Happy New Year everyone!

2025 promises to be another exciting year in merchant payments. With open banking and mobile wallets threatening to challenge the card schemes and ISV’s vying with banks for distribution deals, there won’t be a dull moment. And that’s without Trump 2.0 and his techno friends setting fire to the crypto sector.

I began writing Business of Payments to produce the content I’d wanted to read when working in strategy roles for two of Europe’s largest merchant acquirers. It’s been wonderful to see subscribers growing to almost 3,000 individuals. I’d like to thank everyone who’s been in touch with news, gossip or cool new products to share.

Here’s to a successful and prosperous 2025 for everyone working or investing in European merchants payments.

The Payments Business

With 200,000 merchants across Europe, myPOS is a rare beast in the fintech jungle - growing, profitable and debt free. Revenue was up 39% in 2023 to €84m. Advent, the private equity giant, paid a generous €500m for the business last year and will be looking to widen the product portfolio from payment acceptance to a broader set of financial tools for SMEs. More details on the Business of Payments blog.

Worldine’s JV with ANZ, Australia’s second largest bank, is going badly wrong. Worldline paid €307m for 51% of ANZ’s merchant acquiring unit in 2022 but is reported to be hoping to sell its stake back to the bank for less than half that figure. ANZ cites poor cultural fit, high staff turnover and excessive capital spending. For its part, Worldine called out the Australian misadventure as a contributor to missing its financial targets.

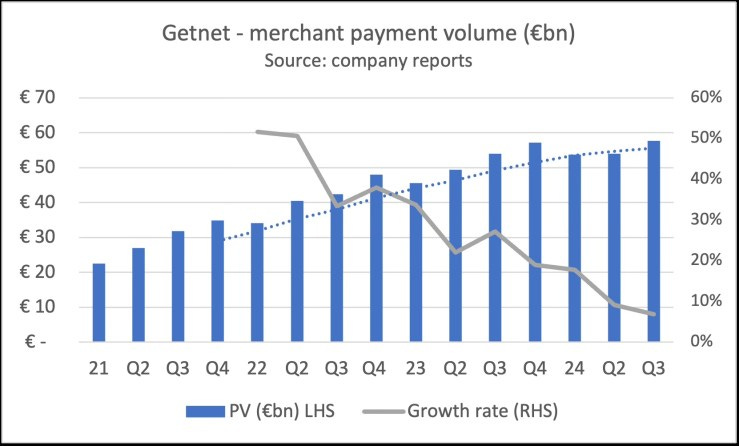

Santander is sticking to a target of 30% annual revenue growth at PagoNxt, its payment unit, although sales have been slowing during 2024. Total volume processed by Getnet, the merchant acquiring division, grew just 7% in Q3. More on the Business of Payments blog.

In corporate news, Shift4 has bought Card Industry Professionals (CIP), a small but well-regarded UK ISO for an undisclosed sum. CIP, which employs 20 full time staff and 150 field sales agents, claims a modest £60m/month of payment volume but provides a solid basis for Shift4 to expand its UK presence. This deal comes close on the heels of Global Payments buying CIP’s much larger local rival, takepayments, for $250m.

Nuvei has acquired Payaut, a Dutch-HQ’d start-up that sells whitelabel marketplace payment solutions to PSPs that don’t have in-house capability. Although the purchase brings an important addition to Nuvei’s product portfolio, Payaut’s existing customers, especially Checkout.com, are unlikely to be happy about a key supplier passing into the hands a competitor.

EPOS Now, one of the larger ISV’s focused on small business POS, has bought Yoello, a mobile order and pay business. Yoello, based in Cardiff, had raised $10m but latest accounts indicate that meaningful revenues are some way off despite claims of 2m users. EPOS Now's interest is most likely in Yoello's payment institution licence which will give the ISV flexibility to develop its PF offer. EPOS Now is boldly describing itself as a "global leading AI-driven point-of-sale embedded finance platform" which may come as a surprise to customers who thought they were buying an ECR system.

