The Payment Business

The new year has started brightly. High margin eCommerce and cross-border transactions are growing, there are encouraging signs that merchants are willing to pay for value added services and last year’s cost-cutting is boosting profitability across the industry.

Adyen is taking full advantage and is reaping the rewards from its single-minded focus on platform investment. Net revenue was up 21% in Q1 with most volume growth coming from enterprise customers, especially in the US. Adyen has been winning share because of its ability to provide omni-channel solutions. Adyen says 515 of its “Unified Commerce” customers process in multiple regions and it now supports a total of 279K POS terminals. One happy client is Bayern Munich which uses Adyen for F2F and online payments.

While Adyen’s policy is to offer a complete payment solution to as many customers as possible, Stripe announced a major change in product strategy as it decouples payments from rest of its embedded finance products. The new, modular approach will please many merchants not wanting to be tied into Stripe’s processing but risks opening the Stripe customer base to more competition from niche specialists.

The unstoppable rise of Stripe and Adyen and their successful move into face-to-face payments is putting pressure on the incumbents, many of whom will be forced to consolidate to survive. Reviewing the outlook for payments M&A, TSG suggests large acquirers and private equity groups are willing buyers of profitable businesses provided that sellers recognise valuations are well down on 2021.

Insiders have told me that Global Payments has bought takepayments, a leading UK ISO with 75,000 merchants, for a reported $250m. The deal is looking like a reverse takeover because Clive Kahn, the entrepreneurial founder of takepayments will now lead Global’s sales/marketing for UK & Ireland. The deal comes as a blow to Barclaycard Payments for whom takepayments had been an important channel partner.

Token services and payment orchestration are both markets with too many vendors with sketchy business models chasing a limited pool of merchants. It’s no surprise to see consolidation.

TokenEx of the US has bought Ixopay, a Vienna-based orchestrator which works for DHL, Siemens and eToro among others. This LinkedIn discussion gives a sense of the debate within the payment industry about the value of orchestration. While merchants gain more control, orchestration risks introducing another single point of failure.

On the Continent, the Italian press reports that investors have poured cold water on the idea of merging Nexi and Worldline, citing the cultural challenges of putting together French and Italian companies with difficult records on labour relations.

Turning to business results, Mollie, the Dutch PSP which raised an astonishing $800m in 2021, revealed operating losses narrowing to €28m in 2023 from €107m the previous year. Revenue reached €99m boosted by expansion to the UK, Germany and France while the bottom line benefited from making 10% of the workforce redundant. Adrian Mol, the founder, admitted “we hired too many people in a short time and went too far. The company is no longer efficient.”

HiPay, a Paris based PSP specialising in retail, iGaming and marketplaces reported a strong improvement in profitability in 2023 following a year of cost-cutting. An 11% increase in revenue to €65m helped turn a loss of €8m into a profit of €2m.

And from the Business of Payments blog:

Brexit and the end of the crypto bubble hit profits at emerchantpay

A move away from high-risk merchants caused a 20% fall in revenue at Ecommpay

GoCardless lost another £92m and says it’s time to prioritise profitability

Turning to investment, Flatpay, a Danish SME-focused payment facilitator, raised €45m to expand out of Denmark into new markets including Germany and Finland. Working with acquirers Shift4 and Rapyd, Flat Pay has won 6,000 merchants in its home market and forecasts €3bn volume this year. Recognising the value of a software/payments bundle, management says that 25% of customers also take Flatpay’s ePOS system.

ISVs are the new ISOs

Shopify has led the way distributing payments and here's a good explainer of how 70% of the ISV’s revenue actually comes from merchant solutions. European ISVs have been generally slower than their US counterparts to maximise payment revenues but UBS suggests that the shift to software-led payments will deliver 5-10 years of above market growth in payment processing on this side of the Atlantic. Banks currently account for 50% of merchant processing but the analysts believe 11% pts of this will move to ISVs by 2026.

