the Nordics.

Other partnership news is coming thick and fast as the ecosystem reassembles itself around ISVs.

Cardstream, a UK based gateway, has ambitions to support ISVs with its new payment-facilitator-as-a-service proposition. Surfboard, a Swedish ePOS and SoftPOS vendor, is the first customer and will take a joint proposition to market.

FreedomPay, the US POS gateway, is also looking to grow its European business, supplying ISVs with acquirer-agnostic terminals and transaction routing. It has announced new partnerships with Zonal, a UK ISV focused on hospitality (using Castles devices) and LS Retail, a mid-market retail ePOS vendor based on Microsoft Dynamics. LS offers acquiring from Adyen and Elavon.

New Shopping

2023 was a record year for self-checkout with over 217,000 machines delivered worldwide, up 12% on the previous year. Europe is the fastest growing region with growth powered by large scale implementations at grocery and pharmacy chains in the UK and Germany.

Some years ago, I pitched self-checkout to Primark. The fast fashion brand wasn’t interested. “How would we get the coat hangers back?” the CIO asked. Times change and Primark is now rapidly installing ranks of self-checkout machines. Customers are not so happy. 78% of Yahoo readers said the machines (Toshiba ECRs linked to Ingenico Lane 3000 payment terminals) make shopping worse.

Nexi has partnered with shopreme, based in Graz, Austria to bring integrated payment/mobile checkout to merchants, initially in DACH markets with Italy and Nordics to follow.

One of the key problems with self-checkout is shrinkage. Dollar General in the US is removing self-checkout machines because the customers are stealing too much.

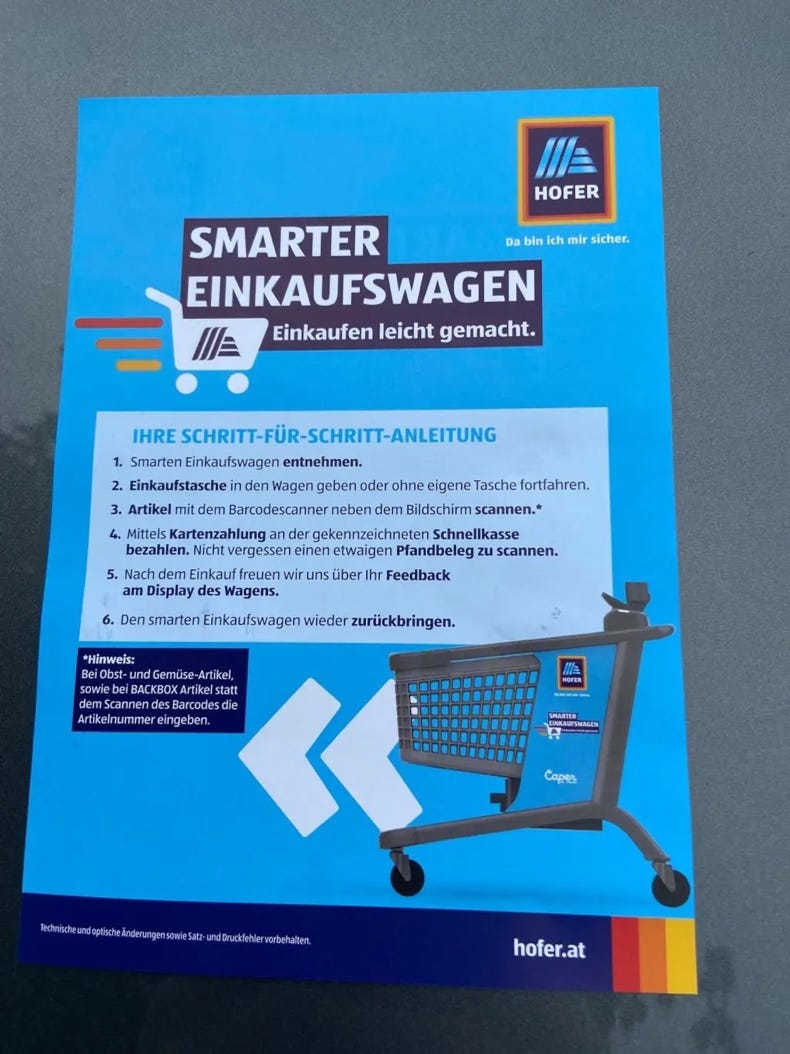

Smart carts offer a half-way house between self-checkout and fully autonomous shops. The sensors and cameras sit in the shopping trolley not the store’s shelving units.

