The Payments Business

Rapyd, the global acquirer/fintech is reported to be raising $300m at an unexpectedly low valuation of just $3.5bn. The additional capital will go towards an unspecified acquisition and comes soon after its $610m purchase of the least interesting parts of PayU. The new valuation is well below the $9bn set in 2021 and will make its slated IPO in 2026 harder to achieve.

IPOs aren’t always a positive, especially if private equity funds are selling stock. Paysafe, the high-risk acquirer and pre-pay wallet provider, was originally listed on the London market but taken private by Blackstone/CVC for $4bn in 2017. These giants floated Paysafe in New York in 2020 at a market capitalisation of $8bn. Since then, the shares are down 80% (see chart) and management is now looking at divestments and/or selling the whole business to to another private equity fund. This sort of corporate ping pong enriches lawyer and bankers but does nothing for customers.

Checkout.com generated the wrong sort of headlines as fintech journalists focused on the poor financial results of one of its UK trading entities. Checkout comprises several businesses in different countries which often trade with each other and are ultimately wrapped up in an offshore holding company. There’s no way of telling how well it’s doing from the regulatory filings of one entity.

Fighting back, Checkout put out a release claiming worldwide revenue grew 40% in 2024. And the business is profitable on “an adjusted EBITDA” basis which I was told means cashflow positive. Following the termination of its relationship with Binance and OnlyFans, crypto/adult traffic now represents less than 5% of Checkout’s sales.

Checkout claims 40 merchants processing over $1bn, well behind Stripe’s 100, but impressive nonetheless. These numbers are not audited but are consistent with feedback I’ve had from the market. Checkout is certainly winning business from the incumbents and competing head-to-head with Stripe and Adyen.

It's good to see Worldpay spending money again after its wilderness years entombed within FIS. The deal to buy Ravelin Technology, the London-HQ'd fraud specialist, will give Worldpay something new to sell to its enterprise clients.

Ravelin has top quality management and good technology but there really isn't much money in fraud screening. Despite a stellar client list that includes Spotify and Deliveroo, Ravelin had only managed to achieve £15m annual revenues and may have needed refinancing soon. Merchants increasingly expect the service free of charge with their payment processing bundle. Meanwhile, Elavon (which recently signed with Ravelin) will likely need to find a new fraud vendor or risk Worldpay being able to view its customer list.

DNA Payments Group has made good progress with building a UK SME proposition from a series of acquisitions, notably from fast-growing revenue streams from acquiring and additional payment volume from new ISV partnerships. But 2023 accounts show significant losses continuing. Read more on the Business of Payments blog.

The JP. Morgan vs Haris Karounis litigation, centring on a $2bn difference of opinion about the valuation of Viva, continues but has moved from London to Athens. The US banking giant is now claiming €916m damages from Viva’s founder following the creation of this troubled mPOS joint-venture. Both parties accuse the other of bad faith but it's the lawyers that will likely win this one. For those interested in Regulation K of the Edge Act, 1919, the full UK judgement is now available.

In other banking news, Unicaja, the sixth largest in Spain with over 900 branches, has chosen Fiserv as its merchant payment partner. This is a good win for Fiserv and gives the American giant a bank partner in Spain for the first time.

It’s been a busy month for fundraising news. Here are the highlights:

Flatpay, the fast growing Danish POS-focused payment facilitator, has raised a further €58m to support market expansion, taking total fundraising to €120m. Investors claim Flatpay is “the fastest growing Danish startup ever.” And there’s a new TV commercial in which Danes say “Flatpay” and “no brainer” to each other.

Flatpay already has 150 people in its Berlin office with 50 more to be recruited this month and is actively hiring staff in Italy. The proposition is based on a PAX A920. There’s a simple price plan although the flat rate of 1.49% in Italy isn’t particularly competitive. Shift4 is the acquirer/processor.

Flatpay isn’t the only new entrant to Italy. Dojo has opened an office and Qomodo, based in Milan, has raised €13.5m (€48m in total) to build out its POS payments solution for high ticket SMEs such as dentists and vets. Qomodo claims 2.500 merchants are using its PAX A920 Pro, of which 20% take an in-house BNPL product. Transactions are keenly priced at 0.95% for international cards and 0.49% for Bancomat.

