Having spent the last ten years working for two of Europe’s leading merchant acquirers, I’ve set up this newsletter and the associated blog to provide the sort of information I would have found useful. Get in touch, let me know what you think and feel free to suggest new topics to cover.

The payment industry’s fortunes are closely linked to consumer spending which is performing much less badly than feared. Both Visa and Mastercard reported trading in Europe ahead of expectations in Q1. Vasant Prahu, Visa’s CFO, said “Europe is strong, defying what we may have expected going into the year. If there is a positive surprise, it’s clearly Europe.” More detail on the Business of Payments blog.

France has long been a missing piece in Worldine’s jigsaw and its management were very pleased to announce a joint-venture with Credit Agricole. Worldine will bring the products. The bank will bring the customers and, equally importantly, large scale Carte Bancaire volume. Worldine expects €300-€400m annual revenues once the venture is mature.

In Italy, two banks are considering options for their merchant services businesses. Local press reports that Banco BPM will soon announce a strategic partner. Worldine or Nexi are considered the most likely options. The much larger Unicredit is expected to announce the consolidation of its payment operations into a standalone business unit to be managed in-house by Alberto Palombi, an investment banker recently hired from UBS.

Local press reports that Nexi will buy a stake in Computop, the last man standing in the German payment industry. Computop is the country’s leading eCommerce PSP with 12,000 customers and €36bn payment volume. It also provides white label services to a number of banks. This is a good move for Nexi although I’m slightly surprised that Global Payments (now implanted in Cologne through the EVO acquisition) didn’t make a move.

Bank of Greece reports that total national volume rose to €30bn in 2022, still small by European standards, but fast growing and with a good share of high margin international transactions. The Greek payment market has consolidated remarkably quickly and is showing the future for other countries. All the major local banks have divested their merchant services units or partnered with one of the international players. Worldline, Nexi, EVO/Global Payments and Euronet together now hold 92% of the market.

As an example of the innovation that the international processors can bring, Cardlink, Worldline’s JV with Eurobank, has launched a PAX A920 with a set of restaurant-friendly features for €19.90 per month.

We’re still waiting to see if US processor Shift4 finally concludes the $525m acquisition of Finaro. The deal has been held up for over a year due to the presence of sanctioned Russian oligarch on the Israeli acquirer’s share register. Meanwhile, Finaro is making good progress extending its reach into POS with a contract to process contactless ticketing transactions for the Bavarian City of Regensburg. Czech specialist, Switchio is providing the payment gateway.

Nuvei reported 20% revenue growth in Q1 but more eye-catching was the revelation that Ryan Reynolds has invested an undisclosed sum. The actor, who recently banked $300m from his stake in a wireless provider, said ““I know as much about fintech as I did about gin or mobile a few years ago but Nuvei is impressive and… it’s about time a Canadian company got the type of attention American tech companies do.”

FIS gave a little more detail on its plans to spin off Worldpay into a separate publicly traded business “by early next year”. FIS will retain up to 19.9% of the company it bought for $43bn in 2019. The Q1 results show that the POS-focused US and UK businesses are struggling. UK enterprise revenue was down 7% which is a dismal performance when consumer price inflation is running at 10%.

RS2, the Maltese based payment software vendor, reported 3% lower revenues in 2022 as its bank customers delayed projects. FIS and ACI have been making similar complaints. To mitigate its reliance on two very large customers, RS2 has entered the increasingly crowded German market with a new brand – Beyond by RS2 – selling POS payment acceptance direct to merchants. Without a bank partnership, distribution is likely to be a challenge.

We’re used to reading about persistently loss-making payment businesses. So it’s a pleasure to find out more about Bratislava HQ’d TrustPay, a consistently profitable family-owned merchant acquirer with operating margins of c.30% that has never taken external capital.

Fiserv bought the UK operations of NetPay, a POS gateway, in 2021. Netpay’s management is rebooting its Irish business and targeting 20% merchant market share within 3 years. That’s a very bold target given the strong competition from BOIPA (EVO), AIBMS and Elavon.

