The Payments Business

Global Payments has outlined how it plans to deliver $600M in annual cost savings from the Worldpay acquisition. The savings are split evenly across three areas: tech and vendor consolidation, operations and facilities; and organisational streamlining. Investors are sceptical. While the stock has recovered a bit since the deal was announced, it’s still 28% down on last year.

Management seems determined to unify both businesses under a single brand although it’s not yet clear what combination of “world”, “global” and “pay” will prevail. With the deal not closing until 2026, Global has introduced a new slogan. “We’re on it,” replaces “Payments made easy.” The rebrand also includes a new arc and a ping over the “g,” which apparently symbolise “forward momentum and precision” or possibly someone throwing a boomerang at a Wi-Fi signal.

Global has finally launched Genius, its new hero product that provides a bundle of payment acceptance combined with POS software. The retail version is “coming soon” to Germany, Austria, and Czechia. An enterprise version, targeting large restaurant chains, venues, and stadiums, is promised later this year.

Genius presents a dilemma in the UK, where Worldpay has just launched its own POS product, Worldpay 360, based on software from Stockholm-based Yabie.

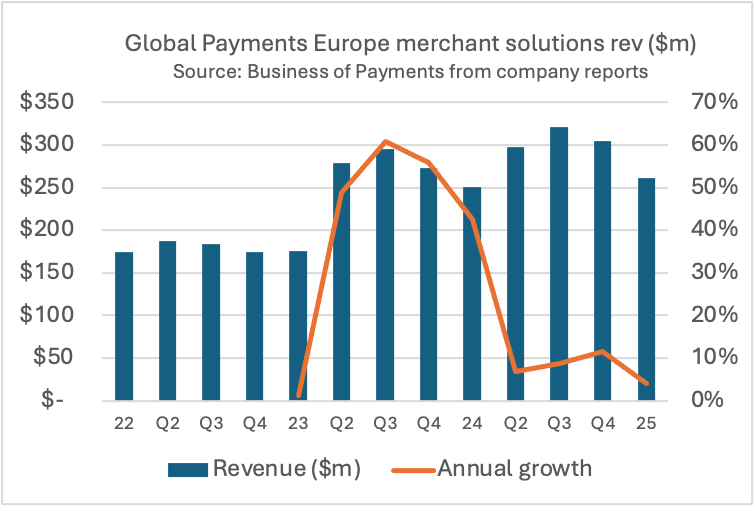

In a sensible move to simplify its structure in central Europe, Global has bought CaixaBank’s 45% stake in a joint venture with Erste Group covering Czechia, Slovakia and Romania for $108M. This gives Global Payments control of the JV and a good platform from which to distribute Genius. Extra sales will be welcome. In Europe, Global’s revenue grew just 4% in Q1.

Worldline also has growth challenges. Overall Q1 revenues fell 3%, and the stock hit an all-time low of €4.90, down from €80 in 2021. New CEO Pierre-Antoine Vacheron says results will improve later this year.

Merchant services revenue fell 1% year on year, with “terminal and software availability” cited as a drag. Still, there are bright spots: notably, strong bank partnerships in Italy and the launch of a first product (basic eCommerce acceptance) through Cawl, Worldline’s high profile JV with Credit Agricole in France. Cawl = Credit Agricole Worldline in case you were wondering.

As you’d expect, Worldline remains bullish on bank distribution. Vacheron said he was “not that concerned about any drastic market shift from bank to ISVs. Banks still have significant appetite and significant growth in Europe.”

Management promises to execute on the basics: exiting non-core markets acquired in past deals and consolidatomg Worldline’s sprawling tech stack across four platforms: global acquiring, regional eCommerce (ex-Ogone), global eCommerce (ex-GlobalCollect) and POS acceptance (AXIS). Four platforms still seem a like a few too many; Adyen and Stripe are doing fine with just the one.

Nexi, Worldline’s biggest European rival, had a steadier quarter. Merchant solutions revenue rose 4.5%, with good performances in Italy, Poland, and Germany; the latter growing at 9% thanks to strong ISV sales gains via Orderbird (an in-house restaurant ISV) and increased referrals from its investment in Computop. Nexi also announced a potentially interesting partnership with Planet, starting in the Nordics and expanding into Italy and DACH, targeting hospitality and luxury retail. Advent, Planet’s owners, are reportedly looking for an exit and Nexi could be a possible purchaser.

