Business of Payments

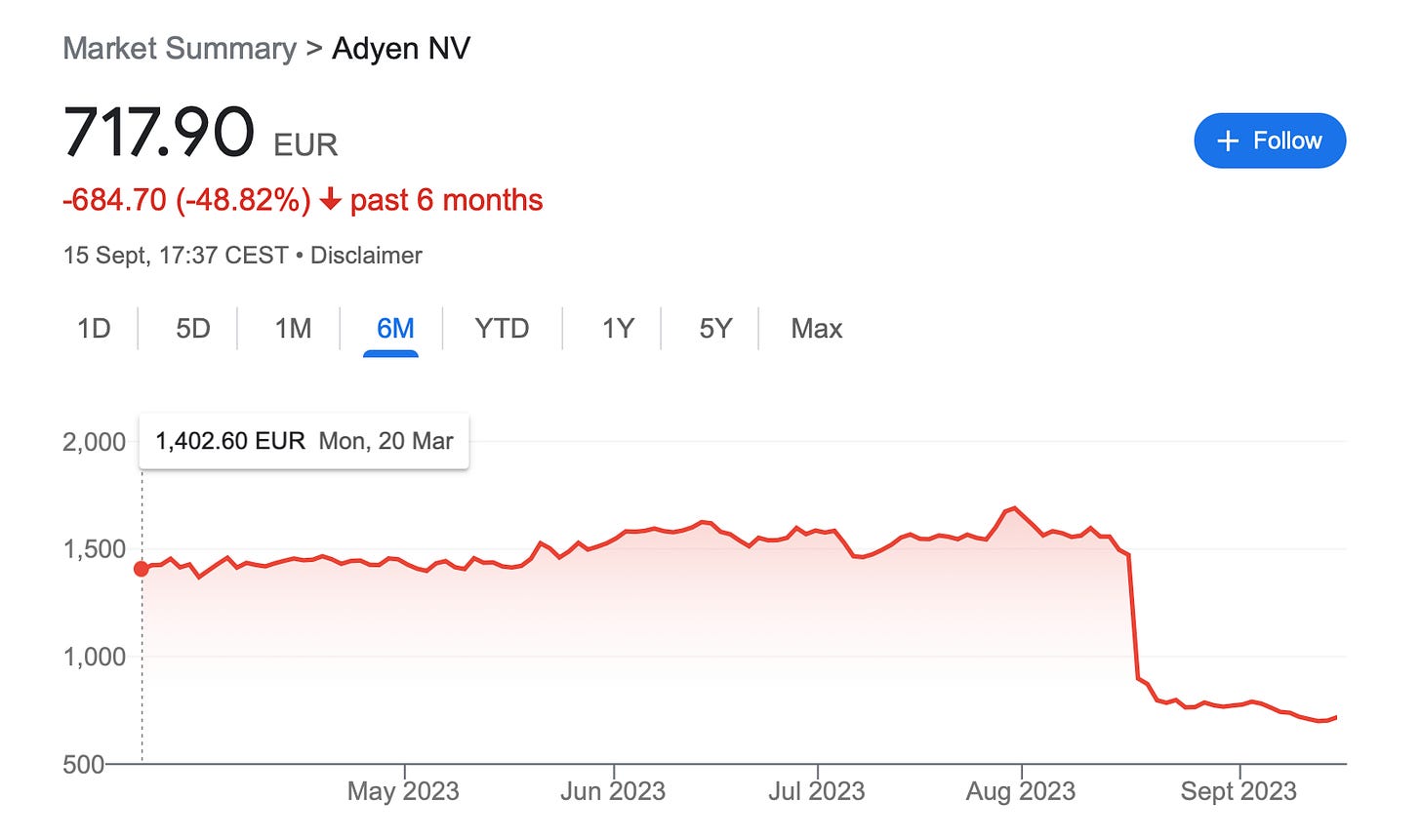

Over $600bn has been knocked off the value of the world’s top ten merchant acquirers over the last 18 months. Adyen’s disappointing H1 results only added to the summer gloom surrounding the global payments industry.

While Adyen’s performance was objectively pretty good – revenue up 21% with EBITDA margins of 43% - analysts had been expecting faster growth and took fright at the cost of extra investment in people and product. The stock price which peaked at €2700 in 2021 collapsed from €1700 to just €700.