Flagship Consulting says PSPs should be making at least 20% of revenue from VAS, notably vertical software for small businesses and foreign exchange, payouts and virtual bank accounts for enterprise clients. The potential gains are significant such as Euronet’s new partnership with SOFTONE (a Greek ISV) shows. The deal gives the acquirer access to 75,000 retail and restaurant customers.

How do you get ISVs to partner with your payment business? Good commercial terms are important but US research from TSG shows ISVs also need easy merchant onboarding, high quality customer support and developer-friendly APIs.

These can all be delivered with a dedicated ISV platform such as Payrix, now owned by Worldpay, or Cardstream which is set for the big time having recently joined Mastercard StartPath. Nexi looks to be creating an in-house ISV platform from Orderbird, a German restaurant software vendor it inherited from the acquisition of Concardis.

The shift to ISV distribution impacts acquirers risk models too as PSE Consulting explains. The good news is that ISVs are well placed to monitor ongoing merchant behaviour and flag potential problems. The bad news is selling software is normally unregulated and ISVs have little understanding of compliance.

Scheming

Q1 started brightly for the payment schemes. European volume was up 12% with Mastercard again growing a little faster than Visa.

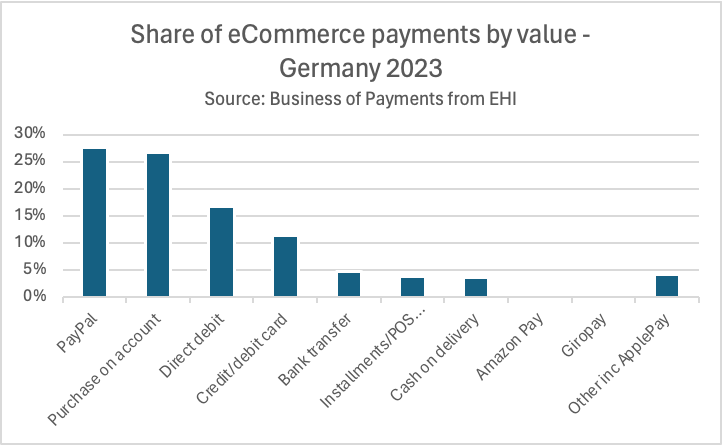

Both brands say they are increasing debit volume at the expense of domestic schemes such as Carte Bancaire. Visa says it has converted 20m domestic cards to Visa debit over the past five years. Mastercard migrated 7m Maestro to debit Mastercard in the last quarter alone. Overall, international debit cards doubled their share in Germany to 4.1% in 2023 according to EHI. These cards are more expensive than Giro and retailers are not happy about paying the higher fees.

In the US, retailers have protested against last month’s legal settlement in which Visa and Mastercard agreed to reduce interchange fees. The National Retail Federation (NRF) says its members would save just $6bn of their $100bn annual payments to the schemes. Another concern is that allowing differential surcharging by card type leads to a confusing customer experience like we see in Australia today.