Like Worldline, Nexi is built from a series of acquisitions, each bringing its own technical platforms. Unlike Worldline, Nexi has made good progress with platform consolidation and has now brought all DACH processing back from Fiserv. However, other cases are handled market by market. Nexi says success in Poland and Finland is due to local platforms run by local people and doesn’t plan changes.

The latest statistics from EHI, the German retail institute, show that PayPal remains the leader in eCommerce with 29% share of transactions. As Jochen Siegert notes, that figure jumps closer to 40% if you exclude Amazon, where PayPal isn’t accepted.

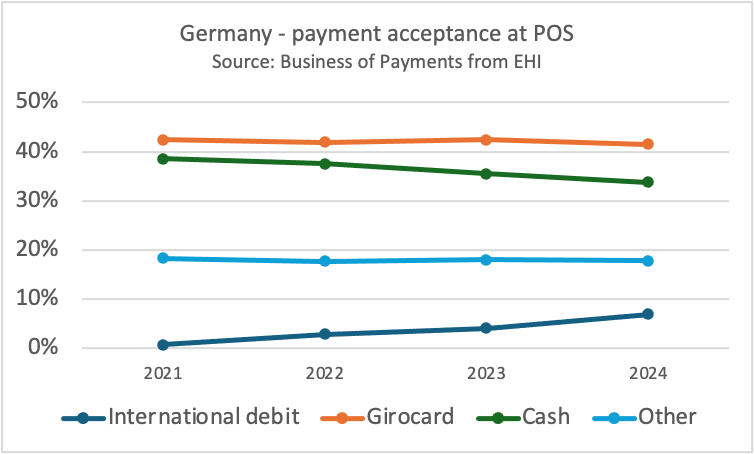

Meanwhile, international debit usage for in-store purchases has jumped from 1% to 6% over the past three years; a small number, but a big shift, and one that’s likely to worry Girocard, Germany’s domestic debit scheme, which is used to being the only game in town.

In corporate news, Fiserv disclosed it paid $229M for CCV, a Dutch-based POS payment gateway earlier this year. At around $500 per merchant, this is good value and CCV has already helped Clover, its POS bundle of hardware and software, launch in Belgium.

Fiskaly, a provider of cloud-based fiscal receipts in Germany, Austria, and Spain, has acquired competitor Deutsche Fiskal from GK Software. Fiskaly says it is integrated with software at 600,000 POS and generates more than $10m annual revenues.

Finally, in Italy, banks are raising eyebrows over the government’s plan to sell PagoPA, the public sector payment gateway that processes €33B annually, to Poste Italiane for €500M.

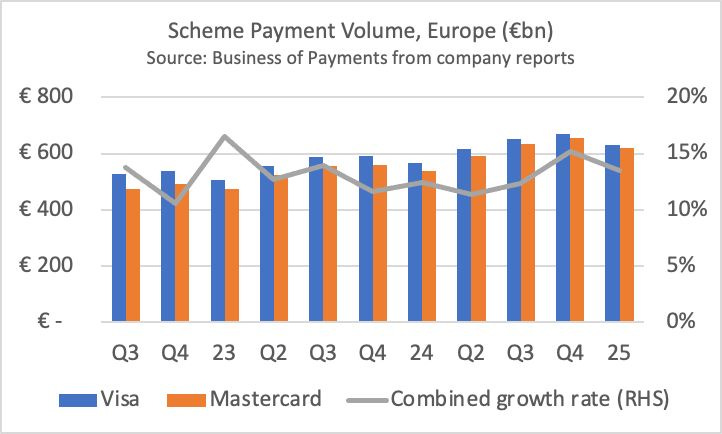

Scheming

Visa and Mastercard delivered another strong quarter in Europe. Combined Q1 2025 volumes were up 14% in euros (11% in dollars), not bad for a region supposedly flirting with recession. Global cross-border growth has slowed slightly, possibly in response to the Trump tariff farrago, but not enough to cause alarm. Not yet anyway.

Despite the continued rise in scheme volumes, predictions of card-mageddon persist, driven by concerns surrounding protectionism, wallets, tokens, open banking, stablecoins, and agentic commerce.

What’s really happening? Jeremy Light offers a useful perspective: cards can be growing and dying at the same time. Use is up - there were 2.5 billion plastic payment cards shipped last year, according to the Smart Payment Association - but so is the list of challenges.

