Welcome to the fourth Business of Payments newsletter.

If you find the content useful, please forward to your colleague. But first, let me take the opportunity to wish you and your families a very Happy Christmas and a prosperous New Year.

Business of Payments

JP Morgan announced that it had already processed an eye watering $2 trillion in 2022. With a train set this big, it’s no surprise the US banking giant has hired a “head of platforms and rails” to drive its locomotive forward. In response, European must accelerate the formation of groups large enough to compete with JPM’s vast economies of scale.

Worldline and Nexi, both hyper-aquisitive, are probably Europe’s best hope. Worldline is reportedly in pole position to buy Banco Sabadell’s Spanish merchant acquiring unit for €300-350m. This would give Worldine a strong position in Iberia for the first time.

EVO Payments (shortly to be taken over by Global Payments) has concluded its JV with National Bank of Greece. This market has been the focus of intense deal making as local banks have sold or partnered with international players including Euronet, Nexi and Worldline. JP Morgan is also present through its Viva Wallet business and is hiring 50 staff for an Athens-based payments R&D centre.

Shift 4 Payments still hasn’t concluded the long heralded acquisition of Finaro. The presence of a sanctioned Russian oligarch on the target’s share register is reportedly the cause of the delay. Meanwhile, the US processor doubled down on its commitment to European expansion by spending $126m on very low profile Swiss payment gateway called Online Payments Group. Trading as Securion Pay, OPG was targeting mainly high-risk merchants. Here’s a blog post from the CEO which includes a great many percentages but very few numbers.

Also taking advantage of the strong dollar and low European tech valuations, Bluefin has bought TECS, an Austrian POS payment gateway with a strong client list, notably in unattended payments The deal brings Bluefin a full payments stack for the first time.

Payments downturn?

FIS is the only established processor yet to announce job cuts. Its new CEO blamed the macro-slowdown as she promised $500m cost savings. Away from the industry giants, Rapyd is reported to be reducing its team by 10% with its CEO, Arik Shtilman taking a combative approach:

“…we had to let go of the irrelevant people. We conduct ourselves the way we think we should and if it bothers some people, that's their problem. It really doesn't interest us. Our financial performance is excellent and that's why investors really like what we do.”

Open banking start-ups have also been reducing headcount with many having invested too much, too early. Truelayer was the first. Now Plaid is cutting 20% of its staff. Management blamed the economy rather than its own inability to change consumer payment behaviour as quickly as investors demanded.

Winter may be coming soon for dLocal, an emerging market payment gateway which trades through a UK company listed on NASDAQ, regulated in Malta and with an HQ in Uruguay. Muddy Waters, the outspoken US short-seller, believes something is fishy. dLocal’s management refute multiple allegations of poor financial practice but haven’t helped matters by admitting to losing $6m of stablecoins in the FTX collapse. They explained that the tokens were held “to move funds out of one African country in a bid for efficiency." Well, that’s alright then.

Product news

The softPOS ecosystem is coming together. New use cases are arriving and 2023 should be the year the technology finally reaches the mainstream. A great example is Danish Railways replacing several different hardware devices used by train guards with one Android tablet running spoftpos. The technology suppliers are Softpay (a Danish start-up) and Nets.

Global Blue has widened its tax-free shopping service to include click and collect for the first time. Working with Venistar, an Italian retail software vendor, merchants can offer international shoppers the ability to order online, have products sent to their hotel and still reclaim the VAT.

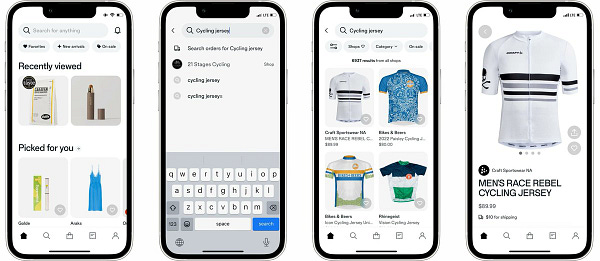

It was an obvious next step but the news that Shopify is moving towards becoming a marketplace came as a surprise to many. Consumers will relish the chance to shop across its million merchants through a single interface. Some retailers (who think they are simply renting a Saas eCommerce platform) may wonder whether this is quite what they signed up for. Disintermediation beckons.

New shopping

The blurring of channels and extension of online purchase tools into physical retail threatens to upend traditional merchant/acquirer relationships. For example, Checkout.com, an online payment specialist, has won the in-store scan and pay business from supermarket Sainsbury. Its eCommerce skills have given it a bridgehead into a long-standing Barclaycard account. Sector diversification is good news for Checkout as its reliance on Crypto may be one reason for the sharp reset in its valuation from $40bn to $11bn

