The payments business

Barclays is set to give away 80% of Barclaycard Payments, the UK's second largest merchant acquirer, to Brookfield, a giant Canadian investment fund. In return, Brookfield will "bear the costs associated with growing the business." This is a major U-turn from the British bank which had valued Barclaycard at $2.5bn as recently as last September.

Barclaycard must be in more of a mess than outsiders had realised. We knew the SME business was in freefall after Global Payments. bought Barclaycard's best ISO but this deal suggests the corporate business is under huge pressure too.

Brookfield will be looking to emulate Bain and Advent’s stunning success in carving out Worldpay from RBS in 2010. The two PE funds leveraged their $1bn investment in Worldpay, into a $5bn return. The Canadians should be well prepared. Brookfield already has one large acquirer (Network International) on the books and Sir Ron Kalifa, the man who led Worldpay out of RBS, on the payroll.

Sir Ron and the team will have some easy costs to cut as many believe that Barclaycard employs twice as many people as it needs. And, with c.£300bn volume and 400,000 customers potentially moving into the joint-venture, there’s scope for growth. But the new owners will need to upgrade the product and replace ageing systems fast if they are to stem customer losses to Stripe, Adyen, Checkout and many others.

Dojo, a fast-growing London-HQ’d acquirer has also been taking large chunks out of Barclaycard’s SME customer base. Processed volume has grown from £10bn to £40bn in just three years. Dojo has reported its first operating profit although the bottom line is still weighed down by a mountain of debt. European expansion to Spain and Italy is an urgent priority. More details on the Business of Payments blog.

Worldline is in a mess. The stock price is down 90% and the CEO has been forced to resign after yet another profits warning. Management said the latest problems stemmed from “slow trading conditions”, the travel sector and “specific performance issues with the Pacific business.”

Figure 1 Worldline stock price

Some commentators argue that Worldline, valued at just €1.7bn, is ridiculously cheap for a business with €4.6bn annual sales and 20% EBITDA margins. The company has some protection against an opportunistic hostile takeover by the presence of both SIX and Credit Agricole as long-term shareholders.

The primary reason for Worldine’s evaporating valuation is management’s continued failure to meet its own modest targets accompanied with implausible explanations (such as blaming the weather) for the lack of growth. The CFTC union, which represents Worldline staff, has some well-argued commentary.

Nexi, Worldline’s arch-rival, is in better health. Q3 merchant revenues were up 7% on 13% higher payment volumes. Nexi has received a vote of confidence in the form of a €220m loan from the European Investment Bank to commercialise new business ideas from Nexi Digital, its R&D joint venture with Reply.

Competition is hotting up in Italy, Nexi’s home market, with the launch of Numia, the new name for BCC Pay. Numia is a joint-venture between a consortium of rural banks and FSI, the Milan based private equity group which has also invested in Bancomat, the Italian debit scheme. Numia claims €60bn processing volume from 200,000 POS terminals under management.

It's often worth “buying” a big deal if it fundamentally shifts your market position. Adyen did just this in 2018 when it swiped eBay’s processing business from PayPal in return for granting eBay the right to buy four tranches of Adyen shares at €240 per share. The stock price is now €1400. eBay has exercised the second of four tranches of its Adyen warrants, netting a cool profit of €467m. For Adyen shareholders, the eBay deal is looking really expensive.

Unzer, the German PSP formerly owned by KKR, reported a €381m loss on sales of €200m in 2023. The bulk of the deficit was due to write-offs related to acquisitions and the company highlighted positive EBITDA of €27m. Unzer, which has 85,000 merchant customers, has spent €20m on beefing up compliance and has cleaned its customer portfolio of pornography and gambling. BAFIN has withdrawn a ban on signing new customers.

Klarna’s newly independent checkout business is relaunched as Kustom. The new brand claims to serve 24,000 merchants processing €13bn annually with the volume shortly to be moved to Stripe. Why Kustom? The new name “fundamentally reflects our desire to offer a high degree of customization for our merchants.” And it begins with K so the company is still KCO for short.

