Happy New Year and welcome back after the festive break. From SoftPos to open banking, it’s going be a fascinating year for the payments industry. There’s much to talk about so feel free to share this newsletter with your colleagues and business contacts.

The Payments Business

JP Morgan is struggling to turn market share gains into revenue. Positioned at the commodity end of the processing market, JPM’s volume has been outpacing its competitors since 2017 (see chart) but turnover has been lagging. From data presented at a recent Investor Day, I calculate JPM generated just $1.25bn revenue on its colossal $2 trillion volume in 2022. Worldpay, with a similar total volume processed, recorded sales of $4.8bn in the same year.

JPM’s management doesn’t see scope for increasing prices. Instead, it wants to grow profit margins by commercialising developer-friendly value-added services and expanding outside the US, especially in Europe. JPM modestly told analysts that merchant acquiring was “still work in progress” and that it remains committed to investing in product and distribution.

A key part of JPM’s European expansion plan was the $800m it spent to buy 49% of Viva Wallet. Less than 12 months after the deal, the US bank had already fallen out with its new partner. Two of JPM’s board directors resigned and Haris Karonis, Viva’s founder and CEO, replaced them with his own people. Viva has expanded from its mPOS roots and the resignations are said to stem from management’s decision to process payments for a Greek adult entertainment channel. A golden rule of M&A is “don’t do joint ventures” but, if you must, always take a majority stake.

“Dark clouds are gathering over European payment firms” according to Jefferies, a research firm out to generate headlines over the festive season. On closer reading, most of the gloom centres on the general economic outlook rather particular issues with individual businesses. The exception is Worldine which the analysts believe faces “multiple company-specific headwinds.” It’s no surprise that Worldine is reportedly considering asset sales or investment from Credit Agricole to shore up its sagging share price.

Nexi escapes criticism and continued its consolidation of the Italian market with the acquisition of Cassa di Risparmio di Bolzano (Sparkasse) merchant services business for €30m. Meanwhile, Worldline has gained direct access to the local PagoBANCOMAT scheme which will make it a more attractive partner for small Italian banks such as Banco Fucino, which sold its merchant acquiring unit to the French payments giant last year.

And in Spain, Redsys, which routes payments on behalf of over 60 financial institutions, shocked the nation with two outages in November. These were the company’s first failures in 12 years.

Payment investors everywhere will be cheered that Stripe is finally making money ($). Revenue has rebounded after a quiet 2022 while costs have been kept well under control. Sales to enterprise customers are going particularly well although there’s a clear risk of over-reliance on a few key relationships. One analyst suggests Shopify alone accounts for one third of Stripe’s payment volume.

Meanwhile, here are five signs you’re ready for an alternative to Stripe. Number one is “you’re tired of talking about how expensive Stripe is.”

London based SumUp which claims 4m small businesses customers in Europe, the Americas and Australia has raised €285m fresh funding at a valuation of €8bn. The cash will be spent on widening the product beyond mPOS to broader financial services and expanding beyond its current 36 international markets. SumUp now claims to have positive operating cashflow.

You’ll find the Dojo branded PAX A920 machines everywhere in the UK. The business has been a remarkable success story, having tripled revenues to £300m in just two years. Dojo is now expanding to Ireland and Spain but will need to move fast to outpace the imminent refinancing of its £500m debt mountain.

Raypd’s controversial CEO has made waves in Iceland with his vocal support for the Israel government’s war in Gaza. Two large merchants have already announced they will boycott the processor. It’s certainly an opportune moment for Adyen to enter the Icelandic market, announcing a partnership with Straumur, part of Kvika Bank, which claims 25% market share.

In more good news for the Dutch processor, Adyen announced a deal to become the acquiring bank for Klarna across Europe, North American and Asia.

Card-linked loyalty

I’ve never been quite convinced by card-linked loyalty, a market in which most vendors struggle to make money. In the UK, the most successful is Reward Insight which powers the NatWest current account reward programme. It generates over £40m sales and is profitable. Other start-ups are struggling. Bink has lost £67m over eight years and FidelAPI lost $22m on sales of less than $4m in 2022.

The sector is not dead yet. Nice-based Izicap, which has a clever SME proposition sold in partnership with Bank Populaire, Credit Agricole and Nexi is still trading and hasn’t yet exhausted the €15m raised in 2022. And I’ve been impressed with Krowd, a London-based start-up with a strong merchant proposition that powers some Amex offers programmes.