Although Fintech fundraising remains challenging, money is still available for the right combination of product and management. Here’s a roundup of the last deals:

Cellpoint Digital, a London-based payment orchestrator focused on airlines, has raised $30m. This comes on top of $25m funding secured in 2022. Cellpoint hasn’t filed its 2023 accounts yet. In 2022, it made an operating loss of $19.4m on sales of $2.6m.

Honei, based in Barcelona, has raised €1.45m for a QR pay-at-table solution for restaurants. Honei, which sits on top of Stripe’s APIs, has processed 1m transactions in two years.

Torus, winner of last year’s innovation prize at the MPE conference, has raised an undisclosed amount. Based in Lithuania, Torus provides merchant acquirers with tools to correctly calculate scheme fees. It claims $1m revenues from ten customers already.

Pi-xcels has raised $2.7m for its one-tap digital receipt product which is now available on PAX, Ingenico and Newland terminals.

Norbr, based in Amsterdam, has raised €3m for its white-label payment infrastructure-as-a-service proposition to ISVs and PSP. Management says it’s on track to reach €10m revenues by 2027.

JUST, based in Paris, has raised €8m for its checkout solution which integrates with Shopify, Prestahop and other leading eCommerce platforms. JUST claims 500 merchants and 1m user credentials on file. The funding will pay for market expansion including a launch in the UK.

2023 was a good one for Poland’s payment industry according to the annual report released by Cashless Poland. Revenues of the top 100 companies grew 10% to €2.7bn. One of the fastest growing companies is PSP, the organisation behind Blik, the wildly successful mobile payment standard, which saw revenues up 50% to €74m.

Cashless, an industry-funded programme to widen card acceptance has been a great success. In its first five years of operation, over 685,000 POS terminals have been placed with 500.000 merchants. The scheme will now be extended to online merchants.

Scheming

The election of Trump 2.0 in Washington has accelerated political pressure to reduce Europe’s reliance on Visa and Mastercard. The ECB’s Piero Cipollone explained to the Committee on Economic and Monetary Affairs at the EU Parliament that people could only buy tickets to the Euro football tournament using American or Chinese means of payment.

Europe has many domestic schemes and mobile payment wallets which could form the basis for a continental response. The challenge is bringing them together with enough scale to challenge the global players.

Bancomat (Italy), Bizum (Spain) and MB Way (Portugal) have formed the European Payments Alliance which will provide interoperability between the three schemes. The members are looking for more national schemes to join the partnership.

One of these might be Bluecode, backed by four Austrian banks, which is an advocate of what it refers to as “payment roaming.” Bluecode is offering customers the chance to pay at any Discover enabled terminal with the transaction backed to an A2A transfer.

The CEO of the European Payments Initiative, promoters of wero, took to LinkedIn to explain why interoperability is a bad idea. She says EPI looked at this in detail before concluding that a better solution was to migrate national schemes to a single European one.

Figure 1 Photo: Nicola Breyer

Wero, which already incorporates iDEAL (Holland) and Paylib (France), announced its first eCommerce transaction and, to answer Mr Cipollone, this was made at the online store of FC Kaiserslautern. VR Payment and Atruvia (the IT service provider of the German co-operative banks) were behind the scenes. Discussing the advantages of accepting wero, the football club said “It is also European, which for a European Football Club is a key asset.”

Vipps, Norway’s mobile wallet, is the first national scheme to make contactless transactions using Apple’s NFC chip. At first, the service works with card terminals that take BankAxept cards (the Norwegian domestic debit scheme) but will be available for Visa/Mastercard before the Summer. Vipps plans to launch the service in Denmark, Finland and Sweden in 2025.

The three banks that own Vipps – DNB, Sparebank and Eika - have steadfastly refused to allow their customers to link their debit and credit cards to Apple Pay. This should give Vipps NFC capability a boost as there will be plenty of pent-up demand.

Mobile wallets will not only be competing with Visa and Mastercard but also with card-based domestic debit schemes such as Giro in Germany. Giro is fighting back with a new marketing campaign featuring a series of short scenes in which merchants congratulate shoppers on using a low-cost card. “The most beautiful of all the cards, better use Giro,” it says.