Rezolve AI, Dan Wagner’s venture into conversational commerce, isn’t proving a good investment. Based in London but quoted on NASDAQ after reversing into a SPAC, Rezolve’s stock price has fallen from $11.36 at floatation in August to just $2.73 at the time of writing.

Figure 2 Rezolve AI stock price

Fiserv looks set to buy CCV, the Dutch-HQ’d POS infrastructure provider which is one of the few family businesses left in the payment sector. CCV has a strong European footprint in parking, EV charging and vending. Fiserv will be thinking of cross-selling payment processing to CCV’s 750,000 merchant locations but CCV’s capability will be useful to Fiserv and its bank partners too.

VR Payment, based in Frankfurt, has bought Wallee, a Swiss-based PSP with 80,000 terminals under management in the DACH region, Poland and Lithuania. Wallee also brings excellent automated boarding tools as well as integrations into eCommerce shopping carts. VR Payment is owned by the Volksbanken Raiffeisenbanken network and manages 286,000 terminals in Germany.

DNA Payments, a London-based acquirer/PSP owned by two Kazakh bankers, has denied reports that it would pay €50-60m for the merchant services business of Card Complete, Austria’s leading acquirer. In a statement, DNA said: “We can categorically state that DNA Payments is not acquiring Card Complete's Merchant Services arm, nor is this something we are in discussions with them over.”

SumUp’s remarkable growth continues as the UK/German mPOS provider reported €1bn revenue in 2023. SumUp has cut costs, especially sales and marketing, to focus on “profitable growth” resulting in a maiden operating profit of €11m. This positive result was drowned by €148m interest payments on SumUp’s €1.2bn debt mountain. Undeterred, SumUp has raised an additional €285m funding and €1.5bn in loan finance and is reportedly hiring very aggressively once more.

Hardware

A combination of destocking following the pandemic’s supply chain whiplash and the recent tough retail trading environment has made life challenging for the terminal vendors. PAX reported sales down 15% in H1 2024. You can read more details on the Business of Payments blog.

Ingenico, owned by Apollo, the US private equity giant, has fared even worse with sales forecast to fall 33% this year. S&P has downgraded Ingenico’s credit rating and fears its “capital structure could become unstainable” if market conditions don’t improve.

Scheming

New research from Flagship shows the steady decline in Europe’s local card schemes with their market share in France, Germany, Denmark, Norway and Italy falling from c.80% in 2017 to 65%-75% today. Domestic schemes have suffered from being slow into eCommerce and late to insert themselves in the Google and Apple Pay wallets.

Dankort, the Danish debit scheme, is a good example. After years of enjoying quasi-monopolies both Dankort and Nets, Dankort’s sole acquirer, are under pressure.

Flatpay, which does not accept Dankort, is the main beneficiary, having reached 10% market share in Denmark with a Visa/Mastercard-only proposition. Nets, owned by Nexi, is not taking this well. Local press reports that it is bringing 17 small business customers to court for refusing to pay €270 “exit fees” to terminate their contracts.

European banks and regulators are concerned at the increasing reliance on US card brands. Wero, a QR-based mobile payment which uses SEPA Instant for settlement, is backed by Worldine, Nexi and a consortium of banks. Wero has launched in France and Germany with some lively commercials.

Wero’s French launch has clarified that the brand is pronounced Ouiro but that Vero (assumed to be the German way) will be tolerated.

In Germany, Wero replaces the disastrous Giro Online/Paydirekt which processed just €1.6bn last year. But management will need to work hard to displace PayPal which dominates German eCommerce, accounting for 28% of online transactions.

Of course, Wero is not the only European mobile payment method challenging cards. Blik, owned by Mastercard and a consortium of Polish banks, reported volume up 36% in H1 2024 to €37bn and is expanding into both Slovakia (with Tatra Bank) and Romania.

