Opportunities

Before we discuss this month’s news from the payment business, I’ve been approached by two trade buyers looking to make acquisitions in the UK and Europe. Get in touch if you’re looking to sell either:

Payment gateway, ISO or small merchant acquirer with >€200m monthly volume up to €50m valuation; or

Retail or restaurant POS software of any size

For a confidential introductory conversation, drop me an email: geoff@barracloughandco.com

The Payment Business

Life only gets worse for Worldline. A coordinated investigation by several European newspapers accused the French group of dodging regulatory scrutiny by shifting high-risk merchants out of PayOne, its joint venture with Germany’s savings banks. These merchants were allegedly moved to Worldline affiliates in Belgium, then Sweden.

Der Speigel has the details (in English) including pornography, dating sites, and murky subscription services - often tied to individuals later jailed. A former Worldline employee, quoted in the so-called “dirty payments” exposé, recalled: “We handled transactions without even knowing where the money came from. We were just waiting for the Financial Supervisory Authority to show up.” Almost on cue, Brussels prosecutors have launched a money laundering investigation.

Although news to the general public, much of the story was already known within the industry. In 2023, Worldline’s CEO admitted the company had “terminated in an orderly manner some specific merchants’ relationships whose associated costs and potential risks did not match our revised requirements.” The company took a €1.15bn write-down on its PayOne stake and forecast a €130m annual revenue hit from exiting these clients.

I have some sympathy for Worldline’s leadership, who inherited the mess via its 2020 acquisition of Ingenico which had taken control of PayOne the previous year. Blame lies with Ingenico’s management for failing to vet the customer portfolio and with PayOne for not questioning why some merchants were happy to pay 10% transaction fees.

But Worldline deserves criticism for not being more transparent about its actions leading up to the moment it terminated the merchant portfolio in 2023/24. It’s always the cover-up that gets you.

In a stroke of luck, Worldline raised €550m in a new bond issue at 5.5% just a day before the “dirty payments” story broke. Good timing for the company; less so for bondholders who are already nursing losses. Shareholders are suffering too. The stock dropped 30% on the latest revelations, slashing Worldline’s market cap to just €868m, a bargain-basement price for for a business handling €500bn annually in merchant payments. The major shareholders, SIX and Crédit Agricole, may be eyeing a take-private deal.

Figure 1 Chart from Reuters

Paddle is another business in trouble for not keeping a close eye on its customers. The merchant of record (MoR) vendor has agreed to pay a $5m fine to the US Federal Trade Commission for not stopping scammers selling fake tech-support services to elderly Americans. Unlike Worldline, Paddle didn’t process the payments itelf, but the London-based unicorn did sell the software used, highlighting the importance of ongoing sub-merchant monitoring. The FTC’s response may seem harsh, but US regulation is a reality nobody can ignore.

Turning to financial news, Amsterdam-based Mollie reported a 30% rise in gross profit to €115m in 2024, from 250,000 merchants across Benelux and Germany. Following significant cost-cutting in 2023, operating expenses stayed flat, enabling Mollie to post its first positive EBITDA since 2018. The company previously raised a remarkable $800m in 2021.

PayPoint reported weak results from its ISO business, likely the UK’s largest. For the six months to March 2025, payment volume fell 10% to £3.3bn. While PayPoint blamed soft consumer spending, rising competition from Dojo and others seems a bigger factor. Acquiring revenue, mainly commissions from payments processed by EVO Payments and Lloyds Cardnet, dropped 19% to £9.8m.

Haris Karonis founded founder of Viva.com has won his legal case in London against JP Morgan. The litigation relates to the American bank’s $800m investment in 2022 for a minority share of WRL, Viva’s holding company. Karonis, whose motto is “it’s hard to beat someone who never quits” wrote on LinkedIn “The bank’s ongoing lawfare is counterproductive, unnecessary, and has failed. It now remains for WRL to exercise its remaining call option to take full control of Viva.com and for JPM to exit.”

In a busy month for bank partnership news, Allied Irish Banks has sold its 49% stake in AIB Merchant Services to Fiserv, its joint-venture partner. While the price wasn’t disclosed, Dublin analysts suggest an enterprise value of around €300m, roughly 4x operating profit. It’s a modest outcome, but typical for minority stakes.

The deal suits both sides: AIB releases some regulatory capital while Fiserv gains full control, boosting its European eCommerce ambitions and adding a UK ISO channel for Clover. The acquisition will lift earnings immediately, though synergies are limited: AIBMS already relied on Fiserv for most technology and payment processing.