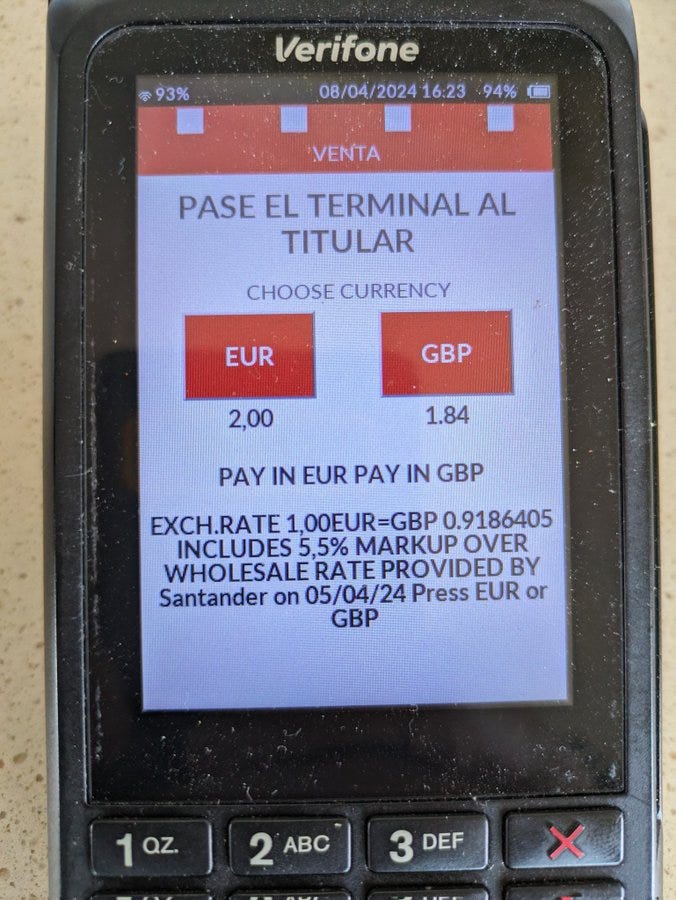

Figure 1 Photo form @mjenkins88

Sadly, the NRF has lost the plot in also supporting an unhinged campaign accusing Visa and Mastercard of collaborating with China Union Pay to steal American data. This sort of paranoia undermines the federation’s credibility.

Europeans are sensibly taking a less combative approach to China. I do like this promotion for Alipay on the Dutch/German border showcasing terminals from Adyen Worldline and Nexi all featuring the Chinese QR based wallet.

Domestic QR schemes are expected to provide stiff competition for cards. Arkwright Consulting have summarised the details in an excellent report but much will depend on whether the current fragmented landscape can consolidate into a small number of regional schemes or, even better, a single solution based on the European Payment Initiative (EPI).

The EPI, owned by a consortium of banks, has a technical solution based on iDEAL, the Dutch online A2A standard. Adrian Mol isn’t happy. He accuses iDEAL’s new foreign owners of mainly looking for an excuse to charge higher merchant fees.

New shopping

Following revelations that Amazon’s autonomous stores relied on the manual intervention of 1,000 back office staff in India, the retail giant has been defending its technology. Amazon says “Just Walk Out” is live with over 140 third party operators around the world and works well for small format stores. Retail Optimiser, a blog which follows this sector closely, writes that all vendors, not just Amazon, are unwilling to reveal how many shopping baskets are manually processed after the customer leaves the store. This smells fishy.

For large format stores, Amazon believes its Dash Carts are the ideal automation solution and claims shoppers spend 10% more when they use one of these smart shopping trolleys. Richard Crone, a retail consultant, has made a helpful video showing how the Dash Carts work. A key insight for the payments industry is that they shift yet more transactions from POS to mobile.

Germany, with its rich history in vending machines, has been quick to adopt autonomous stores but the robots have a legal right to a day of rest. In many states, autonomous stores are banned from opening on Sundays.

Here's two more AI powered shopping innovations from Germany.

Backwerk, the German bakery chain, has implemented image recognition to speed up self-checkout. This video shows how easy it is to buy a croissant. The self-checkout is from Pan Osten and the software from Smoothr.

EDEKA, a German supermarket, is using Diebold Nixdorf’s age verification solution to decide whether a self-checkout can sell you alcohol. If the robots think you look more than five years over the legal age, the self-checkout will let you buy a drink. If not, an assistant is summoned to check your ID. The retailer says 80% of transaction are automatically approved, greatly speeding up the checkout.

In biometric payment news, PopID, an early leader in facial recognition, has installed its technology at 300 branches of Steak ‘n’ Shake in the US and claims transactions (check-in + payment) take just 2-3 seconds, slightly quicker than Apple Pay. User adoption is going to be a challenge because consumers need to register their face. This offer of a $10 discount if you sign to “pay with a smile" makes sense.

Figure 2 Photo from Lois Beckett, the Guardian

Voice recognition is next. Elavon Europe has announced a deal to provide payment processing for audico, a voice-activated ordering system. Audico straddles the apparently unrelated use cases of ordering food in corporate hospitality boxes and helping the elderly live more independent lives.