Giro quotes a Bundesbank study showing a typical transaction cost of €0.67 for its debit card compared to €1.70 for a credit card or €1.80 for cash. In total, Giro claims German merchants save €2bn by taking its cards. Jochen Siegert did the maths and concludes the figure is closer to €200m.

Meanwhile, PaySys has published a very helpful analysis of German payment terminals that answers a perennial question: how many POS don’t take international cards (ICS)? The answer is fewer than you’d think. Of 1.412m active devices, just 110K accept Giro only. And 42K of these are vending machines.

Turning to the international schemes themselves, UK’s Payment System Regulator has finally determined that “a lack of competition allowed Mastercard and Visa to increase their cross-border Interchange fees to an unduly high level.” Interchange charged to British merchants for EEA cards rose after Brexit from 0.2% to 1.15% for debit and 0.3% to 1.5% for credit. As a result, the regulator concludes British merchants are unfairly charged £150-200m each year and proposes to restore the 0.2%/0.3% levels as before.

There was better news for Mastercard as it settled a £10bn class action suit in the UK for just £200m. An extraordinary war of words then broke out between the solicitor representing the claimants and the American hedge fund that was paying for the litigation. The hedge fund thinks £200m is chicken feed and wants to hold out for more.

ISV

Software businesses are increasingly taking on the distribution role previously performed by banks and ISOs. ISV’s simply have much stronger merchant relationship than financial services companies ever will. Acquirers without strong ISV partnerships are going to struggle to onboard new SME customers and risk losing the ones they’ve got.

Here’s how strong relationships work in practice. Worldpay’s compliance team mistakenly deactivated the account of a large concert venue. The venue couldn’t sell tickets and was in real trouble. Worldpay’s client account manager was on annual leave and it took a few days before reactivating the customer. Meanwhile, the venue asked its ticketing software vendor for help and were immediately shifted to Adyen. Who owns the customer? The ISV does.

Hospitality software vendors are in particular demand for payment partnerships in 2025 because over half of restaurants are looking to replace or upgrade their POS software, The key drivers are “supporting omnichannel ordering” and “mobile ordering and payment integration.” Payment companies that can support these new use cases will be much in demand.

The growing interest in ISVs is sparking some serious research into this sector for the first time. An excellent report from PSE Consulting (working for Unipaas, a vendor of white label payment infrastructure) shows attachment rates of embedded payments at 70-90% compared to just 5%-15% with the old-fashioned referral model. PSE suggest acquirers should build in-house PayFacs to take advantage of the trend.

PSE Consulting also asks whether it’s time to retire the payment API. ISVs are reporting $1-3m spend needed to integrate with acquirers’ onboarding, reporting and support API’s and are complaining about the GDPR and other compliance requirements of the payment industry. Much better, say the consultants, to offer ISV’s the chance to white label the acquirer’s own tools.

Product

Stripe continues to churn out well researched product innovation, this month releasing an SDK that integrates its financial APIs into LLM (AI) workflows. There’s a long way to go but this could lead to a corporate travel bot that build itineraries, reserves travel and books tickets without any user intervention.

More tangibly, Stripe has launched a clever tool that allows merchants to A/B test different combinations of payment options. This should help settle arguments between retail marketers (who typically want to add every possible payment type to a checkout so as to maximise reach) and the finance team (who want to minimise the number of payment options to reduce administrative overheads).

If you sell online in the Netherlands, this well-researched deck from the Dutch Payment Association outlines the optimal payment page. Unsurprisingly, it suggests that iDEAL should always be at the top. Interestingly, 23% of Dutch shoppers say that having too many English words on websites makes checkout more difficult.

In its first product innovation since becoming an independent company once more, Worldpay is leveraging Mastercard Move and Visa Direct to offer instant refunds. HMV, the UK entertainment retailer, is named as the first client. A month after the announcement, there’s no sign of the product on the Worldpay website or any indication of pricing.