Pressure on cards is also mounting from regulators. A coalition of European retailers, including Amazon and Carrefour, has called on the EU to cap scheme fees. Their complaint: Visa and Mastercard have made their rules and pricing so opaque that even the giant merchants struggle to figure out what they’re paying for. The European Commission has reportedly opened an investigation, requesting evidence from PSPs and terminal vendors.

Meanwhile in the UK, Mastercard has settled a long-running £10 billion class action lawsuit for just £200m after the litigation funder walked away. The payout to consumers, either £45 or £70, may be so small it discourages similar cases.

Reflecting the dominance of the American card brands, European officials continue to talk up the need for “strategic autonomy” in payments. But that requires building viable alternatives to Visa and Mastercard.

The digital euro is a long-term play, but in the short term the European Payments Initiative (EPI) has launched its commercial wallet. Called wero (from “we” and “euro”), the project got a boost with news that Revolut is joining although not as a shareholder. Revolut is the first neo-bank involved in the initiative and brings customers, credibility and fintech glamour to the project.

Wero currently covers Germany, France, Belgium, and the Netherlands. Wallets from other nations (like Bizum, Bancomat, and SIBS) have formed the EuroPA alliance which was bolstered this month as Vipps (Norway/Sweden) and Blik (Poland) have signed a letter of intent to join.

EuroPA advocates interoperability between schemes rather than their replacement with a single European product. Speaking at Web Summit, Blik’s CEO said: “Interoperability is not just a vision—it’s a necessity.”

Martina Weimar, wero’s CEO, initially dismissed the idea of interoperability with EuroPA members, saying it didn’t “create synergies.” But she’s since changed course, confirming that EPI is now exploring cooperation with Bizum, SIBS, and others.

Wero is live for P2P transactions (see below advert in Belgium) and the pilot eCommerce acceptance launches in May, with general availability in September. Nuvei has joined Computop (Nexi) and PPRO as a distribution partner.

Figure 1 Photo credit: wero

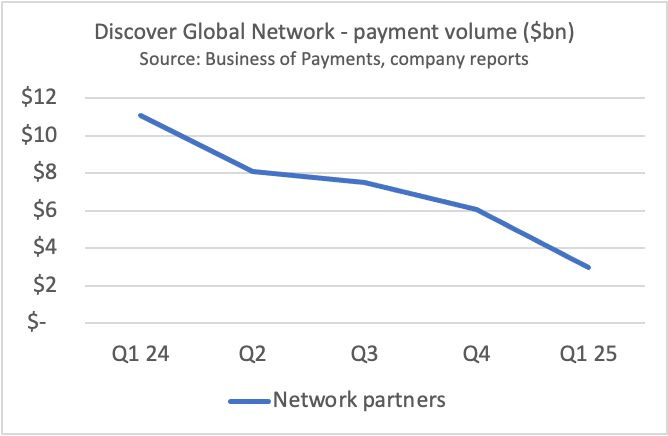

Over in the US, regulators celebrated Capital One’s acquisition of Discover by slapping Discover with a $1.2 billion fine for overcharging merchants. Discover had been misclassifying consumer transactions as commercial for 17 years. Capital One also inherits Discover’s large but struggling global acceptance network. Despite new partners like Bluecode and Airwallex, volumes have dropped sharply, largely due to the loss of AribaPay, its biggest client.

ISV

The highly fragmented European vertical software market is hotting up. US investors, excited by the returns in North America, are looking to replicate their success on this side of the Atlantic. For example, Shift4, says it is signing over 1,000 merchants a month in UK, Ireland and Germany on the back of its acquisition of Vectron, a hospitality focused ISV.

Vertical SaaS adoption in Europe is rather lower than in the US. Analysts put penetration at 5–20% compared to 60% across the Atlantic. Even taking into account the narrower processing margins here, there is great potential to sell new bundles of software and payments that deliver a virtuous circle of lower prices and greater merchant loyalty.

JP Morgan research, for example, shows software vendors can boost customer lifetime value by 3x using payments revenue to cut prices and reduce churn.

Small businesses are the primary target but, despite all the AI hype, new challengers are aggressively hiring good old-fashioned sales reps who show up in person.