Aldi is trialling Caper Carts, a digital shopping trolley supplied by Instacart, at an outlet in Austria, having already introduced the carts in the US. This is Aldi’s second such pilot, the first using technology from Shopic which attaches to existing carts, didn’t last long.

Photo: Stephan Ruschen

Home shopping was meant to be transformed by voice commerce enabled by Amazon’s 500m Alexa devices. The reality is that these gadgets are not generating revenue despite the massive investment. “We’re worried we’ve hired 10,000 people and we’ve built a smart timer,” a disappointed employee told the press. It’s time for a rethink.

Will AI give natural language commerce the boost it needs? Dan Wagner, a colourful British entrepreneur, is back with Rezolve, an AI powered conversational commerce plug-in which, he confidently expects, will be adopted by most leading eCommerce websites. Rezolve has reversed into a SPAC listed on NASDAQ and now commands an improbable valuation of $1.7bn. If you’ve experience working with Rezolve, let me know.

Biometrics

Most Europeans and most Americans can pay for things simply by using the biometric authentication already set up with their mobile phone. Yet vendors continue to experiment with alternative payment flows in which the biometrics are stored by the merchant or PSP.

Payeye, a Polish start-up which is pioneering payments based on iris and facial recognition, has signed a partnership with Worldline to commercialise its eyepos 3 terminal outside Poland. Recognising that the technology may take some time to mature, the terminal also takes cards. ITcard remains Payeye’s domestic partner.

Facial recognition software is also said to be used in these new ammunition vending machines that have appeared in grocery stores across the USA. The AI ensures that customers are over 21 or at least look over 21. So, that’s alright then.

Ingenico is working on palm-based payments. Shoppers register their phone number, payment card and have the veins of their hand mapped by some clever software from Fujitsu. Carrefour began testing the system in one of its Paris stores ready for the Olympics.

What could go wrong? Well, in Washington DC a murder victim was found without one his thumbs which had been cut off to gain access to his mobile payment app and steal his money. Less extreme no less worrying, thieves have stolen selfies and ID numbers for 80% of the population of El Salvador.

One-click to heaven

A fascinating battle is emerging for control of eCommerce guest checkouts. A number of global players are vying to improve conversion rates by securely storing shoppers’ payment credentials to enable one-click shopping.

Apple Pay is the market leader and makes its money through charging the credit card issuers c.15bp of the transaction value. Others, such as Stripe and Shopify, hope their pay buttons will encourage more merchants to choose their payment processing or commerce software.

It's becoming a crowded market. Adyen announced it would include PayPal’s guest checkout product, Fastlane, in its merchant offer, sending PayPal’s share price soaring. Meanwhile, a consortium of US banks has launched their own one-click solution called Paze and Bolt (which many thought was dead or dying) has raised money at $14bn valuation. Or maybe not $14bn. It’s complicated.

Although most one-click checkouts back the transaction onto a credit card, Visa and Mastercard are worried about disintermediation and have put renewed focus on Click to Pay, their own guest checkout product.

Despite recent partnership announcements, such as Lidl, most observers feel believe that Click to Pay has come to market too late to gain widespread consumer adoption. Drew Edmond explains why Click to Pay is going to struggle.

SoftPOS

SoftPOS, a downloadable payment application which turns any consumer device into a payment terminal, is moving quickly to the mainstream. Adyen has announced Prada will be using its softPOS at all its stores worldwide.

ISVs will be key partners for SoftPOS vendors. SoftPay.io from Copenhagen is making particularly good progress with this channel. SoftPay has announced merchant rollouts at Swedish Railways with Extenda Retail, Kitch’n, a homeware retailer, with EG Retail and at rock festivals with Tickster.

As predicted, eService, the largest acquirer in Poland, has terminated LitePOS, its softPOS product based on MyPinPad’s technology. eService will now sell Global Payments’ TOM (terminal on mobile) instead. This micro-merchant proposition retails at 5 PLN (€1.10) per month + transaction fees.

Carrefour, the French supermarket, piloted Marketpay’s PayWish softPOS solution at 20 stores in Paris during the Olympics.