Brexit bonus

Outside the EU, the UK competition authorities have discovered a backbone. The Payment Systems Regulator (PSR) is reviewing cross-border interchange fees paid by UK acquirers on card-not-present transactions from Europe. Before Brexit, EU regulations kept these fees at 0.2% for debit cards and 0.3% for credit. Freed from the dead hand of Brussels bureaucracy, Visa and Mastercard increased them to 1.15% and 1.5% respectively, generating a handy extra £150-£200m annual Interchange for issuing banks in the EU. The PSR says “we have not seen any persuasive evidence to indicate that the increases were necessary or appropriate” and is expected to re-impose the previous Interchange level.

Paradoxically, the PSR says it has no interest in regulating Interchange flowing the other way, from EU merchants to UK issuers. British banks will be happy. European merchants less so.

Converging national schemes

Europe seems finally to be getting its act together with alternative to its risky reliance on Visa and Mastercard. The European Payments Initiative (EPI) – a consortium of French, Germany and Benelux banks - is making good progress building an account to account (A2A) wallet. EPI just made its first transaction between customers at Sparkasse Elbe-Elster in Germany and Banque Populaire in France. The wallet, brand name “wero”, will be launched this year with technology is based on EPI’s acquisitions of iDEAL and Payconiq.

EPI is a northern European initiative but there’s a similar move in the south of the continent. Spain’s Bizum, Italy’s Bancomat Pay and Portugal’s MB Way have agreed to allow customers to make instant payments across each other’s networks. The three mobile payment solutions carried a total of 1.47bn transactions in 2023 on behalf of 43m people so there could be considerable demand for the service.

The national debit schemes are also working on inter-operability. French integrators FrenchSys and Elitt have partnered with Lavego, a Munich-based network operator, to bring Girocard acceptance to standard FRv6 terminals. These are supported by all French acquirers and this move could help Giro gain wide acceptance in France. The move underlines Giro’s ambition to move well beyond its narrowly defined German debit heritage.

New Shopping

We’re tracking the growth in autonomous stores in case because this could spark the long predicted shift in transactions from the merchant’s devices to the shopper’s phone. If so, it could have profound implications for European merchant payments.

SSP, a catering company, has opened autonomous stores at Dublin and Oslo airports. Shoppers tap a payment card on a PAX IM30 unattended terminal at the entrance before picking up sandwiches or other purchases from the shelves. Planet (the acquirer) makes a pre-authorisation and generates a token which is sent to Zippin, the Californian vendor providing the store software platform, camera and sensors. On exit, the final basket is calculated and Zippin sends a payment request to Planet.

There’s a fine line between an autonomous store and a large vending machine. Carrefour has opened an 18m2 fully autonomous shop near Brussels airport. Shoppers need to have downloaded the Carrefour BuyBye app before entering the shop. Reckon AI, a Portuguese start-up, is providing not only the technology but also helped design the outlet.

Autonomous stores need sophisticated artificial intelligence to spot product sold loose, such as fruit and vegetables. Aldi says 3/10 customers buying loose products won’t use conventional self-checkout machines so it is piloting automatic recognition of fruit and vegetables in Cologne using Diebold Nixdorf’s “Vynamic Smart Vision” product.

As consumer frustration with badly implemented self-checkout machines grows, this use of AI a potentially great way of helping customers and cutting costs at the same time. Shoppers take 15 seconds to select the right fruit or vegetable from the menu, but the AI can do this in just 3 seconds.

Retail is about choice as much as convenience which is why we’re seeing merchants offer multiple checkout options in physical stores. For example, some Tesco convenience stores are now offering four choices – staffed, traditional self-scan checkout, Magic Tills (which tell you what’s in your basket but you pay on the terminal) or GetGo (scan a QR at the store entrance and just walk out with payment automatically billed to your account). Trigo is providing the sensor technology.

Wearable payments

Advances in provisioning card credentials are making it easier to turn any object into a payment device. There’s a lot going on in the industry although it’s doubtful whether any of these ideas will get beyond niche use cases as long as we’re all carrying a phone in our pockets.

SmartChip Switzerland has demonstrated a contactless enabled fingernail (see video) working with Infineon and Digiseq, a UK vendor which claims the leading platform for managing remote card credentials. Dave Birch, Digiseq’s chair, explains how it works. Digiseq and Infineon have also worked on a pre-certified ring-inlay which jewellery producers can build into their products.

In Poland, Invispay has launched a range of payment-enabled watch straps priced between €99 and €299 which can be provisioned with card credentials from a number of local banks. Wearonize, a Swiss fintech-as-a-service, is providing the technology.