Meanwhile, scientists in Poland have created an algorithm to encode a bank account number in your speech pattern. They believe this will be useful when the country introduces a deposit scheme for plastic bottles. People can throw a bottle into a recycling bin, say their name and be reimbursed.

Finally, Digiseq has taken wearables to new extremes in offering a contactless payment chip glued on to your fingernail.

Product

Stripe has given a fascinating insight into the scale of its development operations which include a remarkable 6bn test runs daily. Stripe’s test card number alone has been used 12bn times. Rollouts are progressive and inspected against 55,000 different metrics. You can find out more by watching the Stripe Sessions.

Stripe’s checkout page now offers over 100 local payment methods. Management believes a wide choice is needed to secure a greater share of transactions from enterprise merchants. “What we’ve heard historically is, hey, we need more payment method coverage if you want us to go all in on Stripe,” said its CFO. Like Adyen, Stripe is also making good progress with omni-channel retail and has won URBN brands for 700 stores worldwide.

One disadvantage of electronic payments is that it gives unscrupulous merchants the chance to add random charges to your bill. One London restaurant has added a 15% “brand” fee to diners bills. Another adds 0.5%-2% if customers use the Sunday mobile app to pay their bill quickly by QR code.

DCC is another opportunity to rip off customers. The ex-CEO of Wise (who knows something about cross-border fees) took to Twitter to complain about a Banco Santander POS terminal lying about commission fees. He says the (already excessive) 5.5% mark-up was 7% in reality.

With marketplaces taking an increasing share of eCommerce transactions, more vendors are providing specialist payment processing. The latest is 1Point6, backed by BNP Paribas, which has signed its first customer, a pizza franchise in South West France.

Market Pay, a Paris based acquirer spun out of Carrefour, will be providing acceptance and processing for REMA 1000, the Norwegian grocery chain. The deal sees PAX A35 terminals deployed across over 1000 stores and brings €200m processing volume. The technical solution was built by Novelpay, the Franco-Polish developer acquired by Market Pay last year.

Payment data quality is not very good. New research show that only 63% of transaction are correctly assigned the right MCC. Acquirers have little incentive to accurately categorise their customers and this makes life challenging for any business trying to commercialise analytics products. Payment firms themselves struggle. A new report shows 84% still use spreadsheets for reconciliations.

Delupay is a new French QR payment wallet which takes a direct debit at the end of the month for your purchases. What could go wrong with this open invitation to friendly fraud?

SoftPOS

One of the big selling points of SoftPOS is that merchants no longer need payment terminals because any Android device can be payment enabled. Tabesto, a French smart kiosk vendor has an early lead. Already working with MarketPay, it has announced a partnership with Worldline.

We’re keeping a close eye on Rubean, a German SoftPOS vendor listed on the Munich Stock Exchange. It reports €500K sales in Q1 and announced a new contract win with SEUR, Geopost’s Spainish subsidiary which will equip “thousands of devices” with Rubean’s software. Couriers taking payments on the doorstep is a good early use case for SoftPOS.

Congratulations to Nearpay, the Saudi SoftPOS vendor, which has joined Mastercard’s StartPath.

Elsewhere, Visa announced a pilot in Brazil in which shoppers can pay for eCommerce purchases by tapping a payment card on their own phone. From a card scheme perspective, this is treated as a POS transaction which means it is cheaper for merchants and more likely to be authorised by the card issuer. Symbiotic, a Brazilian startt-up, is providing the SoftPOS application.

The idea is not unique. Maxa, a London-based start-up, has been proposing something similar for some years without yet gaining much traction. There are some interesting use cases but the need for consumers to download an app or for merchants to include Maxa’s technology within their own app could be a barrier to adoption.

Open banking

The UK Government seems determined to promote open banking payments as part of its efforts to modernise the nation’s payment infrastructure. Mike North has a good summary of the latest proposals in his newsletter. Hannah Regan from the British Retail Consortium argues that before open banking payments becomes mainstream it needs to be cheaper than cards for all transaction values (not just high ones), become quicker (30 secs average is too slow) and needs an acceptance mark.