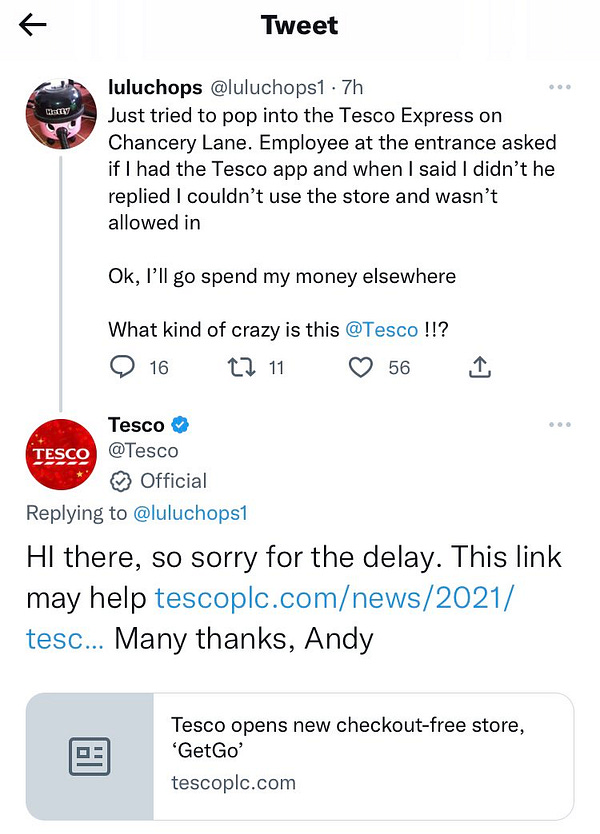

Amazon is extending its walk-out shopping products to include hospitality. Here’s a great use case at a basketball stadium that helps fans quickly purchase drinks and snacks without waiting in line. Not everyone is comfortable using the Amazon app and retail outlets will need to remain inclusive as Tesco is discovering.

We all have share an in ensuring that electronic money does not leave sections of society behind. It’s pleasing to see Thales begin to address the challenges faced by blind and partially sighted people that use payment cards in store. This innovation might also offer way for PIN on glass to be used by people who can’t see the keypad.

Mastercard’s carbon calculator is to be available as an API within the Nexi Pay platform. Cardholders will see the amount of CO2 generated by their purchases and to buy offsets if they wish. Swedish fintech Doconomy is providing the service. Credit to Nexi for bringing this first to market as it will certainly help win issuing clients.

Tik Tok is huge. Tik Tok shop, first launched in the UK, will most likely be huge too. Today, Tik Tok shop is an affiliate network which takes 5% commission for driving sales to merchants’ websites. In the long-term, it’s probably inevitable that Tik Tok will end as yet another marketplace. This will drive an even greater share of online retail transactions into fewer and fewer processors, underlining the need for consolidation.

In contrast, ten years after launch Alexa is increasingly looking like a legacy product and is reportedly losing Amazon several billion dollars this year alone. People love voice commands for playing music. Not so much for shopping.

Crypto corner

There’s little I can add to FTX-related commentary other than to say it would be a profound mistake to extend financial services regulation to crypto. Any words from the Financial Conduct Authority, SEC or similar would legitimise the category as an investment. Crypto is gambling (and many think there’s nothing wrong with that) but it should be regulated by the same folk who oversee casinos.

I’m still surprised how far the schemes were mixed up with this madness. In October, Visa announced a global debit card agreement with FTX only to terminate this in November but the reputational damage was done. People trust Visa. It needs to be much more careful about the brands it associates with.

With the European Central Bank describing Bitcoin’s recent dead cat bounce as “an artificially induced last gasp before the road to irrelevance” it takes a true optimist to put more money into this sector. Here’s one. Anglo-Polish Ramp just raised another $70m to help it “provide developers with a non-custodial payment infrastructure that allows for the collection of digital assets from exchanges and then embedding them into other platforms.”

Just as Teflon span out of the original space programme, I’m still hoping that something useful will come out of crypto. It’s not Ramp, but if you’ve found anything, please let me know.

I’ll leave the last word with a Polish Bitcoin ATM operator called, without observable irony, Shitcoins Club. It has a four star rating on Google Reviews.

Open banking

Just like softpos, we can now discern the open banking ecosystem emerging through the hype, although adoption in retail payments is likely to be painfully slow. Changing payment behaviour at POS or checkout takes time and requires clear consumer benefit. For open banking payments, there are still too many questions about returns, refunds and consumer protection for the technology to be ready for the mass market.

But there are some interesting niches appearing already. One of these is instant payouts for gambling. Truelayer is enabling Bet City to push winnings instantly to customers’ accounts. These payments can take three or four days by standard bank transfer.

Another is where the payer doesn’t know the payees bank details. Teneo is using NatWest’s Payit openbanking API to send money to creditors of insolvent companies.

There’s also been some movement on extending open banking payments from online to POS. Kevin, the well-funded Lithuanian fintech, has launched an SDK to accept openbanking payments on in-store POS terminals. Worldine and Switchio, a Czech terminal manager, are the first partners.

In other news

The UK Payment Systems Regulator fined Barclays £8.4m, helpfully reduced by 30% for prompt payment. The offence was not providing sufficiently detailed information on card transaction fees as required by the Interchange Fee Regulation (IFR). Compliance fines are a cost of doing business in banking and this one is pretty small. The British bank was hit with a £50m penalty the previous month for a Qatar related scandal.

The future of cash is a becoming a political football with ministers in different countries taking widely divergent views. The Central Bank of Nigeria has put a limit of $45 a day on cash withdrawals from ATMs with the goal of promoting use of internet banking and of its own digital currency, the eNaira. Meanwhile, the new populist prime minister of Italy would like to water down existing requirements for small businesses to accept electronic money.

Here’s a very good round up of the state of retail payments in the US from NRF. TLDR everyone is still paying with cards.

In case your boss is asking for a New Year strategy deck, I recommend a very helpful set of 2023 tech predictions from Activate Consulting and this very sensible discussion of the metaverse from Ben Evans.

About Business of Payments

Having spent the last ten years working for two of Europe’s leading merchant acquirers, I’ve set up this newsletter and the associated blog to provide the sort of information I would have found useful in my old jobs. Get in touch, let me know what you think and feel free to suggest new topics to cover.

I’m also available for short-term advisory and consulting assignments.

Geoffrey Barraclough

geoff@barracloughandco.com