Among payment-focused ISVs, Toast is aiming to replicate its US playbook in Europe, planning a stronger field sales push. And Canadian restaurant POS vendor Lightspeed plans to nearly double its European sales team from 55 to 100, focusing on a “hyper local,” city-by-city approach with plenty of boots on the ground.

Danish payment facilitator Flatpay expects to grow to 3,000 employees within two years and is hiring 125 people a month. Meanwhile, SumUp is on a hiring spree in Germany, with 120 vacancies, looking for sales reps to cover towns as small as 11,000 people. MyPOS prefers face-to-face too but is opening 22 showrooms across Europe instead of hiring roaming reps.

Figure 2: On stage at the UniPaas event

How does the market look from the ISV perspective? At the UniPaas “Embedded Advantage” event in London, I moderated a lively discussion with CEOs of two vertical software firms that already offer integrated payments. They shared top tips for PSPs that want to partner with ISVs: be easy to work with, answer the phone when there’s a service issue, and stay flexible with your product roadmap. Kudos to UniPaas, a PF-as-a-service startup by ex-Safecharge execs, for hosting.

The increasingly easy integration of software and payments is inspiring new store technology formats. Here are two examples. Waitermate, based in the UK, offers an all-in-one device integrating payments, software, and customer ordering (like Deliveroo), priced from £30/month plus 0.8% per transaction on a PAX A920.

In Poland, one of the biggest ISVs, Posnet, launched EVO, powered by a softPOS application from Planet Pay (not to be confused with Planet Payments). The TV commercial begins like a 70s porn film but remains safe for work throughout.

New shopping

Agentic commerce is the hottest trend in payments. Shoppers are already using AI to search for products so it's a small step from “tell me about flights to Paris” to “book me the next available flight at less than €200.”

While AI capability is moving rapidly, payment rails are less agile so it was good to see Visa and Mastercard making big agentic commerce product announcements. Visa’s demo shows an AI agent booking a $1000/night hotel room with a tokenized credit card. Only a marketing team based in San Francisco would find this price normal.

PayPal launched new APIs to help agents integrate its checkout tools. The first partner is Perplexity, an AI tool that answers 150 million queries a week. Shopify is also reportedly adding AI-assisted shopping within ChatGPT, allowing users to search and buy without ever leaving the chat.

It’s all moving fast and but there are open questions. What if the AI buys the wrong thing? In case of fraud or errors, is the shopper, merchant, the AI or the card issuer liable? Inside the payment industry, nobody seems sure how agent-initiated payment flows would actually work as you can see from the well-informed comments on this LinkedIn post from Simon Taylor. It’s clear that Visa and Mastercard’s terms and conditions may need updating if agentic commerce is to flourish.

As we shift from mobile-first to chatbot-first commerce, the traditional checkout page may become obsolete. Years of A/B testing on fonts and buttons won’t matter if customers never look at the page at all. AI agents won’t abandon carts because your billing address didn’t autofill.

The shift to chat-commerce favours brands with strong identities and unique products. But it’s tougher for those relying on old-fashioned retail skills such as curation or aggregation; the bots can do that just as well.

Startups offering to help merchants are mushrooming. Here are a few:

Skyfire raised $8.5M to build autonomous payment networks (with 2–3% merchant fees on top of processing costs, I hope my bot can find a discount code).

firmly.ai helps merchants show up in chatbot searches and plug into AI checkouts.

In Europe, Berlin’s Nevermined calls itself the “PayPal of AI commerce.”

SoftPOS

SoftPOS is a downloadable payment app that turns any consumer device - Android tablet or iPhone - into a payment terminal. Originally aimed at micro-merchants, it’s now catching on with established businesses.

In the UK, Sainsbury’s has added softPOS to its Zebra SmartShop devices. Shoppers use the device to scan products that they put into their shopping basket. Now, instead of docking the SmartShop device at the checkout and paying on a card payment terminal, they can pay directly on the SmartShop device itself. This should save time.

Icelandic payment facilitator StringIQ uses Ingenico’s softPOS for thousands of independent MoneyGram agents across Europe. The payment app is integrated with MoneyGram’s app.

Kate Media, an ISV based in Vienna, provides tabletop kiosks for over 300 restaurants that take payments using Viva’s SmartPOS software. Kate says merchants save costs by reducing staff time spent taking orders. And that customers eat more and leave larger tips. It would never be economic to put traditional payment terminals on every table so this demonstrates the new business models facilitated by softPOS.

