The Payment Business

The convergence of software and payments has taken a big step forward. Shift4 became the first processor to acquire a significant European ISV by purchasing Vectron, a German ePOS vendor specialising in restaurants, cafes and bakeries, for €85m.

Vectron offers Shift4 the opportunity to cross-sell payments to its 65,000 merchant locations and through a network of 300 dealers, mainly in DACH and Benelux. Vectron, quoted on the Frankfurt stock exchange, reported €3m EBITDA on sales of €37m in 2023. The move is bad news for Euronet, Vectron’s current payments partner.

Although the EBITDA multiple is high, cost per merchant location is the metric most commonly used by American payment folk when valuing ISVs. By this measure, Vectron is a bargain at just €1,300 per merchant location. In contrast, Shift4 paid $250m for Revel, a US restaurant ePOS vendor with only 18,000 locations last month.

I met with Shift4’s team at Money 20/20. They explained the company’s model is to buy old-school ISV’s that have not yet monetised payments and to aggressively cross-sell into the installed base. Merchants are then offered an upgrade path to Skytab, Shift4’s in-house ePOS product.

While many believe ISV’s will take a major share of payments distribution in Europe, there is plenty of life in the bank partnership market. Worldline is paying €120m for the merchant services business of Credem Banca at “a double digit multiple.” This would be Worldine’s fifth portfolio acquisition in Italy and builds on its current run rate of €35bn processed annually from 320,000 merchants. Nexi is Credem’s current partner and reportedly would expect to be able to retain just 25% of the merchants.

Figure 1 Wordline Italy - source Q1 results deck

The market reacted positively to Wordline’s Q1 results. Although revenue grew just 2.5%, management confirmed it was on track to deliver €200m annual costs savings including cutting 330 posts in France. Worldine’s retrenchment is already having an impact on its supply chain. Ingenico, the French terminal vendor spun out of Worldine is threatening to layoff most of its 100 staff in Belgium blaming weak demand from its largest customer.

Meanwhile, BBVA’s proposed €12bn hostile takeover of Banco Sabadell threatens to torpedo Nexi’s expansion into Spain. The Italian processor had agreed to buy Sabadell’s merchant services business for €350m. The deal includes a 10-year exclusive lead referral deal which might now be worthless. BBVA has a strong in-house merchant services proposition which it will probably prefer to sell through Sabadell’s branches instead of Nexi’s products.

In other bank partnership news, Global Payment’s JV with Commerzbank has gone live just six months after announcing the deal. The offer is very basic but to get anything to market in that time is impressive. Elsewhere, Global Payments has cemented its position in Greece by acquiring EDPS, one of the largest multi-acquirer POS terminal providers. Global inherited a joint venture with National Bank of Greece from its acquisition of EVO Payments last year.

Neo banks are also looking to add merchant acquiring to their business product portfolios. Revolut claims 15,000 merchants accept in-person payments using its simple in-house proposition of free micro card-reader, gateway and payment links. Pricing starts at 1% + 20c. Tide, the UK SME bank, offers a card reader for £89 with all transactions at 1.5%. Tide is as a payment facilitator using Adyen products and will extend to Germany shortly.

Santander beefed up PagoNxt, its payment division, with the purchase of Wirecard’s Munich operations in 2021 for a reported €100m. This was the part of Wirecard that did exist and had real customers but PagoNxt was unable to compete with Adyen, Stripe and others for new business in Germany. PagoNxt is now exiting Germany with the loss of 350 jobs in Munich and will now concentrate on Iberia and Latin America.

Nayax, an Israeli unattended payment specialist quoted on NASDAQ, has raised $63m additional capital after reporting a storming Q1 which saw a 44% increase in connected devices to reach 1.1m. Nayax specialises in unattended payments in vending, kiosks and EV charging. Its latest European win is ASO Vending which will use Nayax terminals in its 8,000 machines in Slovakia.

In other funding news, Ekko, a green payments venture based in the UK, has raised $2.5m to support its efforts to educate consumers by showing the Co2 generated by their online shopping baskets. This is an increasingly crowded market. Connect Earth do something similar and already have partnerships with KBC in Belgium and Tide in the UK which will see Co2 figures added to bank statements. Competition is fierce. Mastercard is offering an identical service to its European issuing clients powered by Docomony, a Swedish start-up.