Adyen bulls point out that the Dutch acquirer/processor is strong in Europe where the level of payment complexity delivers consistently higher margins than the US. And its growing POS business sets it apart from online focused processors such as Stripe and Checkout.

But Adyen has suffered badly in North America where a price war is raging among large acquirers competing for business from large digital merchants. One beneficiary has been PayPal which is reported to be hoovering up volume via its Braintree brand at a margin of less than 2c per transaction.

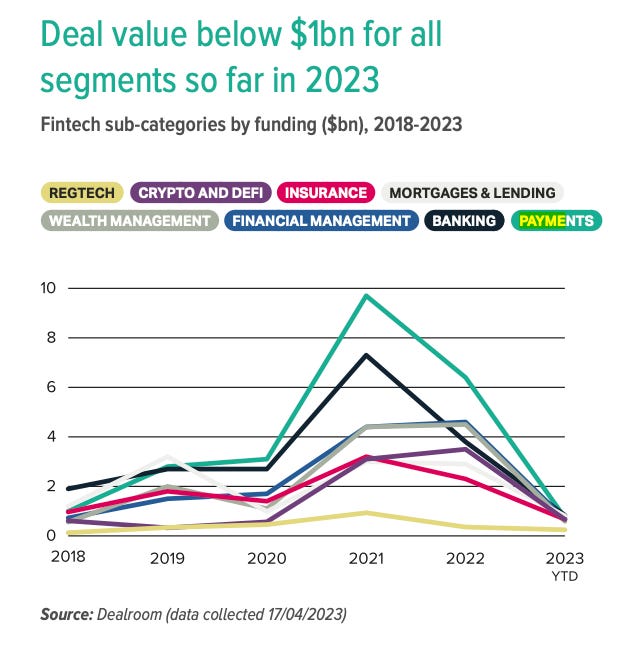

Of course, the collapse in value isn’t restricted to merchant acquirers. Fintech is generally under the cosh. Is it an apocalypse? No, says Ben Robinson, who argues manufacturing and distribution of financial services will continue to separate, opening a significant opportunity for embedded finance sold to merchants via ISVs, some of which now generate >60% of revenue from payments.

Analysis from Sifted Research records a sharp fall in new Fintech finance rounds. Start-ups now have no choice but to prioritise conventional business metrics such a cashflow and margin. “The familiar VC growth strategy — losing money for years to acquire new customers — is not a winning pitch right now.”

There’s full coverage of the payment reporting season in this round-up from FXC while Strawhacker give details on the US merchant acquiring numbers. Fiserv comes out best.

From the Business of Payments blog:

Miura, the design-led payment terminal vendor, is back in the black as its Asia Pacific sales picked up after the pandemic.

AIB Merchant Services grew net revenue 16% in 2022 with a particularly strong performance in its home market of Ireland.

Lloyds Cardnet in the UK was hit by the loss of two large financial institution clients but underlying volume grew just 6%.

New Payment Innovation, the rebranded Irish arm of NetPay Solutions has already hired 25 staff. Management is investing €2m and aiming for 20% share of the Irish card payment market.

Following the announcement of the $610m purchase of the less interesting parts of PayU, Arik Shtilman, Rapyd’s colourful CEO, gave a long interview with FXC revealing that the combined business will process $120bn payment volume from 250,000 clients and generate revenues of c.$1bn. This is only the start. Shtilman maintains that Rapyd will hit $2bn revenue and $400m EBITDA by 2026. We’ll be following this very closely.

dLocal, one of the small group of cross-border merchant payment specialists which competes with Rapyd, may be up for sale. Trading through a UK company listed on NASDAQ, regulated in Malta and with an HQ in Uruguay, dLocal has shrugged off a short-selling attack and a fraud probe to post annual revenues of c.$600m. Rapyd would certainly be interested. Maybe Worldpay too.

Like Don Quixote tilting at windmills, EVO is not giving up on its €1bn damages claim against Santander. It alleges the Spanish bank failed to deliver enough sales leads. The American acquirer, now owned by Global Payments, is appealing a lower court decision in favour of Santander. Meanwhile, Universal Payments, EVO’s Spanish unit, is being merged into Commercia, Global Payments’ joint venture with La Caixa.