The financial press is speculating that Tiger Global could be looking to offload its $1.5bn stake in Stripe. More interesting to readers of Business of Payments is Stripe’s conveyor belt of new products and customer wins. This month we saw the launch of S700, a developer friendly portable Android terminal. Exciting features include the ability for ISVs to control the payment screen.

As Stripe demonstrates, it’s become increasingly important for eCommerce specialists to offer an integrated POS solution. Mollie, the Dutch payment unicorn with 130,000 online merchants has launched a small range of PAX terminals at €350 up front or €10/month. The products are available today in Germany and Benelux with other European markets coming soon. Another example is WIX, the eCommerce platform, which has integrated with Square to offer POS payment acceptance for its omni-channel merchant customers. UK rates are 25p + 1.4% for domestic cards.

Stripe is still winning eCommerce business too, cementing its relationship as “strategic payments partner” for Uber across most major markets. This indicates a major shift from Uber which, up until now, built most of its payment infrastructure in-house. According to Stripe, its sales team took a while to convince Uber’s management that the processor was able to handle the scale of its payment operations.

High risk acquirer emerchantpay has been embarrassed by the resignation of Grant Thornton, its auditor. The accountants cited governance concerns. Undeterred, emerchantpay has invested €18.5m capital into Ibanera, a banking-as-a-service provider. The rationale is to ensure Ibanera can “keep supporting” Bitline, a Florida based gateway that helps people gamble crypto assets in casinos.

Hands In, a brilliantly simple way for friends to jointly pay for holidays by splitting the basket, has raised $550K. The UK based start-up won the Innovation competition at this year’s MPE Conference in Berlin. Samuel Flynn, the founder, is in his early 20s and has already attracted a stellar community of investors.

New Shopping

Amazon’s “just walk out” technology hasn’t really delivered. Its own store roll-out programme has gone much slower than expected and 3rd party retailers have been unaccountably reluctant to buy core technology from a deadly rival. But Amazon “just walk out” isn’t dead. The retail giant is tinkering with the customer experience including removing the entrance barriers. And it is winning a few customers such as a new store at the Excel exhibition centre in London and at Lagadere’s network of airport shops.

Starbucks has begun testing Amazon One – a biometric payment system based on palm reading. It says initial reactions to the palm payment system have been met with uncertainty from older consumers. “They’re kind of freaked out by it,” said one staff member.

With shoppers still confused by “just walk out” stores, Smart Carts may be a better idea. Hastok, operator of 40 homeware stores in Israel, will be deploying 1000 shopping carts equipped with scanners that automatically recognise purchases. The technology is said to ignore personal possessions placed in the carts, including stray children. When finished, shoppers simply checkout on the integral touchscreen, making payment via the attached PINpad. The vendor, A2Z Smart Technologies, is getting upfront and monthly fees for each cart plus a cut of any advertising revenue.

New shopping needs to be accessible for everyone. Some customers are unhappy with Marks & Spencer’s new cashless cafes because the ordering kiosks are too high to operate from a wheelchair. Accessibility isn’t the only dilemma. Americans are now fretting about whether it’s rude not to tip a self-checkout machine.

There’s no need for high-tech convenience stores if robots can make local deliveries cheaply and quickly. There’s a pilot going on in Wakefield in the north of England led by Starship Technologies. and covered by this good BBC local news report. The robots keep getting stuck but cheerful locals are always on hand to put them back on the pavements.

European Payments Initiative

Not dead, merely resting. The European Payment Initiative (EPI) has sprung to life. Rather than build a Visa or Mastercard competitor from scratch, the consortium – which includes Worldine and Nexi - has bought iDEAL, the Dutch account-to-account payment scheme, along with Payconiq, its technology provider. This gives EPI a solid basis for success in terms of both volume - iDEAL brings 20% of all Eurozone online transactions – but also establishment support. EPI members represent most major banks in Benelux and Germany. Here’s some good analysis from Ron van Wezel at AITE.