Openbanking

UK vendors have begun to realise that “the biggest banks are not prioritising building up their capability or technology,” sparking calls for the government to rescue open banking from its current disappointing state. For example, Yapily’s CEO has called for early legislation to create a permanent entity to manage the open banking ecosystem, oblige the banks to take the technology seriously and mandate a funding model that no longer relies on voluntary contributions.

Valuations are beginning to reflect a growing realisation that open banking will take longer to mature than many had hoped. Paypoint, a UK ISO and bill payment specialist, has bought a majority share of OB Connect at a valuation of just c.£30m. This is a great exit for the management and a fine return on the £3m capital invested but indicates that the sector is unlikely to produce many unicorns. OB Connect, which has 25 staff, lost c.£0.8m in 2023.

In merchant news, the most exciting announcement has come from Wetherspoons, a large British pub operator, which is now offering open banking as a payment option within its consumer app. Wetherspoons is using Natwest’s PayIT product.

Could this be the game changer that pushes consumers across the chasm to mass adoption of open banking payments? I’d say it’s unlikely unless the pub operator offers incentives for people to try this new way of paying, Matt Jones explains how merchants could make incentives work for them and their customers.

Even so, open banking adoption will be slow if it relies on hosted payment pages and redirects. Customer experience needs to be slicker. Boodil, a UK start-up, believes it is first to market with an embedded solution that sits within the merchant’s own payment page. Yapily is managing the APIs behind the scenes.

Could POS payments provide open banking a boost? DNA Payments, which is having a busy time of late, has added open banking to its payment terminals. Shoppers scan a QR code produced by the POS. Ecospend, Trustly’s UK subsidiary, is providing the technology. The value to consumers, used to tapping smartphones on payment terminals, is not clear.

Away from the UK, Kevin, the high profile Vilnius-based open banking start-up, has been banned from taking new customers by the Bank of Lithuania. Kevin, which raised $65m in 2022, is four months late submitting its accounts.

There is a small but growing argument for Request to Pay (RTP) as an alternative to open banking for consumer-to-business payments. Toriipay, a Polish start-up founded by former Kevin execs, believes RTP offers the standardisation missing from open banking today. RTP is a messaging system sitting on top of SEPA Instant as you can see from the video.

Crypto corner

The continual drip of bad news stories about crypto criminals hasn’t dented market enthusiasm. Bitcoin trades near an all-time high.

Where do you buy your crypto? Avoid ATMs in Germany. BAFIN seized 13 crypto ATMs and 250.000 euros after suspicions of money laundering. Locals took to LinkedIn to complain that this wasn’t an efficient use of 60 investigating officers.

Photo: BAFIN

€250K is a low number for a crypto criminal. Global theft of cryptocurrencies is likely to reach $3bn in 2024 up 75% on last year. Centralised exchanges are the main target, experts say. If you find yourself with billions in stolen cryptocurrency, Dave Birch explains, hypothetically, how you might go about hiding the source of funds.

The UK regulator has issued over 1,000 warnings to crypto firms since October leading to the removal of 48 apps from the local app stores. It may also have led many crypto companies avoiding the UK and setting up elsewhere which is no bad thing.

It’s depressing that established brands are still mixed up with this boondoggle. Mastercard continues issuing crypto cards. These convert your favourited digital currency to actual dollars to pay the merchant although Ferrari will now let you buy one of its sports cars using crypto following requests from “wealthy customers.” The dealers receive real money. Somebody makes a spread. It’s not clear who.

In other news

Some helpful research from McKinsey on 15 technology trends you need to know. Next-gen software development comes top, closely followed by applied AI.

PCM crunches the European numbers and concludes the value of card payments grew 15% in 2023.

Bancomat celebrated its inclusion in Apple Pay with a nationwide bus tour of Italy and free ice-lollies.

eService, the largest acquirer in central and eastern Europe, is 25 years old.

Go Cardless alumni have gone on to start ten businesses of their own.

Many large retailers’ POS estates are reaching end of life. PSE consulting explains the choices.

Every payment CIO worries about cyber attacks but 95% of incidents are home-grown screw ups in their own technology team, according to a survey from BAFIN.

And finally

It’s remarkable to find Americans still writing cheques. Target, the retail giant, will finally stop accepting them but there are some things for which only a cheque will do. The cast of Saturday Night Live explain. Enjoy.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com

This was great ty