Having spent the last ten years working for two of Europe’s leading merchant acquirers, I’ve set up this newsletter and the associated blog to provide the sort of information I would have found useful in my old jobs. Get in touch, let me know what you think and feel free to suggest new topics to cover.

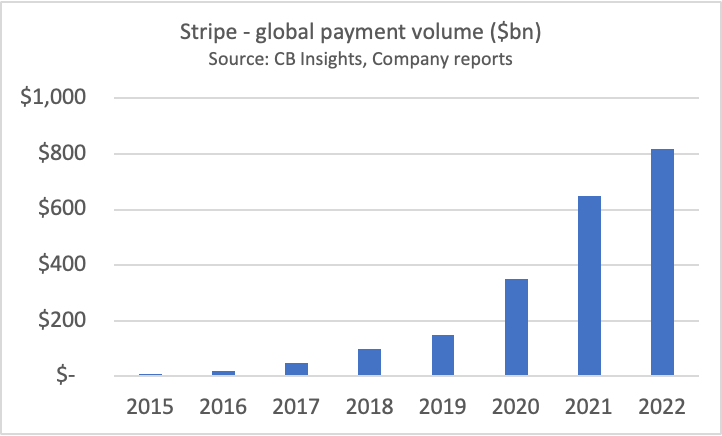

Stripe’s annual letter revealed the payments giant processed $817bn in 2022. Growth is moderating - up “just” 26% compared with 2021 - but Stripe is still gaining share. And the pace of product development hasn’t slowed. 244 “user facing features” and 336 API updates were shipped in 2022. How many acquirer/PSPs can say the same?

Stripe began life servicing small businesses. Now it boasts 100 customers that process >$1bn. It’s not just eCommerce acquirers that need to worry about Stripe. The push into POS has been successful too. Stripe is now connected to over 100,000 terminals worldwide.

While Stripe publicly announced layoffs in November, Checkout.com is “rightsizing”more quietly. The London HQ’d acquirer has been losing senior execs and is said to be “reducing its overall headcount gradually.” One insider told Sifted “we are seeing 20 to 30 deactivations a week. Every team apart from sales has been losing people.”

Would Checkout list in London or prefer New York? Some argue that the UK stock market is best avoided having delivered a number of dud IPOs. Here’s another one. Network International, the Middle East and Africa-focused acquirer spun out of Emirates Bank, revealed it was considering a takeover bid that would take the business private. The market cap at flotation was £2.2bn. Four years later, even with the takeover boost, the valuation is just £1.9bn. Mastercard took a $300m stake at the IPO. This raised a few eyebrows as it’s unusual for networks to extend their reach into merchant acquiring. Mastercard now looks to have lost money on the deal.

In Italy, Worldine concluded its acquisition of Banco Desio’s merchant services business. This brings 15,000 merchants, 19,000 terminals and €2bn payment volume. The unit will be merged into Worldline’s existing Italian JV company, formed after it bought Axepta last year. Worldine’s increased presence will tighten the competitive pressure on Nexi, the local champion.

Meanwhile, BPM Bank of Milan has brought in Bain to advise it on selling its merchant acquiring interests. It’s no surprise that Worldine and Nexi are the likely purchasers. Whoever wins will have to contend with an Italian government intent on cutting fees paid by small merchants. Its proposals are to exempt transactions under €10 from any fees with reduced amounts payable between €11 and €30.

In Poland, local press reports that Fiserv is considering divesting Polcard, a business it acquired in 2007. SIBS and Worldine are the likely suitors. With over 200,000 POS terminals, Polcard would be a good acquisition for either brand.

Landsbankinn is launching merchant acquiring in Iceland with RS2 Software behind the scenes. The bank says it will be offering the island’s first omni-channel payment service. This may come as a surprise to Borgen SaltPay and Valitor Rapyd.

Start-up news

Irish orchestration start-up, WhenThen, has been acquired by French marketplace payment specialist, Mangopay, for an undisclosed sum. It’s a good deal for Mangopay. WhenThen’s CEO will become the company’s Chief Product Officer.