ABIMS, the largest acquirer in Ireland has begun selling eCommerce webshops “tailored for Irish SME’s” and provided by Dublin’s FCR Media. The price of €1900 set up + €76/month is eyewatering although merchants get a rebate of €750 if they process with ABIMS. There’s also a €9.75/month “PCI fee” charged to merchants for no obviously good reason.

Sticky, a UK start-up which uses NFC tags to transform any object into a point of sale, has deployed its technology at a restaurant attached to the Excel exhibition centre in London. The venue says it prefers NFC to QR codes for order-at-table because they are easier to keep looking nice and more secure.

Turning to wearables, PAGOPace, based in Cologne, is commercialising a range of payment devices including a bracelet and a ring that doubles a Tesla key. A payment bracelet sounds niche but might be handy if you wear gloves. Your Pago device links to any payment card stored in a Curve app. Fidesmo, from Stockholm, is supplying the payment infrastructure.

PAGOPace is also working with VNTR, the venturing arm of PostFinance, the retail banking division of the Swiss Post Office to test NFC chips glued to customers’ fingernails which link to the yellow Post Finance Mastercard debit card. This is even more niche than a payment bracelet.

Cashflows, a UK acquirer, is offering “programmatic payment technology.” Using capability from Raimac, a UK start-up, Cashflow’s merchants can offer shoppers the chance to specify their own flexible payment plans. It’s like a DIY BNPL solution but with AI.

In Softpos news, Elavon has stopped white labelling the SoftPOS.eu application following the Polish start-up’s acquisition by Worldline. Elavon is now working with PinAppAll, also based in Warsaw. Pricing is equivalent to €2.34 per month + 0.61% + 1.6c per transaction.

SoftPay, based on Copenhagen, has deployed its solution on Zebra CC600 Android tablets at branches of Coop supermarkets in Denmark. The tablets deliver self-checkout for the first time and are used by up to 60% of shoppers in some branches. Nets (Nexi) is the processor/acquirer.

Figure 2 SoftPay application on Zebra hardware

The Italian job

Installation of new gas pipes by a local authority in Switzerland accidentally brought down much of Italy’s consumer payment infrastructure on Black Friday. Construction workers cut connectivity from Worldline’s data centres in Lugano, leaving consumers unable to pay with cards, or use ATM machines. Nexi and Banncomat both send transactions to Visa and Mastercard via Worldine’s network and the incident raises questions about the country’s reliance on a single point of failure.

Banco BPM wrote to frustrated customers blaming both Nexi and Worldline for the outage but pointing out that its latest products (which use Numia) were unaffected. Revolut Italy issued a statement saying that it ran its services in-house and had no reliance on 3rd parties.

Open banking

The industry took heart from the publication of the UK’s National Payments Vision which discusses "unlocking account-to-account payments for e-commerce" while recognising that POS use cases are a long way off. Positively, the Government is eating its own dog food and boasts of having received 10m tax payments worth £33bn through open banking already.

Given the alphabet soup of regulators with fingers in the open banking pie, it’s helpful that the Vision clarified that the Financial Conduct Authority (FCA) not the Payment Systems Regulator (PSR) is responsible for regulation. The logic is that although open banking is payments, it is not a system. I hope that’s clear.

Whatever the regulatory outlook, the open banking customer experience needs work. Ryan Air is using Truelayer’s solution but as you can see from these screen-grabs, the payment flow is slow and clunky.

Some savvy innovators are looking to smooth the payment flow by investing new open banking checkouts. For example, Volume, based in London, just raised $6m for its one-click open banking checkout product built on Modulr & Yapily technology. The money will fund a payment institution licence and international expansion.

In financial news, Trustly, the largest A2A player in Europe, reported net revenue down 5% at €100m as management continued to clear up compliance problems that had led to a stiff fine from the Swedish regulator. .

It looks increasingly difficult to make money with open banking, even for the best regarded vendors. Yapily, based in London, saw revenues almost double to £5.05m in 2023 while operating losses were cut to “just” £11.4m. Employee numbers fell from 158 to 117.