SoftPOS is a clearly long-term threat to payment terminals but, as PSE Consulting points out, traditional payment hardware is still needed to process offline PIN verifications (a big issue in the UK) and provide tactile key input for blind customers. And many merchants in Europe are still running on installed Windows software which limits the benefits of softPOS. The latter may explain why less than 20% of ISVs currently offer SoftPOS according to Flagship Consulting.

In vendor news, Munich-based softPOS vendor Rubean recently raised €1.5m to fuel international expansion.

A fresh twist on softPOS tech lets shoppers make eCommerce purchases by tapping their own card on their own phone. Cardiff startup Burbank, founded by ex-MyPinPad CEO Justin Pike, raised £5m for its Card Present over Internet (CPoI) solution, promising lower fees for merchants and fewer fraudulent transactions. This works fine if you’ve got a payment card to hand. For Apple Pay, you’d need two phones and this could get confusing.

Figure 3 A man tries using Apple Pay to pay with CPoI

The CPoI idea isn’t entirely new. Maxa Group and Visa (with a Brazil pilot last year) have tested similar products, though success remains elusive.

Open banking

The Financial Times recently highlighted the unexpectedly slow adoption of open banking payments in the UK although catastrophised this into the rather harsh headline “Why Britain’s fintech dream is fading.”

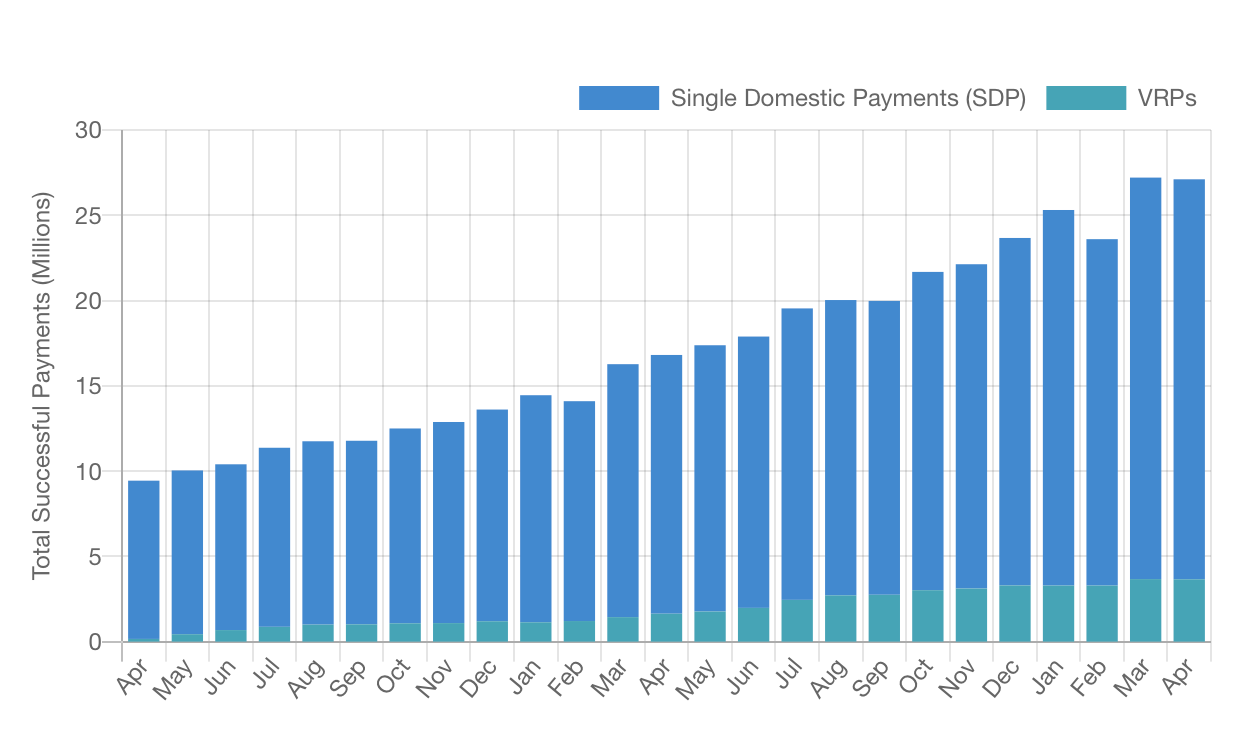

Investors may be frustrated but the technology is far from a failure. One-off payments are growing at around 50% per year (see below) although it will still take a few years for open banking to make a meaningful impact on Europe’s largest payment market.