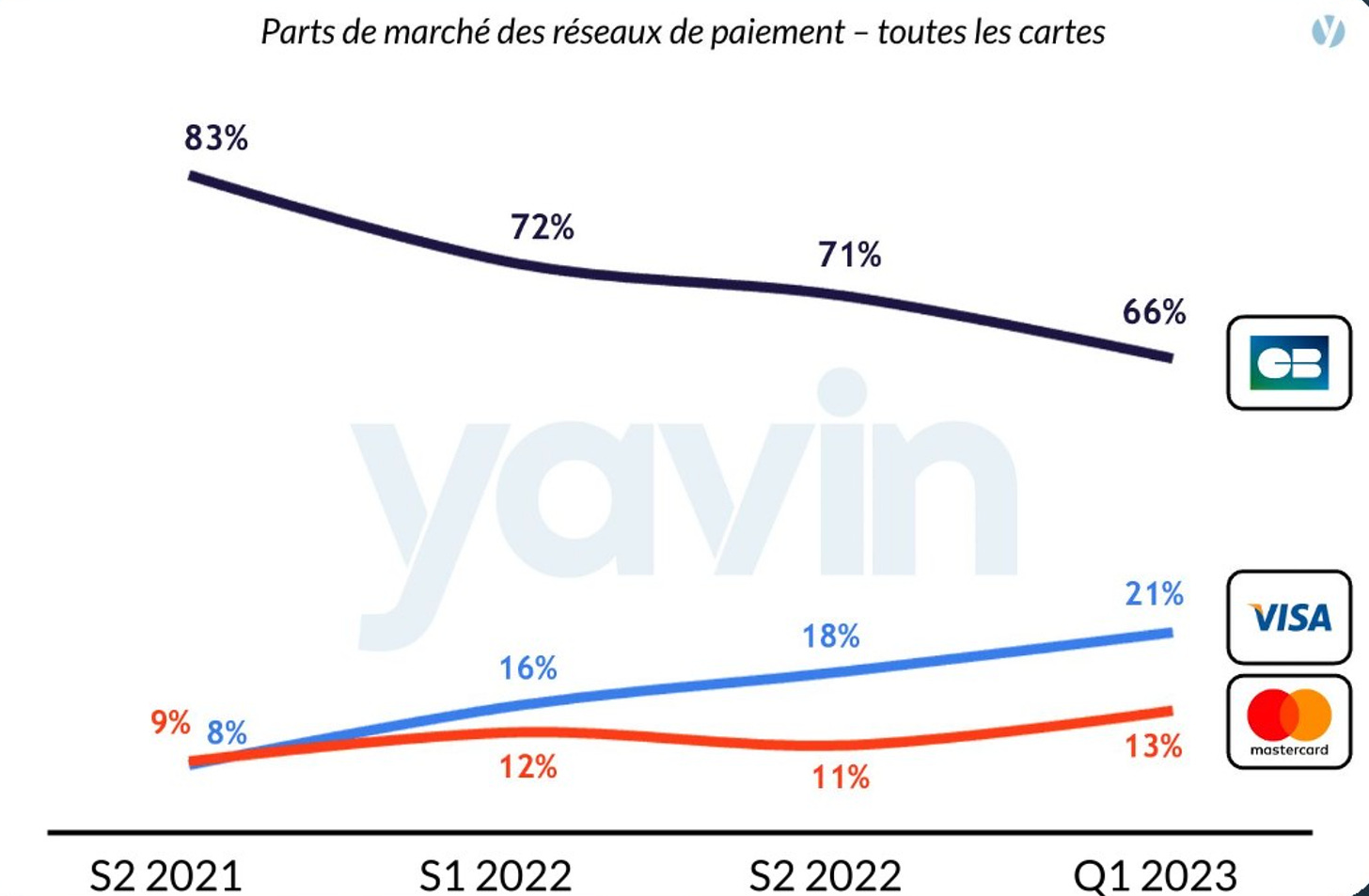

Despite the global dominance of Visa and Mastercard, there’s plenty of life in domestic payment schemes. In this short review, Edgard Dunn counts 90 of them, including many in Europe. Germany’s Girocard reported volumes up 15% in H1 2023 and Blik, the wildly successful Polish mobile payment standard, announced eCommerce volumes up 42%

In contrast, Carte Bancaire, the long established French domestic scheme is losing ground to the international brands. Some French banks have stopped co-branding their Visa/Mastercard cards with Carte Bancaire and the consumer preference for Apple/ GooglePay has stimulated usage of the international brands.