Dublin-based Nomupay which was formed out of the ashes of Wirecard's SE Europe and Asia businesses, has raised $37m at $200m valuation bringing the total capital received to $90m. Management says Nomupay will be profitable this year on $20m recurring revenue from 1,600 merchants. The new money will go on M&A.

Zurich-based Tiun.io, has raised €2.5m for a clever pre-pay micropayment solution for online publishers. 50 titles are already on board. Consumers link Apple Pay, PayPal etc to the wallet and set maximum monthly spend limits per publication. Tiun solves a genuine problem for the media industry and should do well.

Berlin-based Nevermined has raised $4m to develop payment products for AI agents to pay other AI agents. If the future of business is going for lunch while our bots sort out the details, I can’t wait.

In regulatory news, BAFIN, the German regulator, has turned up the pressure on PayOne. Worldline’s joint venture with the local savings banks has previously been accused of lax money laundering controls and will now host a “special representative” sent by the regulator to oversee improvements in its onboarding processes.

Scheming

2024 ended with yet another storming quarter for the American schemes in Europe. Combined Visa and Mastercard payment volume rose 15% to €1.325bn with Mastercard (benefiting from winning the Unicredit portfolio) again marginally outperforming its arch-rival.

Both Visa and Mastercard have finally begun promoting Click to Pay, a digital wallet viewed as their competitor to PayPal and Apple Pay. So far, Click to Pay has failed to excite the industry but Mastercard has launched a clever marketing campaign. It’s based on problems faced by people living in towns with long names when shopping online. No prizes for guessing which Welsh village features prominently.

It would be wrong to write off Click to Pay too soon. JustEat’s product manager posted on LinkedIn that 10% of its manual card entry traffic in the UK opted for Click to Pay, delivering 3ppt increase in conversion.

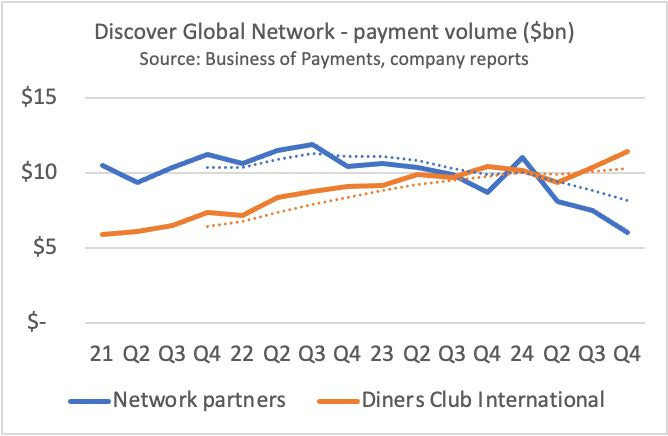

Away from the major schemes, Discover’s global network, built at considerable expense, is going nowhere. Worldwide transaction payment volume from its 25 alliance partners, such as RuPay and SIBS, was down 30% in Q4. It’s time for a rethink. Capital One, which is in the process of acquiring Discover, has the chance to make something of this underused gem which offers acceptance at millions of stores and websites around the world.

MPE Conference

We’re rapidly approaching the MPE Conference, Europe’s leading event for merchant payments which is held in Berlin on 18-20 March. There’s a comprehensive conference programme, exhibition and lots of networking. MPE is a place to do deals. It’s a friendly event and delegates are more likely to take a meeting than at many conferences. Readers of Business of Payments get a 10% discount by using the code mpe-10off at the checkout. Book here.

ISV

Small businesses are increasingly buying payment processing as a bundle with their software. Acquirers/PSPs need to either partner with the software vendors (ISVs) or start commercialising their own business software. I discussed the latest trends with Charlotte Al-Usta from Flagship Consulting on this MPE podcast. Click on the picture for the video version or listen to the podcast here.

Shift4 sells its own software called Skytab, counts one third of US restaurants as customers and has just launched in the UK, bundled with a payment terminal and processing contract. The UK is a crowded market for hospitality software, but Shift4 will be hoping its supersized American-style sales commissions will turbocharge growth. Its network of self-employed agents can expect to earn up to twice what competitors such as Dojo and Global Payments are paying. The Shift4 team tell me that Germany is next on their list.

MyPOS is also moving into proprietary software, having bought Toporder. This Lyon-based ePOS vendor serves 700 small speciality food outlets such as bakeries with its iPad application. This is the first significant move by MyPOS since it was acquired by Advent, a giant private equity group, last year.