Figure 4 UK open banking payment transactions. Source: Open Banking Ltd

In vendor news, TrueLayer says it now processes $10bn monthly although it hasn’t released any information on revenue or margins. Meanwhile, new entrants continue to attract investment: London-based SSV SmartPay, offering a QR-code in-store payment solution built on Yapily’s APIs, raised £5m at a £30m valuation. SmartPay charges 0.5% per transaction. Nodapay launched a similar product priced at 20p per transaction.

A lot of hope is riding on Variable Recurring Payments (VRPs), the open banking answer to direct debits, which more than doubled transactions over the past 12 months. However, the commercial model (how the PSPs get paid) remains to be determined. Industry-commissioned economists estimate setup costs for VRP vendors at £1m–£3.5m, ongoing costs of £200k–400k, and suggest transaction fees may settle around 5–7p.

Open banking isn’t the only way to leverage bank transfers for merchant payments. While the UK payment industry debates cost of capital, Revolut is pushing ahead: Wizz Air now offers 10x Revolut points on flights paid via Revolut Pay. Though not strictly open banking, consumers don’t mind and the model shows how A2A payments can create value for all parties.

Elsewhere, Global Payments has integrated open banking payments into its Tom softPOS product, charging 0.79% per transaction in Czechia.

Power to the people

The recent power outage across Spain and Portugal has raised serious questions about the resilience of Europe’s payment infrastructure. Although Redsys, Spain’s largest card processor, reported that its platform remained stable and operational throughout the blackout, this offered little comfort to merchants whose terminals were blank or for consumers unable to withdraw cash from ATMs. Meanwhile, Bizum, the popular bank-backed mobile wallet, was down for ten hours.

Spain managed to cope with its day without power, but the incident underscores the urgent need for offline payment alternatives. Drawing on lessons from crises such as the tsunami and the war in Ukraine, Dave Birch argues that this situation calls for more technology, not less.

SoftPOS vendor Rubean highlighted that its customers continued trading on battery-powered devices that switched to cellular data. This makes sense. softPOS has been central to resilience of the digital payment system in Ukraine.

The Bank of Finland revealed that Nordic countries are planning to mandate offline card processing capabilities to provide backup during internet outages - not just to counter cyber threats from Russia but also the unpredictable pressures of social media-driven disruptions from America. As one board member put it: “We cannot rule out that one night someone on Truth Social comes up with using payments as a pressure tactic.”

Sweden’s central bank aims to establish a system enabling shoppers to make offline card payments for essential goods during disruptions lasting up to seven days.

The outage also highlights the importance of offline functionality for the digital euro and its sterling counterpart though implementation is complex. The Bank of England notes that while offline payments for a digital pound may be technically feasible, challenges around user experience and preventing double spending and counterfeiting make implementation difficult.

Authorities also see a role for cash. The Dutch central bank advises citizens to hold enough bank notes for a three-day blackout; around €70 per adult and €30 per child. But questions remain about cash’s usefulness in a blackout if tills won’t work and shops cannot open their electrically operated doors.

Crypto Corner

While crypto - stablecoins or otherwise - remains largely absent from everyday merchant payments in Europe, acceptance networks are slowly growing, particularly in France. Nepting, a POS gateway provider, will soon offer Lyzi, a crypto-to-fiat payment service, as an option on its terminals. Shoppers scan a QR code that directs them to a website where they can pay with crypto. This move could open the door for thousands of merchants to accept cryptocurrency, though the user experience still needs work. Lyzi has raised an additional €1.3 million to fuel its European expansion.

The Trumps aren’t helping the sector shake off its reputation for grift. The Financial Times reported that traders made $100 million from frontloading the $MELANIA coin, while diners were decidedly unimpressed by the catering (see below) at a $100,000-a-plate crypto-themed dinner hosted by the President. One guest told Wired, “It was the worst food I’ve ever had at a Trump golf course. The only good thing was bread and butter.”

Figure 5 Photo: Chris Skinner

In other news

JP Morgan has cancelled one of its two legal actions against the owners of Viva, the Greek mPOS vendor in which it invested $800 million in 2022. However, the bank’s second lawsuit remains active. “We haven’t withdrawn our damages claim for €917 million and we do not have any intention to,” a JPM spokesperson confirmed.