To make this a reality across Europe, we need to see active co-operation from the banks. Klarna has helpfully ranked the quality of APIs from 6,000 banks in 16 European countries. Netherlands came out top and Portugal last.

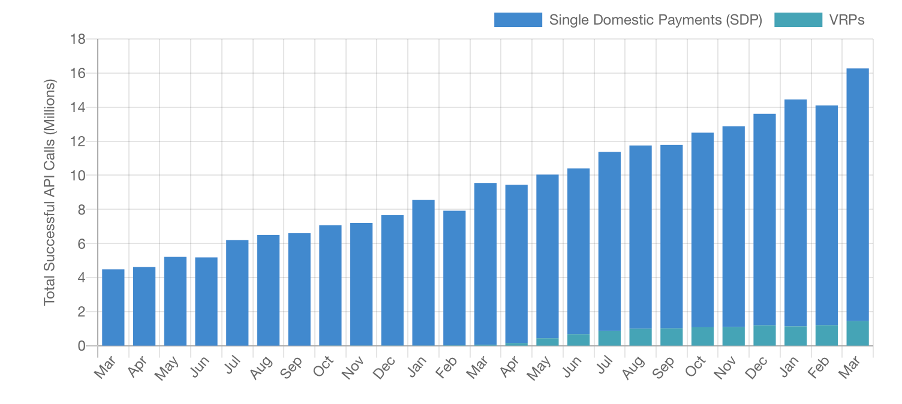

UK open banking payments grew sharply in March 16% month on month although total volume remains modest compared with cards and direct debits.

The unexpectedly slow growth of open banking is causing some investors to run out of patience. This was illustrated by Konsentus, a high-profile London-based provider which has been sold to its founders in a pre-pack administration for just £350K. More on the Business of Payments blog.

If merchants genuinely want to persuade consumers to break the card habit, they need to offer incentives. Truelayer has a good testimonial from JamDoughnut which reports 90% of sales are with open banking payments after the site started offering double cashback for bank transfers. Uber, which uses Stripe’s Link product to offer bank payments is now offering customers discounts when they don’t use cards.

Figure 4 Credit: Jeff Weinstein

Brite, the Stockholm HQ’d open banking vendor which raised $60m last year, has expanded into Germany with distribution through a partnership with Shopware, a popular small business eCommerce platform. In an interview with Sifted, Brite’s founder says her idea for a pan-European A2A solution was sparked by Klarna’s unwillingness to invest in developing Sofort.

Yaspa, a UK business formerly known as Citizen, has received a government grant to help develop a proposition which combines open banking payments with AI to help identify problem gamblers. Yaspa, which already offers open banking payments to punters at the Casino Lugano in Switzerland, has useful experience in this area.

Overlay Payments, a UK start-up, is proposing open banking payments at POS using the NFC chip. This is for Android phones. Meanwhile, Kevin, a well funded but strangely named Lithuanian fintech, has demonstrated open banking payments at POS using an iPhone. Before people get too excited, the POS terminal needs special software to make this work.

Finally, Trustly, the Stockholm based A2A provider, reported strong transaction growth in 2023 with payment volume from its 9,000 merchants up 79% to $58bn. Management said it had “solidified its market-leading position in the US” but gave little other information. Trustly is sponsoring West Ham Football Club and produced a nice commercial to persuade fans to use open banking when buying tickets.