Santander UK has dropped Elavon as its merchant services partner, opting for a referral deal with Worldpay instead. Elavon won’t be too disappointed as lead flows from the bank are thought to be rather modest, but the move is a clear endorsement of Worldpay’s offering, which likely beat Fiserv and Global Payments in a competitive process. The deal also confirms that Santander no longer intends to bring Getnet, its in-house merchant services offer, to the UK.

In corporate news, Paris-based Lemonway, a specialist in marketplace payments, has acquired PayGreen, a French eco-focused eCommerce payment gateway. Lemoway processed €10bn in 2024 and this move expands its addressable market to include direct-to-consumer online retail. PayGreen, which serves 1,500 customers, had been struggling financially and downsized its staff from 41 to 15. Lemonway believes it has hired “a resilient team,” noting, “When you're short of money, you become smart.”

Ryvyl, a San Diego based crypto-centered processor, has sold its small EU acquiring/issuing business HQ’d in Sofia for $15m. Ryvyl EU, formerly known as TIB Credit and then Transact Europe generated $6.3m net income in 2024 from $38m revenue on $3.7bn processing volume. The purchaser is a mysterious UK blank sheet company called Hampstead Holdings. If you know more, get in touch.

New money

It’s been a good month for payment fundraising in Europe.

Dojo, the fast-growing London-based POS-focused SME acquirer, raised $190m to fuel its European expansion. Having gained significant UK market share, Dojo is rapidly growing in Spain, Italy, and Ireland. It reported a maiden operating profit in 2023, £32m on £409m revenue.

Dublin-based Nomupay, formed from Wirecard’s SE Europe and Asia units, raised $40m from SoftBank just months after a $37m Series B round. Nomupay specializes in providing global digital merchants with local acquiring in markets overlooked by Stripe, Adyen, and Worldpay. The funds will support growth in Japan, Indonesia, Singapore, and Vietnam.

Payment infrastructure remains hot. Berlin’s Payrails, founded by Delivery Hero’s payment team, secured $32m Series A funding. Large merchants with complex needs - international payments, tokens, subscriptions, marketplaces, multiple AP’s - are building their own stacks, relying on off-the-shelf components from Payrails and competitors like Primer.

Aufinity, a payment acceptance provider for 80 of Germany’s top 100 car dealers, raised €23m to accelerate expansion into Spain and Italy. Known as bezahl.de in its home market, Aufinity processes €7bn annually, runs on Adyen’s platform and claims to save 20 minutes per transaction by automating 98% of the order-to-cash process, including CRM/ERP integration.

Something blossoms in the state of Denmark

In Copenhagen, politicians, business leaders, and Nets (Nexi) have agreed a future plan for Dankort, the domestic debit scheme. Dankort has seen its market share plummet from 80% to just 40%, widely regarded as both a threat to national security and an unwelcome cost increase for merchants. Increasingly, Danes choose to pay with Apple Pay which processes co-badged cards along the higher-priced Visa rails.

Figure 3 Photo: Ministry of Business and Industry, Denmark

Under the new deal announced at what looked like a wedding reception in the garden of the Business Ministry, Nets will make Dankort available in Apple Pay, launch cards for under-18s and businesses, and give up its acquiring monopoly. Nets can raise Dankort fees, but small acquirers are exempt. Flatpay, a fast-growing Danish payment facilitator which ignores Dankort acceptance today, will welcome this change.

Wero watch

Wero, the payment wallet hoped to provide a European alternative to Visa and Mastercard, is making good progress in bringing new banks on board. After launches in France, Belgium, Germany, and the Netherlands, Luxembourg is next. Five banks in the Grand Duchy will migrate merchants from Payconiq (acquired by EPI, Wero’s parent) by the end of 2025, with consumer migration by mid-2026.

The acceptance network is growing too. Unzer is the latest German PSP to become a wero acquirer, joining Payone (Worldline), Nexi, VR-Payment, and Computop. Amsterdam-based Buckaroo has also joined and will launch wero first in Germany, then Belgium and the Netherlands. Worldline plans to offer Wero as an e-commerce payment option for German merchants this summer, with Belgium going live in October and France in early 2026.

Wero continues high-profile marketing, including giant banners at Frankfurt station next to Apple Pay. Europa zahlt sich aus. Europe pays off.

Figure 4 Photo: Wolf Kunisch

If wero is to challenge Visa and Mastercard, it needs to work across borders. While wero has swallowed national schemes like France’s PayLib and the Netherlands’ iDEAL, many local wallets don’t want to give up their independence - preferring international collaboration over consolidation. After months of debate, the EPI announced it will work with the European Payment Alliance (Euro PA), representing Italy’s Bancomat, Spain’s Bizum, Portugal’s MB WAY, and Sweden’s Vipps, to “interconnect” with these solutions for cross-border P2P and merchant payments.