Tapster is a Swedish start-up also looking to turn personal objects of various kinds into payment devices. Working with Fidesmo as its technology partner, Tapster is supplying a payment ring to customers of Italian bank, Intesa Sanpaolo. The devices use Mastercard tokens.

I’m still not convinced but I’ll let Tapster’s CEO makes his (quite entertaining) case.

Product

One of the reasons for Worldpay’s recent underperformance has been the lack of a convincing international retail offer so the creation of WorldPay Omnichannel as a partnership with FreedomPay is good news. This proposition brings together Freedom Pay’s POS and Worldpay’s eCommerce gateways through a single integration with common tokenisation across the platforms. HMV, the British entertainment retailer, is the first customer, taking Worldpay Omnichannel for its Dublin and Antwerp stores.

Elsewhere, Worldpay’s British merchants have facilitated a total of £10m charity donations via its integration with Pennies, a 3rd party service that rounds-up POS transactions to the nearest pound. Given that Worldpay has been working with Pennies since 2011 and that the Pennies integration is used by 14 of its largest merchants, £10m does not sound very much. I’m not criticising Worldpay, and £10m is very welcome for the charities that have benefited, but there may be better ways of persuading shoppers to make more meaningful donations.

Channel partners are doing interesting things with Clover. EatPOS (which does what you think it does) has turned Clover into a kiosk for fast food restaurants.

Mastercard and Visa’s attempts to introduce sonic branding never caught on but Paytm in India is making $150m pa from subscriptions to its Soundbox service which gives merchants audible confirmation that payments have arrived.

Wesub, a Polish start-up, is looking to become the Klarna of subscription commerce. Wesub takes ownership of the product at point of sale and is responsible for collecting payments from the consumer. The business has recently expanded into France and Switzerland.

Pay Eye, another Polish start-up, has launched in the USA with its biometric payment product and is getting good media coverage.

Two new value added services for POS terminals are tipping and digital receipts. Matt Jones looks at the culture of tipping and the implications for payment products. Vendors to watch include TiPJAR in the UK and Béné in the US.

Digital receipts are attracting attention, especially since the French Government finally implemented a partial paper receipt ban in August 2023. Hat tip to Pi-xcels, on winning the Worldine Payments Challenge in Paris with its clever way of passing a receipt to the shoppers phone without needing an email address or number. “No app just tap,” they say.

Group payments is another growing category. People need help dividing payments for shared holidays or electricity bills. Collctiv is an early leader, having processed £37m from 160K pots and 800K users. Users can settle with Apple/Google Pay or PayPal. The business has expanded to the US following its participation in Techstars New York. A combination of Ryft, a marketplace payment specialist, and Stripe handle the processing on a fintech-as-a-service model.

Regulators are getting tough on fintech as a service start-ups following the high-profile failure of Railsr and others. The moral for customers is that outsourcing compliance sounds great but you’re only as good as the supplier you choose. If they make mistakes, you could be in trouble.

SoftPOS

SoftPOS enables any Android or iOS device to accept card payments. This presents vendors of ruggedised handhelds an obvious upselling opportunity to their existing retail customers. Zebra, the industry giant which boast over 10,000 channel partners has announced its first SoftPOS customer. Thom Group, the French jeweller is implementing the solution in 600 stores and says it will help staff break free from fixed till points. Softpos will be running on 1,000 Zebra EC50 mobile terminals. Rayonnance acted as integrator with Axepta BNP Paribas as the acquirer.

Courier delivery is also proving fertile ground for SpoftPOS. PolCard (Fiserv) is implementing its solution with DHL delivery drivers working on behalf of the Media Expert electronics retailer. PolCard’s PolGo application is integrated with Media Expert’s own software on the DHL device.

The value of Softpos in many markets is reinforced by the growing availability of soft fiscal printing. Again in Poland, Worldine has launched combined Softpos, ePOS software and soft fiscal printer on one Android device. The fiscal software comes from Wirtualne Kasy Fiskalne, a Polish start-up whose name helpfully translates as virtual cash register. There’s a general solution for retail and very niche one one for vending machines at car washes

Open banking

The deadline for setting up the body to oversee the development of open banking in the UK has been postponed once again. We’re now expecting it to go live towards the middle of the year with the first deliverable – the snappily titled “non-sweeping Variable Recurring Payments” (VRPs) – unlikely to appear until Q3.