New Shopping

Rapid urban grocery delivery is in trouble. The sector has absorbed more capital than it took to put Americans into space with little return. There is simply no business model, says the FT.

Maybe that’s why Instacart, the leading US player, is expanding deeper into the grocery value chain with technology and data products. It bought Caper, a smart cart vendor for $350m in 2021. Schmucks is the latest retailer to adopt the carts, commencing with 10-20 in each store.

Smart carts make a humane alternative to the self-checkout machines that are making people lonelier. Trader Joe’s CEO pledged never to replace employees with machines, saying "I have fun bagging groceries and working at the register. Self-checkout is work. I don't want that."

Turning to biometrics, it seems Amazon One, the retail giant’s new palm-payments product, is about more than shopper convenience. It’s part of a plan to own a central ID verification system that would help Amazon compete with Google and Apple. Amazon One uses generative AI. Obviously.

Payface, a Brazilian start-up, says its facial recognition payment product will be in 2,000 supermarkets by the end of 2023. The company just raised an extra $3m following a $6m funding round last year.

There’s nothing more dispiriting than a long queue of cars at a drive-through coffee shop. Starbucks is experimenting with geo-location so people can just pick up their coffee from the hatch and be on their way.

Subscription commerce

New academic research analysing card transaction data shows customer “inattention” boosts subscription revenues between 14% and 200% depending on the merchant. No wonder regulators are beginning to show an interest in helping shoppers terminate unwanted subscriptions.

Payment providers need to be alert to scammers that dupe consumers into signing up for bogus subscriptions. PayOne, Worldine’s German eCommerce payment business, has been banned from onboarding new high-risk customers. The regulator is unhappy that PayOne had been processing transactions linked to fraudulent subscriptions, phishing and fake stores.

Similarly, ING is being sued for €14m lost by investors defrauded by customers of Payvision, the PSP acquired by the Dutch bank in 2018 for €375m. The Dutch central bank has said that Payvision deliberately ignored signals about fraud from its clients. ING was obliged to close Payvision business and write off the purchase price.

And fraud is getting easier. Why build your own criminal infrastructure when you can use scam-as-a-service to create phishing or fake advertising content? The product, available via Telegram, even includes a payment gateway and price optimisation tools.

Product

In a U-turn you can see from outer space, Shopify will make “Buy with Prime” available to its 1.75m merchants. Having previously said Buy with Prime violated its terms of service, Shopify is now encouraging its customers to use Amazon’s global logistics operations. Shopify will processes all transactions via Shopify Pay, a white label arrangement with Stripe. Here’s some informed commentary on LinkedIn.

Car Commerce has long been a focus for payment innovation but has delivered little useful product to show for the effort. BMW has abandoned its second attempt to sell heated seats on subscription. Customers were angry at paying to turn on a feature in a car they’d already bought. A BMW director commented: “People feel that they paid double – which was actually not true, but perception is reality.”

Pace Drive and ryd, two German start-ups developing alternative payment apps for buying petrol seem to be struggling. Commentators point to the declining market for auto fuel and the high cost of customer acquisition. Undeterred, Henderson has introduced a Fuel Pay app targeted at independent service stations in the UK that can’t or won’t afford outdoor payment terminals.

Payment apps make more sense for supermarkets which can use them to integrate complex loyalty programs into a simple checkout experience. Rewe, the German grocer, is ditching Payback, a 3rd party loyalty programme, and launching Rewe Pay in 2024.

Two small UK acquirers made interesting announcements. Acquired.com has launched a hosted checkout including cards, alternative payments and open banking delivered through one integration with a single regulatory license. The company says this is a world first. Any readers disagree?

Ecommpay has launched US acquiring and chargeback insurance. 3DS is still optional for US merchants, resulting in chargeback rates of 4.3% for Ecommpay’s customers. Its new solution would see this fall to just 0.5% although merchants will need to pay additional transaction fees.

Digital receipts should be a standard component of any modern POS bundle. These are cheaper and better for the environment than paper. And there’s always the chance of capturing customer contact data. Verifone has partnered with Receipt Hero, with which it was already working in the Nordics.