SumUp, the mPOS provider which claims 4m merchants in 36 countries, has raised a giant €1.5bn loan. The CFO said the cash would allow SumUp “to refinance existing debt as well as have firepower to take advantage of any opportunities that arise over the next six months.”

Bink, a high-profile card-linked loyalty vendor backed by both Lloyds and Barclays banks has failed despite securing an additional £8m last year. All 46 staff have been laid off. Card-linking is a notoriously difficult business model and Bink’s accumulated losses stood at £67m in its most recent published accounts.

Scheming

In a landmark report, the UK’s Payment Systems Regulator has found that scheme fees charged by Visa and Mastercard have risen 30% in real terms since 2019 with “little or no link to changes in service quality.” These largely unjustified charges are costing acquirers (and their customers) an extra £250m annually in the UK alone.

Scheme fees contain a mix of per transaction and ad valorem elements charged over different time periods and are near impossible to reconcile. The PSR reports “some of the largest acquirers in the UK told us that they need to purchase additional services or consultancy services from the schemes in order to properly understand their fees and services, and several acquirers reported their ‘accidental’ purchase of some services.”

Disappointingly, the regulator has backed away from capping scheme fees. Instead, it is proposing to oblige Visa and Mastercard to publish more detailed financial information including justification for any increases.

Vendors see a clear problem to solve and we’ve seen a growing number of start-ups offering acquirers tools to manage scheme fees and portfolio pricing. Torus from Estonia won the innovation competition at this year’s MPE conference in Berlin but you could also take a look at Finflag, based in Brussels and founded by two former PwC consultants.

The position may be even worse in France where, according to the national competition authority, average card transaction charges have risen from 0.27% to 0.44% since 2018. The French economy minister has called on the EU to act against Visa and Mastercard as soon as the new Commission is installed later this year. Switzerland is not waiting that long. Its competition watchdog has capped Mastercard debit interchange at 0.12%, well below the EU’s level of 0.2%. A decision about Visa debit is expected shortly.

French press reports that the European Payment Initiative (EPI), a consortium of French, Benelux and German banks, will launch first in Germany and Belgium (July) followed by France (September) with the Netherlands following rather later. The service, called wero, is a mobile payment wallet running on SEPA Instant Payments and positioned as a European competitor to Visa and Mastercard.

Blik, the Polish mobile payment standard backed by local banks and Mastercard, goes from strength to strength. Transactions were up 40% in Q1 with payment volume totalling €17bn. Blik now works P2P, at POS and online including a much upgraded service to support subscriptions payments.

With the pandemic’s travel bans a distant memory, payment service providers have restarted projects to include Chinese schemes in their acceptance proposition. In Germany, the Sparkasse have added Alipay+ to the S-POS app as part of the Chinese payment brand’s effort to widen acceptance on the back of its €200m sponsorship of the European football championships. Alipay+ will also be available on 50,000 terminals managed by DNA Payments, a UK acquirer.

Underlining further the rebound in tourism Rome will become the first European city to accept Union Pay and JCB for contactless ticketing on its rapid transit system.

New shopping

We’re seeing a steady launch of new autonomous stores in Europe, each of them contributing to the long-term shift of transactions from POS to consumer app.

Rewe has opened its third site in Germany using technology from Trigo. Shoppers decide at the exit whether they want to “just walk out” or follow a more traditional checkout route. Rewe has also worked with Pixevia, a Lithuanian AI platform for autonomous retail that just raised an additional €1.5m to fund international expansion.

Also in Germany, toy retailer Vedes, has opened an autonomous shop at Munich Airport. This isn’t the only new technology at the airport. There’s also an annoying robot vending machine called Jeeves which takes payments via QR code.

A cheaper alternative to decorating the shelves and ceilings of stores with AI powered scanners is to put the technology in the shopping cart instead. Instacart, a US online supermarket turned technology vendor, expects to have thousands of its “caper carts” deployed in grocery stores by the end of this year. One retail blogger is not impressed. There is still too much manual keying, the carts are not big enough and you still have to pay at a standard checkout machine. Decide for yourself.

Product

Visa provided this month’s big news with a set of announcements that reposition the analogue credit card further into the digital world. This includes a new flexible credential that will allow shoppers to toggle between different card products issued by the same bank. Think Curve but restricted to a single bank’s products. Commentators have been very positive and there’s good analysis in Simon Taylor’s newsletter although others suggest the flexible credentials won’t be simple for merchants to manage.