Cash

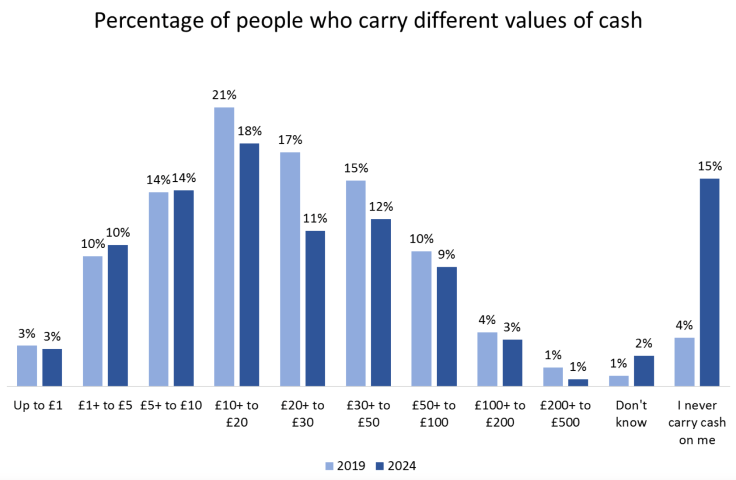

Public policy statements are backing continued access to cash even though shoppers seem less and less inclined to use it. 15% of people say they never carry cash at all. However, the Bank of England says cash is still “hugely relevant” but forecasts its usage will halve by 2032.

The press likes to cover stories of renegade small businesses refusing to accept electronic money like this baker in Belgium, or this café owner in Essex who offers a 10% discount for cash payments. However, the future is more likely represented by an Australian community which has gone wholly cash free.

Crypto corner

With the founders of the two largest exchanges now in gaol, the chances of crypto currencies finding any meaningful role in merchant payments is as far away as ever. The user experience is still terrible although for crypto bros this remains a feature not a bug as you can tell from this utterly baffling Solana commercial.

My guess is that we’ll carry on buying things on credit cards with analogue dollars for a while yet.

Two years after the British Prime Minister announced plans to turn the country into a global hub for crypto, nothing much has happened with even the digital pound looking a long way off. Proposals for a digital Euro seem more advanced although the ECB admitted that it won’t work with iPhones.

Other news

The annual payments survey from EHI highlights some of the peculiarities of the German market. Cash still accounts for 35% by value of retail payments and PayPal is the leading online payment method. Angry at its high merchant charges, some retailers have begun to surcharge Paypal transactions.

It’s very easy for criminals to put fake QR codes where customers are expecting legitimate ones. Car parks are a prime target.

Getting consumers to change the way they pay is tough. Habits are difficult to break. But London’s transit authority reduced the sale of paper tickets by one third overnight with a simple prompt that using contactless cards was cheaper.

The Chief Payment Officer is officially a thing, according to Checkout. This new role drives customer conversion and loyalty while continually shaving basis points off the bottom line. Checkout have also published five ways to get your CFO to take payments seriously.

PSD3 and the Payment Services Regulation are imminent. Here’s a good explainer from EY.

Analysts go to many vendor events so it’s fascinating to read why RSR think Netsuite run the best customer conferences. This is a must read for anyone running marketing events.

Is Frank Bisignano the best paid exec in payments? Fiserv’s CEO received $28m compensation in 2023, a rise of 57%.

Are merchants really losing €60bn from declines? Yes says PSE Consulting.

Lloyds Bank announced it was axing compliance staff so the bank can move at greater pace. Executives had complained that compliance functions were blocking strategic transformation. Many readers of this newsletter will sympathise.

Rapyd, an Israeli company, remains under pressure in Iceland following its founder’s strong support for the war in Gaza. Local press reports the processor has removed its logo from packaging to keep a low profile.

The new Polish Government has cancelled plans for compulsory integration of cash registers and payment terminals but Cashfree Poland continues its successful market stimulation campaigns. Every country should have one of these.

And finally

Nuvei may be going private but Ryan Reynolds (who has a stake in the business) still makes the best commercials in the payment business. It’s a low bar but he consistently jumps over it.

Where to find me

I’ll be moderating the open banking panel discussions at ePay Europe in London on 21 May. And I’ll be at Money 20/20 in Amsterdam on 4/5 June.

Alternatively, you can hear me guesting on Worldline’s Navigating Digital Payments podcast.

How to get in touch

Geoffrey Barraclough

geoff@barracloughandco.com