Commentators in Warsaw have unkindly suggested the EPI is merely reinventing Blik, the wildly successful Polish mobile payment standard. Blik – a consortium of six local banks plus Mastercard - has now moved into Slovakia with the acquisition of VIAMO and is also now present in Romania. Could a merger of Blik and EPI be on the cards?

Orchestration

Orchestration is a hot topic at the moment although sometimes it’s hard to understand where gateways stop, and orchestrators start. After all, both concepts connect merchants with multiple PSPs or acquirers. Most would say that Freedom Pay is a gateway but its President said in an interview with Retail Tech Innovation Hub: “The last payments processing request for proposal (RFP) I did, had a title with orchestration in it – gateways or other such old fashioned language wasn’t in it at all.”

To confirm the trend, Paydock, a gateway orchestrator based in London but founded in Australia just raised £25m. Paydock is focused on both merchants and, as a white label, for banks.

This excellent new whitepaper from Edgard Dunn and Nuvei gives the merchant perspective on orchestration. Reducing processing costs and simplifying internal operations, rather than optimising acceptance, or reducing fraud are the key drivers for adoption.

Product news

As Maestro heads towards oblivion, Aldi and Lidl are wasting no time. The two giant German supermarkets announced they will turn off Maestro in July. The ending of Maestro is more of a problem for Germans who want to use their debit cards abroad. It will also likely lead to higher fees. In Switzerland, the merchant service charge on a CHF100 transaction is 28c on a Maestro card but 60c on Debit Mastercard and CHF1.05 for Visa Debit.

McLEAR has launched a payment ring, called RingPay, in the UK. Working with Gemalto, Infineon and Railsr, the product can be provisioned with any EMV payment credentials. This broadens its target market but these solutions still look rather niche while everyone routinely carries a Smartphone. The ring is priced at £90 and allows a maximum daily spend of £500.

UK-based Miura had an early lead in mPOS terminals but has been rather overshadowed by the emergence of the big Asian brands – PAX, Newland and Castles. It has finally launched an Android device. One of Miura’s distributors told me the proposition was underwhelming, lacking the support services needed by the leading acquirers.

Artificial Intelligence

The people who have been boring you with talk of Blockchain for the last few years moved briefly on to the Metaverse and are now self-appointed experts on Artificial Intelligence (AI). The technology may be different, but the hype remains the same.

Payment companies have been using AI for years, notably in screening transactions for potential fraud. It’s the technology leap into generative AI which is getting everyone exited. Here’s a good roundup from FXC about what the industry leaders have been saying in their Q1 results.

The schemes have contrasting messages. Visa’s CEO said: “We’ve got people all over the company that are tinkering and dreaming and thinking and doing testing and figuring out ways that we could use generative AI.” Mastercard’s boss was more cautious. “We’ve encouraged our employees to experiment with the technology, but we set very clear guardrails. Don’t do it in production…. We will lean in, but make sure that we are a trusted party when it comes to scaling it up.’

Open banking

Mastercard has made a long awaited investment in European open banking. It has taken a stake in Fabrick, an “open finance” spin-off from Italy’s Banco Sella. This may have implications for Mastercard’s existing open banking partnership with Token. Fabrick itself sees opportunities in the UK and has acquired Judopay, a well-regarded mobile-centric PSP based in London which processes over €2bn annually.

Meanwhile, British commentators have noted the glacial pace of adoption of open banking payments. Nick Dunse, former CMO of Pay with Bolt (an open banking aggregator) wrote a good post on why things are not happening. I can’t argue with “Nobody is leading it and there's no money in it.”

The UK authorities are aware and are recommending next steps for the Open Banking Implementation Entity. However, unless volume arrives quickly, a number of start-ups are going to be struggling to attract the funding they need to continue. Now could be a good time for merchant acquirers to buy an open banking API aggregator.