Checkout.com has launched a new AI powered product called Flow which helps merchants choose the right payment methods to present to each customer. Flow then customises the checkout so that shoppers are asked for the appropriate information in the right order using the merchant’s colour palette. Retailers love being able to customise third party services with their branding.

Stripe announced last month that it was unbundling its product to allow merchants the option of using alternative processors including Adyen, Braintree (PayPal), Checkout and Worldpay. The Batch Processing newsletter gives the technical details but concludes this new “orchestration” capability isn’t up to Stripe’s usual high engineering standards.

In mass transit, passengers on the Paris Metro can now use Apple Pay to travel on the network by adding the Navigo pass to their Apple wallet. Flowbird, (ticketing system), Conduent (integrator) and Worldline (processor) delivered the solution.

Electric vehicle charging is a fast-growing and highly complex niche segment of the payments industry. This case study from Computop, the German PSP part owned by Nexi, highlights the challenges. One of the toughest is to allow drivers to pay for their electricity using their preferred app rather than having to download a different one for each provider.

Open banking

Matt Jones wrote a good piece on why open banking is not happening. In short, the touted benefits – faster settlement, lower fees and no chargebacks – carry no weight with consumers. This was echoed in a panel discussion I chaired at the ePay Summit featuring two leading merchants – one from the travel sector and one from fashion – neither of had immediate plans to offer bank transfers as a payment option.

Figure 2 Panel discussion on open banking payments featuring execs from SuperDry, National Expresss, Truelayer and Ivy

For open banking payments to grow, we need an acceptance mark, scheme rules, an agreed pricing strategy, single-minded focus on customer experience and, most importantly, effective leadership from the banks. Without their active support, neither the regulator nor the payments industry can make the market happen.

There’s no lack of committees making recommendations, but the UK’s alphabet soup of open banking working groups, regulators and industry lobby organisations is hard to navigate. This month, JROC (a committee grouping the various regulatory bodies overseeing the financial system) published proposals for a “future entity” to be tasked with setting the standards needed to bring open banking into the mainstream.

The new body will have a mandate to promote open banking although it’s still not clear how it will be funded. The payments industry thinks the banks should pay. The banks are not so keen.

There are good use cases for open banking payments today such as paying of credit card bills or buying cars but none offer significant transaction volumes. Investors are getting worried and we’re beginning to see consolidation of the unnecessarily large number of open banking vendors.

Fabrick, the aggressive Italian open banking specialist backed by Banco Sella, has bought Germany’s FinAPI. The purchase price is reportedly rather lower than the “high double-digit millions” reportedly offered by Yapily in 2022. The combined Fabrick/ FinaAPI business processed more than €65bn from 800 customers in 2023.

I had a good discussion with Todd Clyde, CEO of Token, at Money 20/20. He told me that Token is taking an indirect route to market via banks and PSPs rather than direct to merchant. Token has a blue chip customer list including Mastercard, Computop and Nuvei which together process 41% of all card payments in Europe. Nobody knows when the market will move from card debit to open banking but Token believes it should be well positioned if/when it does.

GoCardless, the London based A2A vendor which has been reporting significant losses says it is now pushing for profitability. The CEO told journalists “We’re pretty close to profitability now, and we’re in a position where we’re very well capitalised – we have a lot of cash on the balance sheet.”

Trustly is one vendor making money from A2A, publicising 2023 revenues of $265m via an exclusive with CNBC. “Adjusted” EBITDA rose to $51m from $33m in 2022. Growth has been very strong in the US but an IPO is still more than a year away.

One market where open banking should take hold quickly is Poland because bank transfers (known in English as “pay by links”) were commonly used for online payments before Blik came along and swept the market. You’d expect PBLs to be replaced by open banking but PBL volume is still growing. I’m told that the open banking APIs are generally not yet at the quality of the older, direct integrations supporting PBLs.

Crypto Corner

While the introduction of ETFs has reinforced crypto’s role as a speculative asset class, these synthetic currencies could have a role in countries whose central bank money is compromised by inflation or political isolation.

Venezuela is looking to circumvent the latest US sanctions by selling oil for Tether, a US dollar stablecoin. This follows the shutdown of the country’s five-year attempt to issue its own oil-backed Petro tokens after $21bn went missing.

But stablecoins are also not what they seem. Visa reports that 90% of stablecoin transactions come from bots rather than real people. While there’s nothing wrong with robots trading with other robots, these figures suggest that stablecoins, like other crypto instruments, cannot be considered a generally accepted means of payment.