Pavel Sokolovals, founder of Kevin, the bankrupt Lithuanian open banking vendor, is publicly venting his frustrations. In a series of LinkedIn posts, he blamed former employees, journalists, and the insolvency administrator for his company’s collapse.

Worldline is pushing for staff to return to the office, but the union warns many buildings will run out of desks if more than 40% of employees show up—particularly at the newly opened office in Blois, France.

Simon Black, former CEO of Sage Pay and PPRO, is launching what he calls the “Davos of Payments.” The inaugural summit will take place in London next February, with BCG and Banking Circle buying the drinks. My invite appears to have been lost in the post.

PAX has launched a new terminal, the PAX A33. Taking a swipe at Worldline, PAX emailed European customers: “Imagine if the Yomani got a makeover, upgraded its brain, and finally discovered Android.” Ouch!

And finally

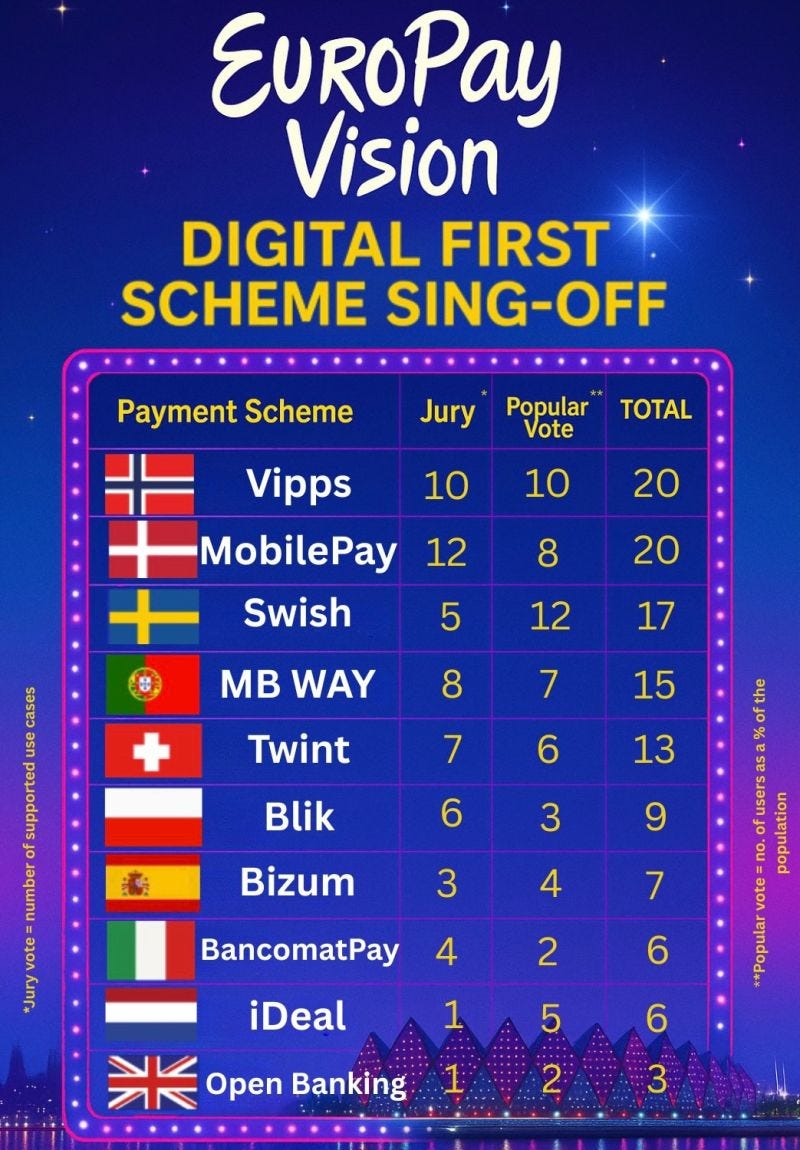

PSE Consulting celebrated Eurovision by ranking Europe’s mobile payment schemes. The Scandinavians win again.

Where to find me

I’ll be at Stripe London on 28th May, Money 20/20 in Amsterdam on 3/4 June and ePay Summit in London on 28 October.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com

Always interesting to read your industry summary, Geoff. Trust you're well!