However, we have seen a steady trickle of merchant announcements. British drivers can now buy a BMW with open banking payments. Trustly is providing the connection via Adyen. At the other end of basket size, Trustly will also be going live with Holland and Barrett. And Topps Tiles is now taking open banking payments using Truelayer.

We’re also beginning to see pricing models emerge. Wonderful Payments has bult a slick merchant UX on top of open banking payments and charges £99/month for 1000 transactions. Its target market is charitable giving.

Counting cash

Access to cash has been a key public policy concern for some time, especially in rural areas. A consortium of UK ATM operators and cash management suppliers has formed the Payment Choice Alliance to push for legal obligations on merchants to accept cash. Whether inclusivity is best served by subsidies and protection for the cash industry or by accelerating universal adoption of digital money is a good question.

One good innovation to help people move away from cash is this reverse ATM, designed by Wavetec, which turns paper money into pre-pay plastic. Venue operators cover the pre-pay card fees so that they can welcome all visitors while keeping their cash free tills turning quickly.

But it’s certainly true that cash is being squeezed. Among merchants, the last cash-only standouts are conceding the game is up. Even the Schweizerhof beer garden in Vienna is now accepting card payments. Hat tip to Global Payments for getting these folk to join the 21st century.

The less cash used, the higher the costs. In the UK, the LINK interbank network is now paying just 27p to ATM operators for each withdrawal, squeezing margins all round.

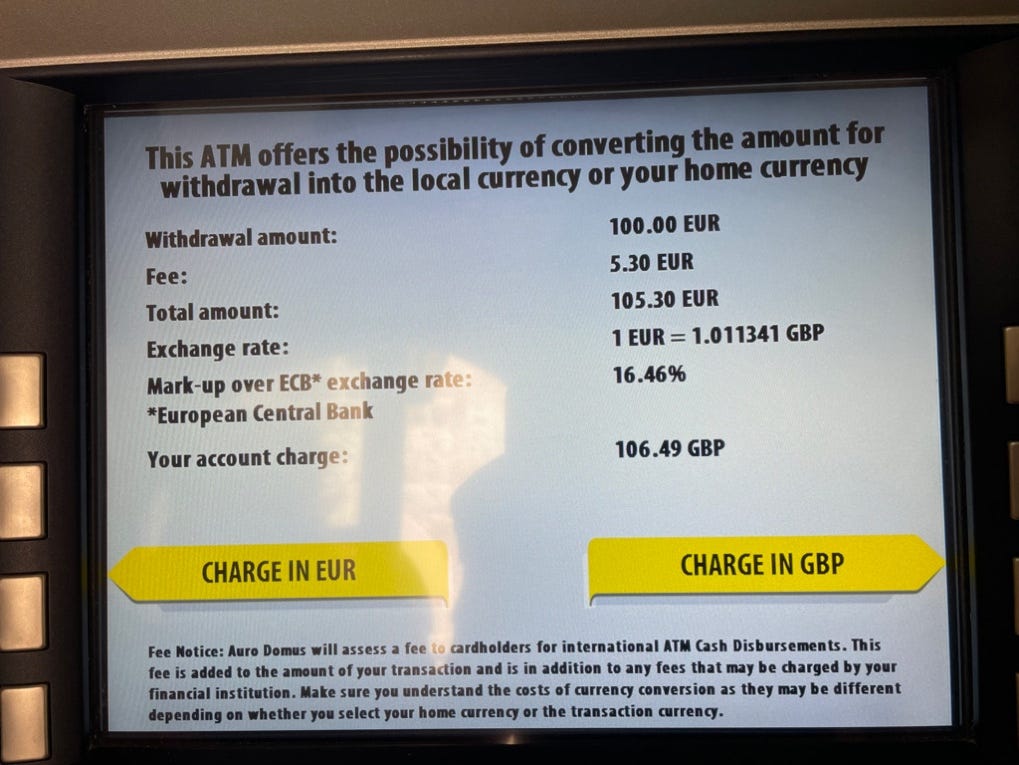

One way for ATM operators to make some extra profit is to rip-off unsuspecting tourists with outrageous DCC charges. Auro Domus in Dubrovnik asked me for an astonishing 16.46% commission. Along with a fixed fee of €5.30, this would make a €100 cash withdrawal cost £106.49. I declined DCC and was billed just £91.68 by Halifax, my credit card company.