Less ambitiously, Worldline will be reselling WIX webshops to its SME customers in Europe and Australia. WIX already claims over 200m merchants and over $1.5bn annual revenues so it’s not clear what Worldline will add to the proposition.

ISVs can be demanding partners for payment processors. They need their merchants onboarded swiftly with no hidden surprises, flawless customer service and transparent pricing. A growing band of start-ups are looking to supply the specialist payment infrastructure that helps ISVs and PSPs to work together.

For example, Unipaas, founded by the former Safecharge management team and based in London, offers payment facilitation as a service to eCommerce ISVs. Management claims 20 ISVs connecting to 75,000 merchants. Nuvei and JPM are the acquirers.

Investors are alive to the need for ISVs to have a strong payment offer. Nelly, a Berlin based software business focused on management of healthcare practices, just raised €50m. It offers integrated payment processing via Adyen. Terminals are free and POS transactions are charged at just 0.99%.

New shopping

The latest generation of autonomous stores no longer require shoppers to use apps or online payments. This is good news for vendors of conventional payment terminals and monoline card processing.

The world’s largest autonomous store, covering 1,200 square metres and 10,000 products, has opened in Portugal. With technology from Lisbon-based Sensi, customers of the Continente Bom Dia supermarket in Leira don’t need to check in or download an app. They simply fill their baskets, confirm their purchase total and pay on a standard card terminal at the exit. It’s a remarkable technical achievement which brings together 1,676 cameras and 2,000 scales. The promotional video is cool. This really could be the future of grocery.

Portugal is a hotbed of new shopping technology. Rekon.ai, based in Porto, has announced a partnership with IKEA for an autonomous microstore in London. In these implementations, shoppers scan their credit or debit card at the entrance and are automatically billed when they exit the shop.

Analysts suggest that 2025 could be the year of the smartcart, an interesting compromise between self-checkout machines and fully autonomous stores.

A2Z, based in Israel and one of the leading vendors, has secured orders for 30,000 carts from Casino, the French supermarket and has high hopes for a massive deal from Carrefour. Analysts estimate the monthly subscription cost of a smart cart at $150 which they say is “peanuts” compared to the potential revenue from selling advertising on the smartcart’s integral screen. This may be true, but supermarkets are ferocious negotiators and unlikely to let a tech vendor see much of this upside.

Turning to biometrics, PayEye, a Polish start-up, is using iris scanning to combine automatic payments with age verification. The first customer is a five star hotel. PayEye, which is working on the project alongside Mastercard, reports 60% of triallists would use the service if offered elsewhere.

JP Morgan showcased two new biometric payment devices at the NRF Show in New York. The Paypad and PINpad both include face and palm recognition. You can see more in the video.

SoftPOS

SoftPOS is going mainstream. Volumes are growing rapidly and enterprise implementations coming thick and fast.

DPD Poland has completed an 11.000 device roll-out of SoftPOS. The payment application sits on the courier’s Zebra handheld terminals and is used to take cash-on-delivery. There’s no need for a separate payment terminal. Planet Pay (no relation of Planet Payment) is behind the solution.

Worldline has announced a similar project in France with GPX Logistics while claims the Spanish postal service has 20,000 devices using its SoftPOS application today.

Despite almost doubling sales in 2024 to €1.9m, Munich-based Rubean is not growing as quickly as investors had hoped and the stock price is down 31% over the last 12 months. However, Rubean is steadily winning new customers such as Deichmann, the German shoe retailer and management has raised an extra €0.9m for expansion into Latin America and the US.

A small group of vendors has begun providing in-store payment acceptance to ISVs using SoftPOS to combine ECR and payment terminal in a single device.

SoftPay, the Copenhagen based SoftPOS vendor, is running its app on an iMin Swift 2 Android tablet integrated to Winsolution software at this Oslo barber. The device looks and feels like a conventional payment terminal but is much cheaper and more flexible.

StringIQ offers SoftPOS based payment acceptance as a service to ISVs. It claims 6,300 merchant sites live across Europe. StringIQ works as an ISO for Rapyd and Cashflows.

Amsterdam-based Klearly is focused on providing hospitality ISVs what they need to offer payment acceptance to their merchant customers. Klearly, which says 4,000 merchants use its SoftPOS application just raised €6m to expand to new European markets.