One to watch. Czech start-up Flowpay seems to have cracked how to scale merchant cash advance and has quietly raised €30m loan capital. Flowpay already has integrations with local platforms Shoptet and Dotycacka.

Bink, a high-profile card-linked loyalty busines backed by both Barclays and Lloyds banks has raised an additional £9m “funding lifeline” which will keep the service going until early 2024. Card-linked loyalty is a tough category to make money from. It’s an intuitively attractive proposition beset with quasi-insuperable operational challenges.

Merchants are always complaining about Stripe’s high prices. Is there space for a cheaper Stripe-lite competitor? You have to admire the chutzpah of London-based Ryft which just raised £1.2m to rival Stripe with a payment proposition for platforms “without the high fees and lengthy pay-out wait times.”

Product

In a boost for biometrics, Payeye from the Polish city of Wroclaw, has signed a distribution deal to sell its technology through 100 branches of Co-op bank. Payeye offers double authentication - eyes and face - and is getting pretty good customer feedback as you can see from the video.

ISVs and platforms want to grow their share of the payments value chain, in part to enhance customer experience but also to grab more of the profits. It’s not always straightforward. The CEO of fast-growing UK marketplace, Onbuy, explained that a project to become a “merchant of record” with Nuvei “consumed almost all of our web development capacity and meant every single team has struggled to get anything done.”

Onbuy’s travails might have been eased by the emergence of the new category of payfac-as-a-service propositions. These take much of the development and compliance burdens away from the ISVs and platforms. The first European example I’ve seen is from Cardstream, a well-regarded white label gateway.

The French Government has postponed, for the second time, its “anti-waste” law promoting digital receipts at POS. Business lobby groups had protested about the administrative cost of going digital. Consumer organisations complained that merchants would short-change their customers if not obliged to print receipts.

Further delay may prove fatal to this environmental initiative but proposals in France and elsewhere have sparked innovation. Paris-based start-up KillBills raised $4m for a card-linked solution in which a digital receipt shows up in your banking app. Pi-excels from Singapore showed a very innovative solution at the MPE conference. The receipt jumps straight form the payment terminal to your browser (pdf) without needing to give the merchant any personal information.

Mastercard is finally retiring Maestro due mainly to the difficulties of moving the product to the online world. It will be replaced with Mastercard Debit which, according to CMSPI, could cost merchants an extra 10bps of scheme fees. This will be a particular issue in the Netherlands where Maestro is the dominant debit scheme. Higher costs for retailers may be outweighed by more sales to international visitors who have long been frustrated by having their cards rejected by Dutch merchants who wouldn’t accept Mastercard.

Direct-to-issuer models send authorisations straight to the schemes, cutting out the merchant acquirer. Here’s a great post from Sandra Mianda looking at the pros and cons. It’s easy to see how the model benefits the schemes and payment orchestrators but direct-to-issuer could be disastrous for acquirers. They will be left with fewer ways to differentiate or add value to merchants.

There’s a ready market for solutions to help merchants reduce the costs of chargebacks but, according to an FTC complaint (pdf), US vendor Chargebacks911 has taken things a little too far. Where consumers disputed recurring transactions because they’d never agreed to buy a subscription, Chargebacks911 falsified screenshots to prove that they had done.

The company challenged 168,000 chargebacks on behalf of just three merchants, all subscription vendors. And when dispute rates crept too high, Chargebacks911 ran large numbers of phantom low-value transactions using pre-pay giftcards. These artificially reduced chargeback ratios to levels acceptable to the processors. The FTC says that Chargebacks911 billed $6m for this service at $1-$2 per transaction.

New shopping

12 months after its launch, Amazon is struggling to make progress with Buy-with-Prime. The proposition is very expensive for merchants, taking fees of 20%-40% and is actively resisted by Shopify. The world’s largest eCommerce platform takes a dim view of merchants that add Buy-with-Prime, sending this message: “You have a code snippet on your storefront that violates Shopify’s Terms of Service. This script removes Shopify’s ability to protect your store against fraudulent orders, could steal customer data and may cause customers to be charged the wrong amount.” Some might call that passive-aggressive but it makes the point.