The industry is pinning its hopes on VRPs, which could replace both direct debits and recurring card payments, so the delay is not helpful. This is a complicated domain and it’s worth reading this very good explanation of VRPs – UK and EU versions – from Ben Rattue at Token. It’s clear this payment type is not yet ready for prime time. As Grant Evans from acquired.com politely puts it “some of the use cases being sold are significantly ahead of roadmap forecast and legislative deliverables.”

PSD3 offers grounds for optimism but won’t move the dial in the short term. Jan Van Vonno from Tink engagingly explains its the new regulations likely impact on open banking in just three minutes.

Maybe 2025 will be the year open banking goes mass market. It’s not going to be 2024.

For widespread adoption, we need clear use cases that add value to merchants and shoppers. For example, many airlines reject Revolut cards because they are pre-paid. In response, the bank fintech has launched Revolut Pay for Airlines which converts Revolut card transactions into A2A payments. This advantages both consumers, who get 1% cashback, and airlines who receive a guaranteed payment. Revolut Pay would make a great application for open banking payments.

POS payments might be another. Kevin, a well-funded Lithuanian fintech, is the first to develop open banking payments at POS via NFC. Here the product team explains how it works.

Yet even if/when volume accelerates, there remains the question of how anyone’s going to make money from open banking. The European Payments Council has published default fees for “premium” open banking services which range from 2c-4c per transaction. The tariff for the Euro equivalent of VRPs, for example, would be just 2.72c. That’s not much. Massive scale will be needed to generate meaningful profits.

Cash

The latest annual payment survey from the British Retail Consortium shows cash usage growing for the first time in many years, from 15% to 19% of their members’ transactions. The BRC thinks this is “reflects a choice by many households to use cash to budget more carefully.”

Nevertheless, many merchants are going cash-free and this is worrying policymakers, especially in the UK, Sweden and the USA where LA is the latest US city to bans cashless stores. Washington DC, which also passed a rule obliging merchants to accept cash, has begun enforcing the new regulation. One restaurant owner, anxious about robberies, is refusing to comply. “Even if I have to gather a couple of violations, I don’t think you can really put a dollar value on the safety of the staff and the guest,” he said.