The growing band of mobile payment schemes will be very interested in accessing Apple’s NFC chip which is now available to 3rd party developers for the first time. This helpful paper from BCG explains more. One of the first European propositions exploiting the new freedoms will be BizumPay, based on the mobile wallet developed by Redsys and backed by most Spanish banks, which launches next year.

Meanwhile, the major schemes relentlessly grow their volume in Europe. Combined Visa and Mastercard payment volume was up 12% in Q3 24 in euros. Mastercard is still growing a little faster than its rival as portfolio migrations from NatWest, Deutsche Bank and UniCredit bring extra spending.

There’s more scheme news in the full version of this newsletter.

ISV

ISV partnerships can be an effective way of distributing payment processing to small businesses, but software companies are not banks. They don’t sign long-term, exclusive agreements and can be fickle partners. Shopify, which processes $236bn with Stripe on behalf its Shopify Pay customers will now be sending volume to PayPal.

In Greece, Viva, is taking legal action against two ISVs which, it claims, charge excessive fees for their merchants to process payments via Viva. The court rejected Viva’s request for an injunction to stop merchants being charged the modest sum of €50 annually for an integration to its service.

New research from PSE and TSG show Europe lagging behind the US in merchant adoption of embedded finance products, including payments. The researchers blame the local ISVs for not promoting payments strongly enough.

A new report from Tidemark, a VC focused on vertical business software, lays out the case for ISVs to include payments as part of their core product offer. A good example is NOQ, a London-based start-up which offers business software and payments (from Adyen) to music festivals and sporting events. It just raised £3.4m.

New Shopping

Opinion remains divided on autonomous stores. Grabango, the automated checkout vendor used by Aldi, has closed down after running out of money. Grabango had raised a total of $93m. Aldi has shuttered its cashier-free supermarket in Utrecht saying “It was a fun experiment, and we learned a lot. But the investments are big.” Amazon has also been less enthusiastic of late, having closed three stores in New York saying “we couldn’t make the economics work”.

Undeterred, Sensei, a Portuguese start-up has just raised €15m to complement an initial €5.4m round in 2021. Metro, the German retail giant, is one of the investors and Sensei aims for 1,000 fully autonomous points of sale by 2026. Sensei has made a nice video that explains the proposition.

We’ve not heard much from the metaverse recently but Shopify merchants will soon be able to sell on Roblox. Expect “buy now” buttons linking you to real-world checkout pages. I hope it’s more fun than the launch video.

Product

Revolut sees an opportunity to cross-sell payment acceptance to its 500,000 business customers. The bank just launched an in-house developed POS terminal available for sale at €169. Card processing is €0.02 + 0.8% at POS or 1% online. On-us transactions with Revolut Pay are just 0.5% and personal customers get loyalty points for choosing to pay direct from their bank account. This could be particularly be disruptive in Ireland where more than one third of the population has a Revolut account.

After its stunning success bundling checkout, processing and value-added services, Stripe has started unbundling. By the end of the year, Stripe Checkout will support 12 other processors including Worldpay. Stripe will become a processing option for FreedomPay’s enterprise merchants and has announced direct integrations with Oracle, Adobe and Cegid. This puts a clear strategic divide between Stripe, which is offering a series of modules, and Adyen which continues to insist customers take all its products.

One key reason for Stripe’s rapid evolution is that it’s been the payment provider of choice to the fastest growing businesses and has expanded with its customers. For example, Patrick Collinson, Stripe’s founder, says his business now serves 41 of the top 50 Gen AI web products.

As ATM networks shrink, supermarkets are picking up the slack with growing consumer demand for cashback at POS. Originally welcomed by grocers as a cheap way of recycling cash and generating some incremental footfall, cashback is now criticised as too expensive. German retailers pay 0.14% for cashback and say they are fed up doing the banks’ job for them.

Merchant cash advance

Merchant Cash Advance (MCA) has been around since the 90s but, rebranded as “embedded finance,” the product and taken a new lease of life. Merchants borrow short-term with repayments taken as a fixed proportion of each day’s card settlement payments. Lenders normally make distribution deals with payment providers – acquirers or ISOs – in return for commission payments.