Pi-xcels, a Singapore start-up which has invented a simple way of pushing digital receipts to shoppers’ smartphones, has raised $1.7m seed funding. Ingenico is already distributing the product and here’s a short demo that shows how it works. I’ve met the management. They’re an impressive bunch. Let me know if you’d like an introduction.

Merchant cash advance involves lending money to small businesses secured on card payment receipts. Some new vendors are making an impact. Keep an eye on PragmaGo which is working with Polksi ePłatności, Poland’s second largest acquirer. It charges 18.5% for a 12 month loan. Also Flowpay from the Czech Republic, which operates a whitelabel model with leading central European ISVs such as Shoptet and Storyous.

In the UK, YouLend, a finance house is winning a good share of partnerships at the moment, including working with Amazon.

SoftPOS

Polcard, Fiserv’s Polish unit, has equipped 4,900 DHL couriers with Polcard Go, its SoftPOS product. DHL says the main benefits are removing the need to carry a separate payment terminal to take payments from shoppers on the doorstep, no worrying about cables/chargers and the elimination of paper receipts. DHL’s comments back up a new survey from RS2, a payment software vendor with a SoftPOS solution, that “ease of use” rather than saving money is the main driver for merchants adopting the new technology.

Certainly, customer experience is the driver for Sephora, the beauty retailer, which is equipping advisors in over 600 stores with JP Morgan’s SoftPOS payment app on their iPhones. The use case is mainly queue busting.

Oona, a Finnish hardware vendor, is taking advantage of this growing interest in SoftPOS from large retailers. It has launched a range of Android self-service kiosks with can be enabled to take payments using SoftPOS applications. Here’s an example working with Viva Wallet, the Greek Fintech owned by JP Morgan.

Viva is active across Europe. It has taken to the London Tube to advertise Tap to Pay on iPhone and in Poland its SoftPOS is offered by Fodmimi, a restaurant software vendor. SoftPOS is offered in a bundle also incorporating Kasa123 virtual fiscal receipts.

Apple has launched SoftPOS in the Netherlands, its second European market after the UK. Adyen and SumUp are the launch partners. SumUp is charging 1.69% with no monthly fee.

Open banking

Open banking enthusiasts welcomed news that the number of payment transactions in the UK more than doubled in July 2023 compared to a year earlier and was 10% up on the previous month. The two main use cases are reportedly topping up e-money or investment accounts and paying credit card bills. Adoption will be boosted by reports that the Government is adding open banking to the list of payment options available through GOV.UK Pay.

Williams Trade Supplies, builders merchants with 42 outlets, are early adopters of NatWest’s PayIT openbanking solution. The Finance Director advises merchants to heavily incentivise customers to try open banking payments. He argues the cost of the incentive will be repaid many times over by a permanent change to this lower cost payment method.

In vendor news, Trustly is looking a likely winner in the forthcoming open banking shake out. It has bought SlimPay, the French account to account payment specialist for a reported €70m. SlimPay brings €5bn volume, a good subscription payment platform and a useful presence in France.

Berlin based Ivy has raised $20m at a reported $80-90m valuation only five weeks after making public its initial $8m seed round. Ivy plans to build an international network of open banking APIs. The CEO makes a bold claim: “Ivy is building for account-to-account what Visa and Mastercard have built for card.” If you’re thinking this sounds a lot like Volt, it does.

Klarna launched Klarna Kosma in 2022 which brought the BNPL giant’s internal scale to the provision of open banking API aggregation in competition with Token, True Layer and others. Klarna announced it was axing the Kosma brand before clarifying that it wasn’t. Klarna says that banking API aggregation sales to 3rd parties have tripled in the past year but disclosed no numbers.

Cash

India has hit its goals for 80% financial inclusion in just six years by investing in digital infrastructure according to a new OECD report. The study also praises PIX, the very popular Brazilian mobile payment scheme (see graph below). Both countries see moving everyday commerce from cash to digital payments as key to combatting financial exclusion.

In contrast, campaigners in developed economies focus on retaining access to cash, even at the expense of higher charges for small businesses and shoppers. Many US cities are passing laws obliging businesses to accept cash. Los Angeles could be the latest. Trends include “reverse ATMs” which turn cash into pre-pay plastic, often associated with high user charges, or for merchants to direct customers to withdraw cash from a captive ATM in store. These often charge upwards of 3.5% commission, as Dave Birch found out in New York..