Software/payment convergence

Money is starting to flow into European vertical software. Tebi, a Dutch ERP/POS/payments startup for restaurants founded by ex-Adyen staff, has raised €30m, bringing total funding to €56m. Unsurprisingly, Adyen powers the payments. Merchant pricing is good value at IC + 0.25% + €0.05, with softPOS available at a €0.06 surcharge per transaction.

Tebi’s new funding will support European expansion, with the UK first on the list. Tebi will compete with the newly launched Worldpay360 which is based on Yabie’s software and whose rollout has been slick, backed by strong video testimonials.

With US players like Shift4, Toast, and Lightspeed Commerce expanding aggressively in Europe, the restaurant software/payment market is heating up. It’s a highly competitive space, as illustrated by some aggressive pricing Shift4 is promoting in the US.

Can software conquer global acquiring? Andrew Dresner has a sharp take on the economics, suggesting that in the US, at least, the low-hanging fruit may already be gone.

Meanwhile in Italy, eCommerce platform Flazio, which claims 1m merchants, is launching FlazioPay, supporting both eCommerce and POS. Founder Flavio Fazio says orchestration and UX were built in-house, and that transactions will cost less than 1%. FlazioPay is launching on an ISO model but may shift to payment facilitation as volumes grow.

Agentic Commerce

Everyone’s talking about agentic commerce. With more people using ChatGPT and its rivals for product search, it’s only a small step to having AI agents make purchases on our behalf. Analysts everywhere are weighing in, but I think this explainer from PSE Consulting is the clearest.

The payments industry will need to move fast to keep up with shifting consumer habits. But agentic commerce has real upside, such as enabling seamless, low-cost micro-charging. That could finally reverse a decision some call “the original sin” of the Internet, that content should be funded by ads rather than direct user payments.

Startups are buzzing. At the Techstars Money 20/20 party, the first three people I met introduced themselves as “founder of an AI agent business.”

Bubble or bandwagon, it’s early days and many start-ups don’t even have a product yet. But take a look at ZincAPI (which lets agents buy from Amazon), PayOS (embedding Visa and Mastercard credentials in agent wallets), and Nakuda, doing similar work. In Europe, Knip is “coming soon” and Paid.ai, based in London, focuses on helping agent builders charge users for services.

For now, these solutions generally involve an agent showing up at checkout with a virtual card. Liability questions such as who’s responsible if an agent books the wrong holiday, will soon need addressing through changes in card scheme rules.

But the bigger shift may be in how merchants approach merchandising. As Simon Taylor puts it, the checkout page is dead. Humans using agents for search and purchase may never need to visit a website.

Stripe Tour

Stripe’s London event doubled as a slick brand showcase and a signal of expanding ambition. It was an exemplary piece of B2B marketing. Stripe talked about its customers and got its customers to talk about Stripe. Of course, it helps that Stripe powers pretty much all the cool start-ups, especially in AI. For example, ElevenLabs (the UK's fastest growing unicorn) took to the stage to say Stripe was essential to its global expansion. This firmly associates the Stripe brand with business success. Any CEO in the audience would have thought "I'll have what they're having."

And it’s certainly true that AI start-ups (see chart) are growing at an astonishing rate. Stripe says these are typically taking just 9 months to get to $5m annualised revenues. Many fail, of course, but are replaced by others also processing on Stripe.

Stripe’s big announcements were a push into treasury via stablecoins, the launch of orchestration and unveiling new POS integrations with Verifone and FreedomPay. The orchestration product is basic and seems more about shifting risk to 3rd parties than trying to acquire new customers. Stripe’s risk tolerance is low.

With an increasingly large product suite, Stripe’s embrace of partners suggests it knows it can’t do everything alone. But any longer-established PSPs in the audience would have been despairing. Today, only Adyen and Checkout can keep up with the Stripe’s frantic pace.

Democratising contactless

The payments industry has been quick to seize on Apple’s forced opening of the iPhone’s secure element. App developers, including banks and PSPs, can now enable contactless payments outside of Apple Pay, avoiding its 5–15 bps fee. The trade-off? A slightly clunkier user experience: users must either open the app before paying or change phone settings to disable Apple Pay as default.

PayPal, Germany’s leading eCommerce payment method, has jumped in fast. It now supports in-store contactless payments with its app via a virtual Mastercard and boasts over 1 million activations. PayPal is pushing hard, offering rewards and special deals at over 2,000 merchant locations. German payment experts are upbeat and expect other app providers, from banks to loyalty and fuel brands, to follow suit.