Two of the European market leaders, Youlend and Liberis, are both based in London.

Youlend, controlled by EQT, grew revenues 75% to £118m year in the year to March 2024 with operating profits a very creditable £14m. Youlend has landed a number of big distribution deals including Dojo in the UK, through which Youlend has extended £1bn in loans to 20,000 businesses, Telecash in Germany and Deliverect in Spain.

Liberis is s little smaller. Sales were up 59% in 2023 to £64m with operating profit of £9m. Liberis has struck new deals with myPOS for ten European markets and with Nexi in Germany

Away from London, keep an eye on Flowpay, based in Czech Republic but expanding across central Europe. Flowpay, founded by the charismatic William Jalloul (read a good interview here) has locked down critical partnerships with local ISVs including Dotykačka, Shoptet and Storyous.

Finmid, based in Berlin, raised €35m to offer financing to merchants through ISVs. Wolt, a Helsinki HQ’d business providing software to restaurants is an early partner, launching Wolt Capital. This offers pre-approved funding to customers in Sweden, Poland, Finland and Denmark.

MCA has become much quicker and easer to access due to advances in credit scoring and the simpler integrations between lenders and Android payment terminals. Possibly too easy. This flow, demonstrated by MWBS, a UK based ISO on an Ingenico DX8000, is a great piece of customer experience. But borrowing money should be a considered purchase and this makes it too easy for a small business to get into debt.

Open banking

Let’s start with the positives. The UK open banking programme has passed a number of technical milestones and merchants are now getting real benefit from the technology. Just Giving, an online charity donation platform, which previously replied wholly on cards, now reports that 8-9% of donations are arriving by bank transfer. GoCardless is behind the scenes. JustGiving is not currently passing on the cost savings to its customers.

Lloyds Bank has produced a very clever advert for a P2P open banking use case. Many readers will empathise with the hero of this story “based on the insight that British people tend to feel awkward having conversations about money that they’re owed.”

However, many insiders are frustrated about the near-term future of open banking payments. The alphabet soup of regulators and competing industry groups making similar but slightly different proposals is confusing and leading to delay. Volker Schloenvoigt from Edgar Dunn explains the problems well in this blog post concluding that “too many (regulatory) cooks are spoiling the broth at the moment.”

Many in the industry are pinning their hopes on variable recurring payments (VRPs) which are the open banking equivalent of direct debits. Justin Hanna explains a fatal flaw. Unlike recurring card payments or standard direct debits, merchants cannot migrate VRPs from one vendor to another.

Sentiment wasn’t helped when Truelayer, the European market leader in open banking payments, reported losses of £54m in 2023 on sales of just £12m. Management is taking steps to stabilise the business. Shareholders have provided a further $50m capital and Truelayer laid off 25% its staff. More details on the Business of Payments blog.

Some are looking to government for leadership, and I spoke to a number of MPs from the open banking panel at the Labour Party conference in Liverpool in September. We had a more lively discussion than the photograph suggests.

With Trump 2.0 looming across the Atlantic, the UK needs strategic autonomy in payments and open banking can provide this quickly.

But we need an acceptance mark, scheme rules (including consumer protection) and a consistent pricing model. Government could try to achieve this through one of its many regulatory bodies; a better idea would be for the UK banks to form a consortium and get on with it.

If domestic interests don’t show some leadership, the US card brands will fill the void and good luck to them. These folks know how to run payment schemes.

Visa’s new A2A product looks like the real deal. It includes both one-click open banking payments and consumer protection as Ciaran O’Malley explains. More importantly, Visa A2A has four banks on board at launch – Barclays, Nationwide, HSBC and Lloyds. Visa A2A debuts in the UK early next year with the Nordic markets following closely afterwards.

In corporate news, Vyne, has been acquired by Tarabut, the largest open banking vendor in the Middle East. Tarabut raised $32m last year. Vyne is supplying VRPs to Visa’s A2A product.