GB News, a right-leaning TV station, organised a petition signed by 300K people demanding retention of cash in the UK. In response, the British Government has pledged that banks will be obliged to ensure customers can find a free ATM within three miles of where they live.

Central Bank Digital Currencies (CBDC) might seem attractive as a means of keeping both sides of the argument happy. It’s cash. But it’s also digital. What’s not to like? Digital dollars or euros would leap from your wallet to the merchant’s wallet without touching the banking system. The Bank of England has launched a consultation on the digital pound which outlines this very unexciting use case. I’ll stick with my debit card, thanks.

Crypto corner

Checkout.com has stopped providing card processing services to Binance, the world’s largest crypto exchange citing concerns over Binance’s anti-money laundering, sanctions and compliance controls. From a peak of $2bn in 2021, monthly volumes processed by Checkout for Binance had declined to “just” $300-$400m. Reports suggest Binance insisted on disabling 3DS resulting in “a European organized crime syndicate [taking] full advantage.”

Customers flocked to Binance in 2021 to take part in the NFT bubble. People lost their heads exchanging dollars for ethereum so they could “buy” jpgs such as the Bored Apes, These were auctioned by Sotheby’s at an average price of $241,000 each. The monkey-themed NFTs are now worth rather less. Disappointed punters are suing the auction house claiming it had “given an air of legitimacy... to generate investors' interest and hype around the Bored Ape brand."

Remarkably, there is still some investor interest in crypto payments. CityPay, from Georgia, has just raised €2m for its crypto/fiat gateway.

I know I’m a sceptic but if crypto is ever to become a mass-market payment instrument, the industry needs to address the user experience. Last month, one Bitcoin user accidentally paid $500,000 in fees to make a single transaction. Complexity seems a feature not a bug.

Stablecoins, sometimes referred to as “backed” crypto are certainly less risky. Indeed, some believe PayPal’s digital dollars (backed 1:1 with US Treasuries) are safer than the real thing. Getting acquirers involved seems sensible too. Visa is piloting USDC stablecoin settlement with Worldpay and Nuvei.

In other news

Tik Tok published an excellent report on Shopping Trends. It’s all about creating moments of joy for your beloved customers.

NCR, the retail tech and ATM vendor, is splitting in two. The retail business will be called NCR Voyix. The “x” represents “the actionable insights delivered to customers and the visual manifestation of the company’s ability to ‘link’ the digital and physical worlds”. That’s a big ask for just one letter. The ATM business is to be renamed NCR Atleos, a portmanteau of At (automated teller) and eos (the Greed goddess of the dawn).

Belgium’s economy minister has proposed to reduce debit interchange below the 0.2% ceiling imposed by the EU’s MIF regulations. The local banking association is not happy.

The European Commission has declared PSD2 a success. Fraud rates on cards fell 50% between 2020 and 2021. PSD3 is next and here’s a helpful list of ten LinkedIn posts to bookmark for the next time your boss asks for a strategy presentation.

Ken Serdons, Mollie’s COO, gives an interview. The Dutch company’s success as “the most loved payment provider” in Europe is all about the onboarding, he says. Meanwhile. Mollie, which lost €120m last year, is making its first layoffs. Adrian Mol, CEO, said “we hired too many people in a short time and went too far. The company is no longer efficient.”

Half of Klarna’s workforce is using the Enterprise version of ChatGPT and the CEO would like the other half to start using it too. In entirely unrelated news, Klarna is outsourcing its German & Swedish customer service teams. 250 staff will transfer to a contractor.

Swish, a P2P payment app, is used by 92% of Swedes. Here’s a good piece explaining why it has grown so quickly. Although market research showed people would pay for the service, there was a massive backlash against user charges when it launched. The product is now free.

Can Elon Musk create the new Paypal? TLDR: probably not.

Wirecard latest. Here’s a full round up from the FT of court proceedings in Germany and Singapore. According to the paper, no witness has yet presented hard evidence that Markus Braun, CEO, was aware of the fraud. Equally, there seems no hard evidence that he took the allegations seriously when brought to his attention.

And finally

“When I want a Whopper, I want it now.” It’s 1993 and Burger King starts accepting credit cards.

Where to find me?

I’ll be at Open Banking Expo in London on 18-19 October and at MPE 2024 in Berlin on 12-14 March. MPE has gone all pop-art this year. I don’t normally look this flourescent.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com