Mastercard is testing a further use case of SoftPOS that would enable shoppers to make eCommerce transactions by tapping a payment card on their own phone. This idea has been around for a while but, so far, has been viewed as a solution looking for a problem. Mastercard’s pilot will allow diners to pay at table by tapping their payment card on bills generated via a Hong Kong restaurant booking app.

Finally, it’s farewell to Phos. One of the SoftPOS pioneers, the London-based vendor was bought by Ingenico in 2023 and is now renamed Ingenico SoftPOS. Ingenico says the new identity “embodies our commitment to innovation and our vision for the future of payments.”

Openbanking

Let’s start with the good news.

A total of 224m open banking payments were made in 2024, 74% higher than the previous year. This includes 3.6m British people paying His Majesty’s Revenue and Customs a total of £12bn to settle their tax bills, up 36%.

Despite the robust growth, open banking accounts for a tiny fraction of the 48bn consumer payments made annually so there’s plenty of upside here. The problem facing the payment industry is that there’s no prospect of volumes rising quickly enough to cover their fixed costs. Jeremy Light has done the maths and believes open banking offers “slim pickings today” with transaction fees typically just £0.2/€0.25.

If that weren’t enough, Martin “money saving expert” Lewis, who regularly tops polls as Britain’s most trusted man, has warned against using open banking for “big important transactions.”

Lack of consumer protection is the problem, not just from bankrupt airlines but also from scammers. As bank transfers move from considered purchase to reflex action, there’s more opportunity to trick people into sending money to criminals. For example, days after beginning to accept Venmo (a US A2A standard), fraudsters began to “deceive and defraud” Jet Blue customers.

Banks, already worried about their increased liability for fraudulent A2A transactions, risk setting open banking fraud controls so high that they reject many good transactions. The CMO of VibePay, an open banking vendor, shared his frustration at Lloyds Bank continually blocking A2A as suspected fraud. If an individual’s first open banking payment doesn’t go through, it’s going to be hard to persuade them to try again.

In vendor news, Tarabut, a leading Saudi open banking vendor, acquired London-based Vyne for its technology platform and is already closing down Vyne’s UK operations. The business did have some decent customers, including Marks Electrical, but revenues were likely to be less than £1m and Vyne had lost a total of £13m by March 2024.

Saudi Arabia is fast becoming a very interesting market for open banking as you can read in this excellent analysis by Jas Shah. He concludes that Jeddah has imported the UK regulations and made them better.

Cash

The UK Government has rightly decided not to oblige businesses to accept cash. The decision is most appropriately left to business owners who are best placed to weigh the costs of cash acceptance against the extra trade it may bring. Meanwhile, cash usage does seem to have grown a little, mainly due to worries about the high cost of living.

With politicians across Europe worrying about how to maintain access to cash, here’s a great idea from Switzerland. Sonect provides consumers with an app that turns store checkouts into a virtual ATM. It’s helpful for people who need cash and gives retailers some extra footfall. 2,300 sites are live in its home market and Sonect has expanded into Italy.

Crypto corner

Trump 2.0 has given full backing to crypto and is planning to roll back what limited regulations the Biden administration had imposed on the sector. There’s loads to worry about. Even established crypto tycoons are concerned that a return to the “wild west” will cause blow-ups that harm the legitimate parts of the industry. As Benedict Evans put it “combining borderless decentralised software with money” will only result in a further explosion of scams and bubbles.

Paul Krugman may be harsh in saying that crypto is for crime but it’s certainly best for gambling, not investing. Football fans are easy marks and could easily confuse trading crypto with sports betting in this commercial from Bitpanda, the new sponsor of Paris St Germain. What could possibly go wrong?

Readers of Business of Payments will be most interested in whether consumers will want to use crypto currencies to buy stuff in shops or from websites. I’m sceptical. If the price of Bitcoin only goes up, why spend it?

Nonetheless, luxury brands often do accept Bitcoin. As one put it, selling expensive handbags to crypto-millionaires can help them “diversify their asset portfolio”. Lyzi, based in Paris, is probably the leading vendor and claims 120K points of sales live with its crypto-acceptance solution including Printemps, the department store. Merchant pricing starts at a chunky 3% which would make many retailers think twice before adding a crypto button to their checkout pages.

There’s renewed investor interest in crypto-acceptance. London-based Helio Fintech, whose plug-in allows merchants to accept crypto and get paid in dollars, sold itself to MoonPay for $175m. That's a punchy price for a business processing just $1.5bn volume from 6,000 merchants. Transactions start at 2%.