GoCardless has completed its acquisition of Senteniel from EML Payments. Senteniel, which includes Nuapay, an open banking vendor, grew revenue by 22% in year to June 2024 to €9.3m on €123bn processed volume. That’s a take rate of 1.2bps. Nobody is going to get rich selling direct debits.

SoftPOS

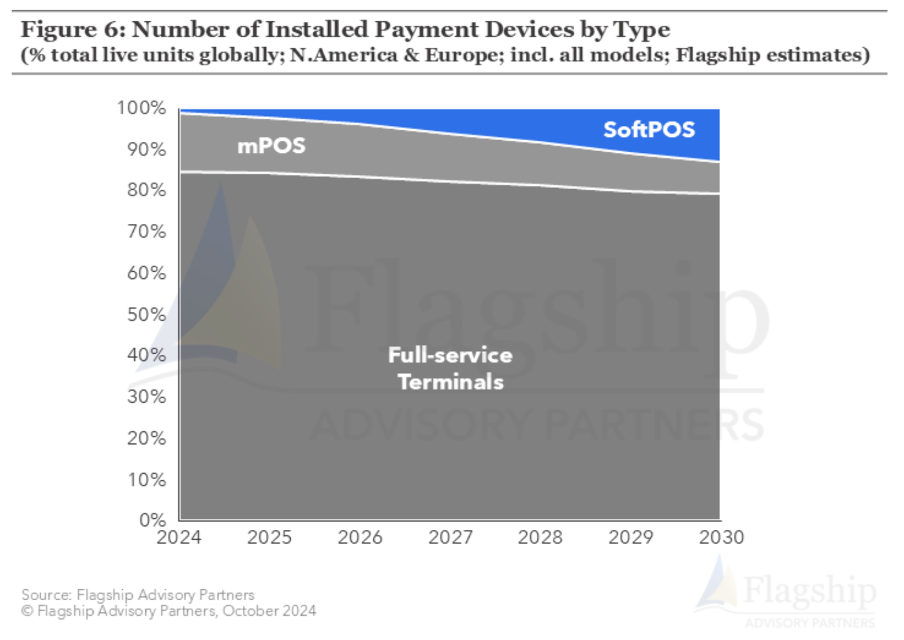

In a new report, Flagship Consulting reveal that two thirds of payment providers in Europe and North America already offer SoftPOS. As volumes increase, the consultants believe it will cannibalise mPOS sales rather than traditional terminals.

I’m not so sure. I’m seeing many good enterprise use cases with kiosks and ECR systems and 71% of merchants in this research said they thought SoftPOS would ultimately replace the usual POS terminal.

Happily for merchants, vendors are meeting this new demand. MarketPay, the French acquirer spun out of Carrefour, has launched a single payment app that works across a mixed estate of SoftPOS and conventional payment terminals. This offers a clear migration path away from traditional devices. Ingenico, Verifone and the others should be worried.

In vendor news, Rubean, the Munich-based SoftPOS leader met market expectations with its Q3 results. A new deal with Deichmann, the German shoe retailer, boosted Q3 numbers and sales in 2024 have more than doubled to €1.3m. Rubean has >50K softPOS terminals live in Germany and Spain.

Banks have been losing share in SME payments but SoftPOS, embedded in an app that SMEs check several times a day, will be a good way to fight back.

Tide, a neo bank focused on small businesses, has included SoftPOS in its standard offer. I’m a customer and was able to register and start taking payments from my wife as a test after just a few clicks. Adyen is behind the scenes and the onboarding was impressive. On the downside, Tide offers net settlement (ie, it deducts the fees from each transaction) which is confusing and makes reconciliation a pain. And refunds are far from straightforward. But it’s early days and the service will improve quickly.

Crypto Corner

Just when you thought that the madness was behind us, Trump and the crypto bros are back in town. Expect a global scale Ponzi scheme backed by the government of the world’s largest economy and promoted daily by Elon on X. Already, the FT reports that 71% of crypto trades are derivatives. This won’t end well.