Tipping pays off

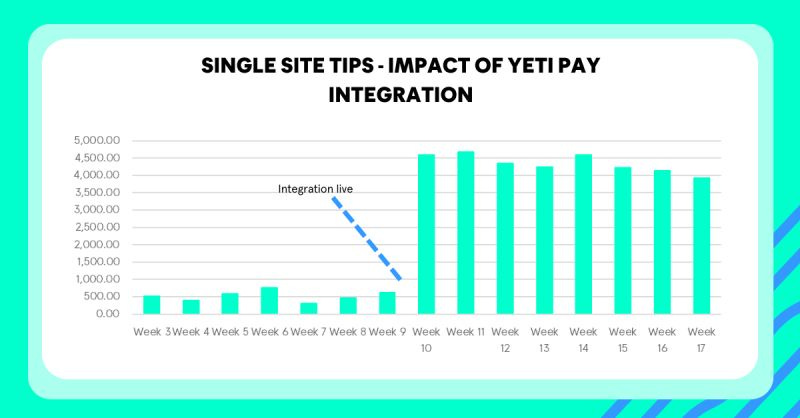

Tipping, long a US tradition, is gaining ground in Europe, helped by pay-at-table tech. In the UK, Yetipay, an ISO reselling Adyen processing, has integrated Tipjar, an app that distributes tips directly to staff and handles admin for venues. Management says real-time tip visibility boosts performance. One operator reported a £4.30/hour lift in team pay and £5,000 in annual payroll tax savings.

Figure 6 Source: Yetipay

SoftPOS

SoftPOS is going mainstream in 2025, enabling new use cases and offering payment providers a low-risk entry into new markets.

eCommerce PSPs are using the tech to offer in-person payments without needing dedicated hardware. Shopify, the world’s largest eCommerce platform, now supports card acceptance via SoftPOS on iPhones, while Amsterdam-based Mollie has launched “Tap by Mollie” using software from Denmark’s Softpay.io which is fast becoming one of Europe’s leading vendors. Softpay now supports Girocard and has gone live in Germany with Lavego, a network operator owned by myPOS.

Germany’s savings banks have also entered the space: S-Payments has launched the S-POS Cube, a SumUp-style device powered by CCV’s SoftPOS application.

Figure 7: S-POS Cube. Photo from CCV

Open banking

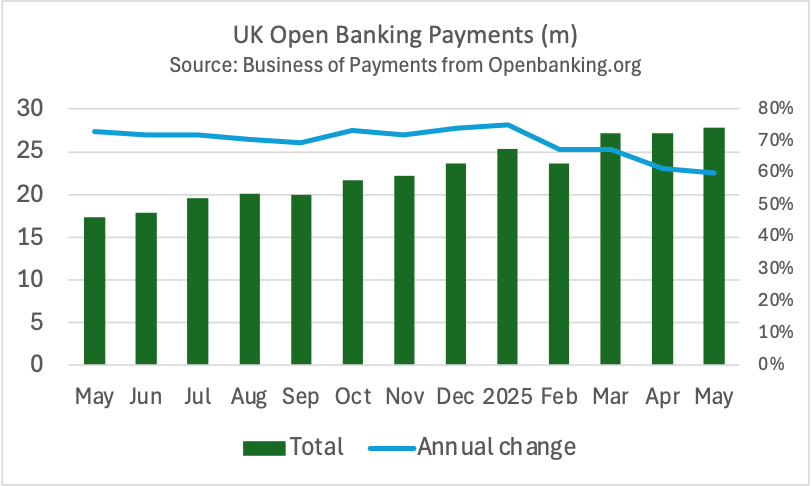

The UK open banking market continues to grow, though likely not at the pace investors had hoped for. Monthly transaction volumes have reached 25 million, with total usage growing at around 60% annually (see chart).

A key barrier to broader adoption is the lack of a unified scheme or acceptance mark. Consumers are confused by inconsistent branding and unclear refund rights. The industry has been very slow to recognise this, leaving space for Visa to plug the gap with its “Visa Pay by Bank” solution. This adds scheme rules and refund guarantees to open banking payments. The service has launched in the UK with support from Lloyds, Nationwide, and Checkout.com. Nordic markets are next.

Pricing also remains a challenge. UK per-transaction fees for open banking payments typically range from 6p to 20p depending on volume but often go lower. This is comparable to traditional payment gateways and rather lower than the margins enjoyed by card acquirers. It’s hard to see anyone getting rich by selling open banking payments alone.

New data from Boodil, an open banking payment vendor, shows the payment type competes most directly with Apple and Google Pay. With a sample of 20 Shopify merchants, open banking’s share was 9–17 points higher when these options were unavailable. Interestingly, when moved from the last to first option at checkout, open banking share jumped 6–14 points which looks like an easy win for merchants that want to steer customers to pay by bank.