Turning to central bank digital currencies, the USA has ruled out setting up a digital dollar, leaving the field clear for the Eurozone and China. The ECB certainly believes a digital Euro is necessary to respond to the proliferation of dollar based stablecoins and help secure the continent’s strategic autonomy. The Bundesbank agrees and is hiring a 30-40 strong team to work on the project.

Michael Salmony has taken a thorough (and quite amusing) look at what the ECB needs to do to make a success of the digital euro. The first step is to agree what problem it’s trying to solve. The second is to align incentives – banks, consumers and merchants – so that all actors get value from the new currency.

In other news

Digital River, which acted as merchant of record for many SaaS vendors, has closed with the loss of over 100 jobs. The Irish arm of the business, which generated 31% of global revenues, is in liquidation with some clients “catastrophically impacted” by its sudden demise. Precipitous business failures are rarely completely unforeseeable. The Register reported on Digital River’s increasingly erratic behaviour last October.

Klarna's CEO says a robot could do his job. "I am not necessarily super excited about this," he explained. Meanwhile, The Dutch Parliament is considering banning BNPL at POS, warning that it can lead to vulnerable people accumulating too much debt. Klarna would be the primary loser.

Here’s an excellent roundup of the Polish payment landscape from Marcin Mazurek

A remarkable 13% of Americans admit to first-party fraud such as falsely claiming a delivery was stolen while one third of Brits say they have stolen from self-checkout machines.

Polish police took 860,000 motoring fines by card payment last year on portable terminals provided by eService (Global Payments).

Criminals used malware to intercept one-time passwords and send stolen card credentials to a smartphone operated by a mule stationed by an ATM. Police arrested “a suspiciously masked man withdrawing money from a cash machine in Prague for a long time.”

Activists in Iceland continue to target sports groups sponsored by Rapyd, the processor whose CEO has been vocal in support of the Israeli action in Gaza. The front door of the Icleandic Sports & Olympic Federation was covered in stickers reading “Rapyd supports Genocide”.

And finally

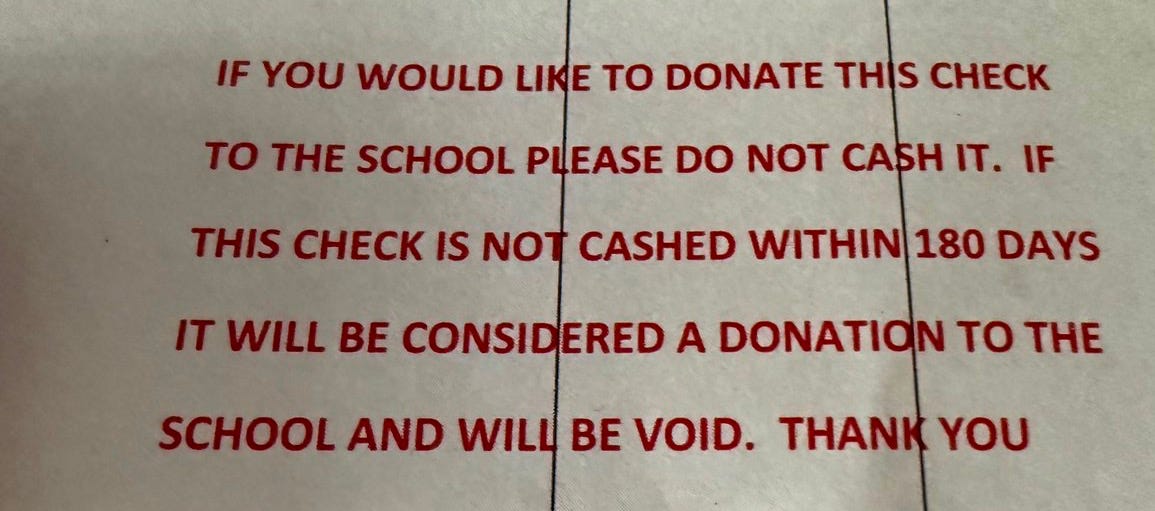

Yay for cheques. Can your payment method do this? (Hat tip Scott Wessman)

Where to find me

I’ll be at the the Shift4 Investor Day in Las Vegas on February 18, at MPE 24 in Berlin 18 -20 March and Money 20/20 in Amsterdam 3-5 June.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com