Even prior to the US election, the major payment players had been reactivating their crypto plans. Revolut now offers its customers the chance to buy one of 210 “carefully vetted” tokens, which will help funnel European capital into the Trump’s casino of doom.

Shift4 will start offering crypto acceptance, partnering with Mesh. The first customers are a Las Vegas restaurant and a business offering helicopter tours of major cities. Jared Isaacman, Shift4’s CEO, paid $200m to Elon Musk to become the first businessman in space putting Shift4 in pole position to become Trump’s payment provider of choice.

Meanwhile, BAFIN, the German regulator, has shut down 47 cryptocurrency exchanges and confiscated 13 crypto ATMs in a long awaited anti money laundering crackdown. Criminals reportedly used these exchanges to conceal the origins of illicit funds, often obtained through dark web drug sales or ransomware attacks.

Petty criminals are active too. A Scottish man attempted to steal £100K in Bitcoin by bashing a woman over the head with a large bar of Toblerone. His lawyer commented: "It has been an unusual case throughout.”

Some are developing solutions for merchants to accept crypto at POS. Musquet, based in London, has raised £750K to launch Bitcoin acceptance on a PAX A920. It claims a world-first. Bitcoin transactions are priced at 1%. Credit cards, processed via Raypd, are 0.9% + 5p.

This is an interesting proposition but not unique. Done4You, an ISO based in Namur, Belgium, has implemented crypto at POS for a petrol station in Luxembourg using GoCrypto’s technology. Crypto transactions are 1.25% compared to interchange + 0.5% for credit cards. NAKA, from Slovenia, is working on similar lines.

Should the schemes be worried? Not yet. Let’s take a moment to review this prediction from 2021.

In other news

Wirecard latest. With Markus Braun’s criminal trial approaching its third year, a key prosecution witness has refused to appear in court citing safety concerns. And still nobody knows where Jan Marselek is.

Rapyd’s outspoken support for Israel’s war in Gaza has cost the business $15-20m in revenue but the CEO is not backing down. Arik Shtilman said “I told our marketing teams that we are not ashamed of our Israeli identity; if a customer doesn't like it, they can leave.”

Only in America. New York State will require a special merchant category code (MCC) for selling firearms so that officials can detect unusual activity at gun stores. Meanwhile, 16 other states have specifically banned the use of the special MCC so that officials cannot detect unusual activity at gun stores.

There’s more legislative confusion in Europe where the Italian Government is planning to mandate the integration of payment terminals with ECR software. This month, the Polish government has abandoned a similar law. Although there would benefits in cutting tax evasion, the practical challenges are too great.

An interesting payments/democracy mash-up from Poland. Planet Cash ATMs in the city of Ełk will offer citizens the chance to vote on the municipal budget.

An enterprising barista took his own SumUp mPOS terminal to work and sneakily directed £4.000 from unsuspecting customers into his own bank account.

Cashless Poland has been a stunning success in helping small businesses move to digital payments and it’s not over yet. There’s a new campaign featuring Szymon Majewski, a major celebrity in his home country.

And finally

Jas Shah has written an entertaining history of PayPal. It’s quite a story and far from over. Paypal has its mojo back including launching the best payments commercial in years. Enjoy Will Ferrell.

Where to find me

I’ll be at the PSE Merchant Acquiring conference in London on 20 November. Next year, I’ll be moderating a couple of sessions at MPE 24 in Berlin 18 -20 March and at the ePay Summit in London 21 May.

Here’s a 20% discount offer from the organisers if you register for MPE right now.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com

Awesome and comprehensive update as ever. The Barclaycard MS giveaway is a real shocker. As you say, the capital investment required to fix the legacy tech must be ginormous if the only way they can fund it is to give away 80% of the UK's biggest acquirer. I think we can expect a pretty bumpy ride for some big BMS enterprise customers whose pricing is probably well underwater at the moment.