The vendor landscape remains complex. Truelayer is arguably the largest player in Europe and claiming around 40% market share in the UK. In April, it processed $10bn across 15 million active users, though it’s unclear how much depends on Revolut, its biggest distribution partner. Beyond the UK, Truelayer sees its main growth opportunities in France, Germany, and Spain. It competes most closely with Trustly and Volt via a direct sales model.

By contrast, Token follows a white-label distribution model, selling through banks and PSPs. This keeps sales costs low but also compresses margins. Token recently secured investment from HSBC and became the first third party processor (TPP) to join Germany’s giroAPI scheme. This is an interesting initiative which offers premium API features such as SCA-exempt micro-payments, based on work from the Berlin Group.

Cash

Politicians have rediscovered a love for cash to promote economic resilience and financial inclusion although their policy prescriptions can sometimes seem old fashioned. Florida is making gold and silver legal tender. “It sounds good in theory,” said one precious metal dealer. “I just don’t know how they would implement it.”

At first sight, it seems obvious that maintaining some cash in the economy would help keep commerce moving in times of crisis, but the experience from Ukraine is very different. After the Russian invasion, the authorities moved quickly to promote digital money with offline capability. It’s worked well as Dave Birch explains.

As cash use declines, banks are finding it more expensive to run their own ATMs and national networks are consolidating. One exception is Revolut which has begun deploying a brand-led ATM at fifty locations in Spain. If successful, we can expect to see these machines in Germany, Italy and Portugal too.

Figure 8 Photo credit: Catalan News

Crypto corner

Stablecoins are one of the hottest topics in payments. Dave Birch has compared their potential to a monetary revolution on a par with William the Conqueror introducing tally sticks. It’s a more interesting analogy than you might think.

Most attention is focused on using stablecoins for cross-border transfers, especially into countries with limited access to the global banking system. But the CEO of Airwallex, one of the leaders in FX and remittances, isn’t convinced. He argues stablecoins don’t reduce costs, since compliance (AML/KYC) still drives most of the expense.

As Worldline can testify, PSP’s need to carefully monitor their customers and we already know that stablecoins are popular with criminals. A UN Development Programme report details how a Cambodian crime syndicate laundered billions via their own stablecoin, marketed with the slogan: “Stablecoins That Never Be Freezed.”

In the US, things are moving quickly. The Genius Act will introduce the country’s first stablecoin regulatory framework. Major retailers like Walmart, Amazon, and Sony are reportedly exploring issuing their own coins. “We’re hearing from merchants, ‘Hey, maybe this has got a lot less interchange,’” said the CEO of Fiserv which hopes to provide white label stablecoins to its clients.

Acceptance is getting easier too. Shopify now lets merchants accept USDC, one of the leading dollar stable coins, converting it to local currency with no FX or multi-currency fees. Coinbase and Stripe are behind the scenes. Standard Shopify Payments fees apply but a 0.5% cashback (likely funded by Coinbase) is available as a promo.

In other news

Sifted has issued a definitive list of European unicorns. The journalists include Viva Wallet, Satispay, Paddle, Teya, PPRO, Go Cardless, Rapyd and Checkout.com. Why no SumUp? Sifted tells me that its merger with Payleven in 2016 disqualifies the mPOS vendor as a unicorn although the same logic would surely rule Teya out of the running.

Consumers clearly prefer paying by phone, but the payment industry keeps churning out plastic. French TV news recently went behind the scenes at Thales to show card production in action.

One to watch: Romania may introduce a tax of 1 lei (€0.20) on all bank transactions, including card payments.

“We did it in Poland." Cashfree.pl has released a TV commercial urging tourists to visit Poland and pay like a local.

If you read one piece on AI, make it Benedict Evans’ latest presentation, whose conclusion is, as ever, “nobody knows anything.” For more, Mary Meeker is publishing decks again.

Donald Trump has decided Jared Isaacman - Shift4 CEO and Musk ally - won’t be running NASA after all. Friendship with Elon seems no longer a political asset.

Is there an MCC for Madame Pipi? Bien sur. It’s 7299 – miscellaneous personal services/not elsewhere classified.

Figure 9 Photo Fabien Pesenti

And finally

A prototype of the world’s first card payment terminal went on sale at Paris auction house with an estimate of €300,000-€500,000. Weighing 45kg, this little beauty was built by Roland Moreno in 1974.

Where to find me

I’ll be at the ePay Summit in London on 28 October and MPE in Berlin next March.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com