Amazon’s high and rising prices (see below) are also creating headroom for start-up marketplaces to grab a share of its business. Many of the new competitors are listed in the excellent Marketplace 100 report from Andreesen Horowitz. This should be the prospect list for any ambitious PSP. Download the document and give it to your sales director.

Open Banking

Talking to vendor sales reps at the MPE conference, it was clear that 2023 will not be the year open banking payments becomes mass market, even in the UK which is ahead of other European countries. One of the many issues is that there’s no agreement about what to call the product. Each bank has chosen its own brand. Some write “pay with bank app” while Barclays merchants are presented with “Bank Pay” and Natwest’s by “Pay It”. The UK tax authorities refer to “Pay by Bank Account.”

Persuading consumers to change payment behaviour is always hard but the UK open banking industry is making life unnecessarily difficult.

Many in the sector are pinning their hopes on Variable Recurring Payments, a new open banking feature that replicates direct debits. Natwest just announced Williams, a builders’ merchant, as its first client. But VRPs don’t come with the “direct debit guarantee” which gives consumers the confidence to give businesses the right to pull money from their accounts.

VCs seem anxious. A new report by Coadec counts £2.3bn raised by UK open banking start-ups but says that early promise won’t be fulfilled without political commitment to statutory regulation. My view is that we need a payment scheme wrapped around the open banking APIs. The industry should move decisively to put this in place rather than pleading for Government to rescue the sector from its collective indecision.

With investors in open banking API aggregators wondering whether they will ever get their money back, Forrester has published a helpful report reviewing the many Open Banking Intermediaries. Vendors are advised to focus on “adding value” rather than hoping for click fees from billions of transactions that haven’t happened yet. Forrester’s evaluation puts Tink and Plaid in the top right quadrant. Token, which is focused purely on payments, gets marked down for its narrow product offer.

The European Payments Initiative is also struggling to launch a product but has at least produced a new logo with “an optimistic colour palette.” How do you pronounce EPI? “We like to say “Epi” as one word,” the marketing folk explain“, but are more than happy for it to be spelled out as “E.P.I” too.” I’m glad we’ve cleared that up.

Metaverse

Like Blockchain, I understand the metaverse when people explain it to me. Also like Blockchain, as soon as I try describing it to anyone else, I find myself repeating an incomprehensible soup of buzzwords.

However you define it, the metaverse is sliding ungracefully into the trough of disillusionment. In the last month, Disney eliminated its metaverse division, Walmart withdrew from Roblox and the UK’s national mint dropped plans to coin NFTs. All three initiatives had been launched with some hoopla but now won’t see the light of day.

New research shows that even US teens are shunning virtual reality. Of those with headsets, only 4% use them daily. We’ve been down this road before. People want technology to surprise and delight. Nobody wants to put gadgets on their heads.

In other news

A man was arrested in Indonesia for putting fake charity QR codes in public places. Locals thought they were donating to help a mosque but were actually transferring money to the thief. I’m surprised this doesn’t happen more often. QR’s are horribly insecure.

US retailer Target has shifted 20% of payment volume from Visa and Mastercard to its own RedCard. It’s an impressive performance which saves 2% merchant service fees on $20bn of sales. How has it done this? It offers 5% consumer discount on products bought with RedCard. That’s a bold business case.

Saltpay, the very well-funded European payment roll-up, has rebranded itself as Teya, pronounced Tay-uh. This means “joy”, according to its Chief Commercial Officer. Dealing with multiple software and payment systems drains the joy from small businesses, he says, and Teya plans to restore it.

A perennial question is whether retailers are obliged to accept cash. Here’s a good round up of the position in each European country from Edgar Dunn.

Enfield, on the outskirts of London, holds a special place in payments history as the location of the world’s first ATM. The local branch of Barclays now boasts a gold ATM and has been placed on the nation’s list of historic buildings.

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com