SoftPOS

There’s a little SoftPOS product news this month but still no indication of usage and payment volumes. Caixa Bank has launched what it claims is the first SoftPOS from a Spanish financial institution.The technology comes from its JV with Global Payments. Natwest is launching a SoftPOS too although it’s not clear whether the UK bank is using a product from Fiserv, its strategic partner, or another vendor.

Crypto corner

Andreessen Horowitz published its initial “State of Crypto” report and concludes that the industry is “healthier than market prices indicate.” AH notes that, even after recent turbulence, 30,000 developers are working on crypto projects worldwide.

The UK is the capital of economic crime and crypto currencies are no exception. British punters lost £300m in the last twelve months, up 40% on the previous year. A third of the fraud was in November 2022, the month FTX failed.

I’ve long been calling for crypto to be regulated as gambling not securities. The UK Treasury Select Committee now agrees with me. It also cautioned the Government against publicly backing crypto assets such as NFTs saying the authorities should “avoid spending public resources on projects without a clear, beneficial use.” The Governor of the Central Bank of Ireland took a stronger line, comparing the purchase of unbacked crypto with a Ponzi scheme.

There are also clear concerns around crypto-currency related money laundering including the continued prevalence of unlicensed crypto ATMs. The UK regulator has closed down yet more of these in three provincial cities. The ATMs are said to be “a key component in the facilitation of money laundering and the movement of funds gained through criminal activity.”

Mastercard thinks it can help fix the plumbing if not the risk. Its new Crypto Credential service is hoped to “bring more trust” in using digital assets for money remittances.

Visa is also maintaining investment. Its CEO said “We see the potential for stable coins. … We’re enabling on and off ramps on crypto. We’re working with exchanges around the world to issue their users Visa credentials. And we’re developing the capability for our issuer and acquirer partners to have a choice to settle in stable coins.”

But Pressure is mounting in the US to regulated “backed” crypto too. The US American Bankers Association wants stable coin operators to be regulated as banks.

In other news

It’s great to see PayU sponsoring the LGTB+ film festival in Poland.

Americans have begun worrying about contactless payment terminals charging the wrong card. According to ABC, one clever device in a supermarket “ignored the debit card in [the customer’s] hand. Instead, it reached into Matthews’s back pocket, through his wallet and charged his Bank of America credit card tucked inside.” That’s one very remarkable terminal.

Global Processing Services (which does roughly what it says on the tin) has rebranded as Thredd. Why? Because its “tailored” solutions are the “thread that runs through our clients’ plans.” And because it wants to be part of the fabric of your business. There’s more. Thredd believes payments should be seamless. Geddit?

Hallelujah. The New York Subway is finally taking contactless payments. If folks can’t understand how it works, they are advised “to ask a young person to help you figure it out.” Cubic is providing the technology.

AITE has a timely report on payment infrastructure. The analysts report that banks have already lost 10% of their payment volume to Fintechs and need to urgently modernise legacy systems. Cloud-based payments-as-a-service vendors should benefit.

The recent MPE Conference in Berlin was the best yet. If you weren’t there, the organisers have published a very thorough report of what you missed.

The Wirecard trial rumbles on. Marcus Braun’s defence has revealed some of the German processor’s very unsavoury “adult” clients including Mindgeek and Netlook.

A new service called Fee Checkers has launched in the UK. Merchants give it access to their acquirer portals. Fee Checkers analyses their transaction history and proposes alternative (cheaper) suppliers. If this works, it will be winner.

A good case study from Mastercard looking at how it helped MediaMarket, the German electronics retailer, evaluate the effectiveness of its price-matching strategy.

And finally

It’s game over for legacy banks as Irish parking meters begin accepting Revolut.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com