Central banks are continuing to develop their own digital currencies (CBDCs) in response to the perceived threat from private initiatives such as Tether. The Bank of England has completed a proof of concept which demonstrates digital pounds (Britcoins) could be accepted on today’s standard POS terminals. There’s plenty of technical detail here for those interested.

Meanwhile, the Merchant Payment Coalition which groups Ikea, Auchan and other large retailers, has issued its response to proposals for a digital euro. The merchants primarily see the digital euro as a way of making B2C payments cheaper. They ask for a fixed fee per transaction “as close to zero as possible” and free of charge for low value payments. The retailers call for all other fees to be paid by consumers not merchants.

We’ve not heard much from the metaverse recently but Walmart have opened a store on Roblox and, for the first time, are selling real-world items. The user experience needs work. After trying out products on their avatars, users can load a browser window on a virtual laptop within Roblox to access Walmart.com and pay by typing in their credit card details. If this the future of retail, retail has no future.

In other news

Banking as a service (BaaS) allows Fintechs to expand quickly but comes with a regular reminder to check your BaaS providers financials. The collapse of Synapse in the US has hit over one hundred fintechs, some of whom will never recover.

In a move described by one newspaper as “Curve pivots to porn and gambling” the card-based digital wallet announced customers could now use their Curve card to pay high risk merchants, even ones blocked by their own card issuer. Eight days later, Curve announced a U-turn saying “We wish to clarify that if your underlying payment source provider does not permit certain transactions, Curve can’t allow them either!”

Klarna reports using GenAI has cut marketing costs by $10m annually, notably a $6m saving from replacing stock photographs with images generated by Dall-E. This is how Bing Image Creator imagines Klarna’s marketing department.

Here are two useful research reports to download and keep for the next time your boss asks for a strategy deck. Worldpay’s Global Payments Report is a helpful reference for statistics on the state of play in payment acceptance while Cap Gemini’s Payment Trends 2024 focuses on back office transformations needed to support decentralised finance, ISO 20022, PSD3 and other buzzwords.

Blusesnap, a US based PSP, has paid $10m to the US Federal Trade Commission in settlement for knowingly processing payments for “deceptive and fraudulent” companies. The FTC was particularly annoyed that management ignored warnings from Visa, American Express and Bluesnap’s own internal fraud monitoring team.

In other legal news, Rapyd, the London HQ’d acquirer/processor is being sued for $1.1m unpaid sales commissions by a former employee in Singapore. Rapyd’s CEO says the transactions in question were “round-tripping” and only done to boost volume on the platform. The salesperson says the client was moving their own funds through Rapyd’s multi-currency treasury products and so was eligible for commission payments.

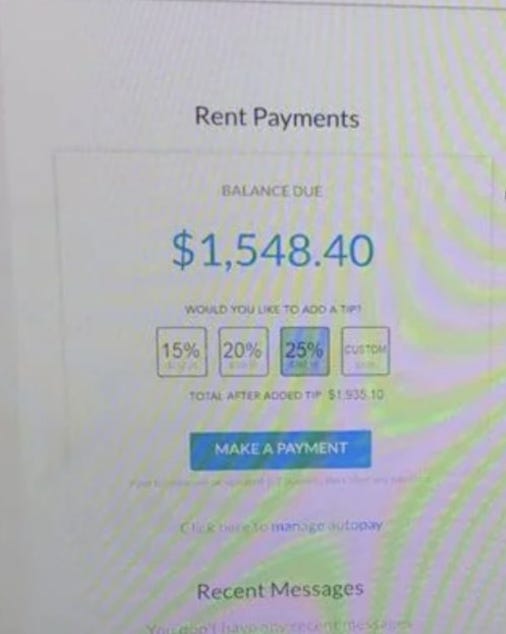

Reddit users discuss what to do when the landlord’s payment page asks for a tip. Answer: hit custom and put in a negative number to see whether you get a discount.

Figure 3 Photo: @TrungTPhan

Thousands of sellers on the Vinted second-hand clothing marketplace were forced to wait weeks for their cash after a glitch at Mangopay.

And finally

Filippo Bergamin found no less than eleven payment terminals at this Milan restaurant. The owner could certainly benefit from some payment orchestration.

How to get in touch

Geoffrey Barraclough

geoff@barracloughandco.com