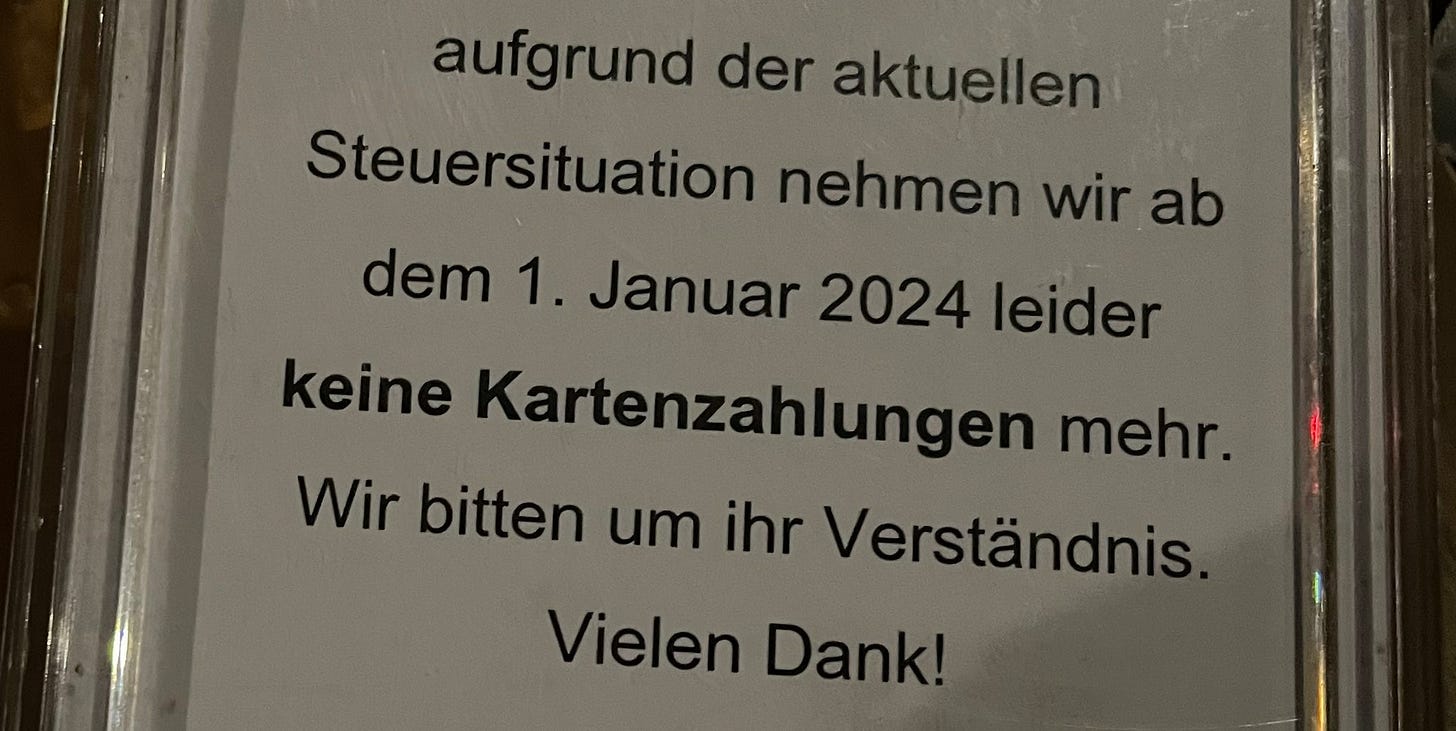

Meanwhile, in Germany one cafe put up this sign “Due to the current tax situation, we will unfortunately no longer accept card payments from January 1, 2024. We ask for your understanding. Thank you!” This “tax situation” may be that VAT is reverting to pre-Covid levels or maybe that the restaurant does not want to pay any tax.

Credit: @ted_knudson

Crypto corner

We’ve certainly come a long way in 12 months. Last February, a far-sighted individual paid $1.6m for this Bored Ape NFT jpg. It’s no ordinary monkey. The million dollar ape features “solid gold fur, with a multicolour grin, service uniform and heart-shaped glasses”. Priceless.

The bubble is over. Bored Apes are on offer around $60K as I write.

In CBDC news, British MPs have warned that plans for a digital pound (known as Britcoin) should proceed with caution, saying: "The extent of the benefits is unclear… nor is it yet clear that a digital pound is the only (or best) means of achieving them." Other than that, they think it’s a great idea. Meanwhile, the Bank of England has hired Diana Carrasco, head of merchant services at Lloyds Bank, to head the project.

Other news

Looking to the New Year, here’s a collection of 140 trend decks compiled by the world’s top analysts. AI is everywhere but it’s like Crypto and Metaverse never happened. As Groucho Marx might have said, “here are my forecasts. If you don’t like them I have others.”

Benedict Evans gives an entertaining presentation discussing AI and concludes that nobody knows what’s going to happen. And if Ben doesn’t know, nobody does.

Maybe Sebastian Siemiatkowski has the answer. Klarna’s CEO has implemented a hiring freeze, saying that AI productivity tools inevitably mean he will need fewer staff.

With dogged determination, Wordline is ploughing on with its Metaverse strategy, announcing “season two” of its Metaverse Shopping Hub. The product is now available for Decentraland and Spatial. And through PayOne for DACH markets. If anyone every makes to the end of season two, please let me know.

It’s 2024 and you can finally pay an Italian motoring fine with a card. But only before 1pm or on Tuesday and Thursday afternoons. Nexi is providing payment acceptance for this piece of flawless customer service.

The new Polish Government has ditched plans requiring all cash registers to be integrated with a payment terminal.

The UK regulator is cracking down on hundreds of firms with unused EMI or PI licenses. It suspects that unscrupulous firms are maintaining FCA authorisation “purely to add credibility to their unregulated activities.” Over 300 firms have applied to cancel their permissions. Something similar is happening in Poland.

Also in Poland, the regulator is unhappy with Euronet’s sneaky ATM fees.

EasyPark Group (owner of RingGo and ParkMobile) sold by BMW/Daimler to private equity investors in 2021 has been hacked. Customer data including partial PANs was stolen.

Latest Wirecard news. The former CFO has been charged with fraud while EY (the auditor that missed the fraud) had a mixed month. The accountants avoided an investor lawsuit but are being sued for €1.5bn by the liquidator.

Where to find me

If you liked this newsletter, you can hear me guesting on Worldline’s Navigating Digital Payments podcast. The team have given an enormous head once more.

And I had the great pleasure of moderating a webinar for MPE featuring two giants of central European payments – Ralf Gladis, CEO of Computop and David Rintel, CEO of Trust Pay.

And you can meet me in person at MPE in Berlin. I’ll be moderating panel discussions on financial inclusion and customer experience.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com