Cash

Political pressure is growing in many countries to maintain both access to cash and the ability to use cash in shops.

Yet consumers are voting against cash with their wallets. Latest figures from UK Finance show cash transactions falling by 7% in 2023 and a 3% decline in ATM withdrawals. 22m citizens rarely use cash.

There are many legitimate reasons to retain cash such as resilience, charitable donations and supporting victims of domestic abuse. But it’s also the preferred payment method of business owners that don’t want to pay tax.

A Dublin taxi driver once explained to me at length how he kept two set of books – one for cash payments and the other for electronic payments. He told me how many sets of tyres should be booked against each one to allay suspicions at the tax office.

I was very pleased to learn that the last Dublin taxi driver still holding out against cash free payments has given in. Faced with losing his licence after 42 years, the driver agreed to carry a SumUp device.

As cash usage declines, the cost of cash acceptance rises to the point it quickly becomes uneconomic. Pay Association Netherlands estimates the cost to merchants of a cash transaction has risen from 29c to 61c since 2017 while debit PIN payments have remained at 17c.

Figure 3 Betaalvereniging Nederland

Crypto corner

2025 will certainly be the year of crypto. The industry has bought the incoming US government which plans to appoint Howard Lutnick, Tether’s point man in Washington, as Commerce Secretary.

Tether, a stable coin described by the Financial Times as “the criminal’s go-to cryptocurrency” and the favoured sanction-busting payment instrument of Iranians has sold $129bn of its tokens. The money received is said to be held in US Treasury bills but Tether has never been audited. What could possibly go wrong?

The VC’s are delighted by the likes mood change on Capitol Hill. Andreesson Horowitz, whose founder backed the Trump campaign, published its latest state of crypto report. The authors believe that stablecoins “have found product-market fit” by enabling fast, cheap global payments. Yet the CEO of Wise, which knows a thing or two about digital remittances, remains a sceptic as you can read from a recent analyst call.

There’s an open question about how payment companies will make money from stablecoins. If the price of international money transfers really falls to pennies, then where is the margin? It seems many are hoping to profit from selling stablecoins and lending the float to other crypto businesses. This sounds a lot like banking although without the regulatory oversight.

Here’s an advert from Bleap, a crypto platform which raised money last month. What could possibly go wrong?

In other news

Bluesnap, the Boston-HQ’d payment orchestrator, was fined €466,000 by the Central Bank of Ireland for mixing its own funds with those of its clients. In better news, the Italian regulator has allowed Lemonway, the French-based market place payment service, to begin onboarding new customers again.

Revolut is reported to be blocking DCC on its cards. Other issuers, annoyed at losing out on FX commission to the merchants and merchant acquirers may follow suit.

Donald Trump has hired the most successful CEO’s in the US payment industry for top jobs in the new administration. It’s easy to see the value Frank Bisignano, responsible for dragging Fiserv into the 21st century, could bring to running the social security administration. Jared Isaacman, the Shift4 CEO picked to run NASA has no scientific or engineering background but did pay Elon Musk $200m for a trip to space and back.

Wirecard update. A British court heard that Jan Marsalek, former COO of Wirecard and thought to be on the run in Russia, was a Moscow agent that recruited a group of Bulgarians to spy in the UK.

One way for merchants to avoid high fees is to pass them onto consumers in the form of surcharges. I was in New Zealand recently and was regularly charged an extra 2% if I paid with Apple Pay. I posted about this on LinkedIn and generated 165 comments from payment folk across the globe.

If you read one deck, read Ben Evans on “AI eats the world.” You will sound much cleverer afterwards even if the conclusion remains that nobody knows what’s going to happen next.

And finally

An Australian journalist inadvertently spent £55,000 on a pint of beer in a British pub. It’s cautionary tale of why you should never use a debit card for anything other than an ATM withdrawal.

Where to find me

I’ll be moderating a couple of sessions at MPE 25 in Berlin 18 -20 March and at the ePay Summit in London 21 May. Come and say hello.

Here’s a discount offer from the organisers if you register for MPE right now.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com