Having spent the last ten years working for two of Europe’s leading merchant acquirers, I’ve set up this newsletter and the associated blog to provide the sort of information I would have found useful in my old jobs. Get in touch, let me know what you think and feel free to suggest new topics to cover.

Business of Payments

Wall Street is speculating whether Stripe will go public this year although latest rumours are that, instead, it will raise $4bn privately at a $55bn valuation. Projections of $1 trillion annual payment volume would place Stripe at the first rank of global processors alongside JP Morgan and Worldpay.

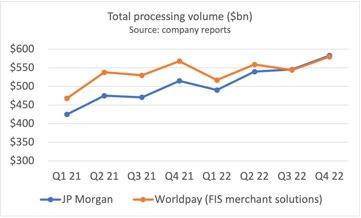

Worldpay is now looking forward to its future as an independent company. FIS said it would spin off the world’s largest merchant acquirer only three years after buying the business. FIS is making a $17bn write down on the $43bn purchase price. I’ve written about this in more detail on the blog. FIS’s new CEO said she was unable to allocate sufficient capital to keep Worldpay competitive. This is underlined by how fast it’s been losing ground to arch-rival JP Morgan.

Here are some of the other highlights of the Q4 2022 results season. For more details, click through to the Business of Payments blog.

Mastercard is closing the gap with Visa in Europe.

Despite the name change, Square Block has stopped talking about Bitcoin and begun focusing on financial discipline. International volume at Square was up 23%.

Worldline reported strong performance in merchant services as acquisition synergies deliver top and bottom line growth.

Shopify merchants processed $34bn through Shopify Payments in Q4. That’s 56% of all sales and shows that 3rd party processors are being steadily squeezed out.

Adyen reported net revenue up 30% in H2 2022. Management has its “gaze fixed on the horizon” despite deteriorating margins. Investors are cautious about its apparent commitment to growth at all costs.

PagoNxt, Santander’s payment unit, grew volume a very impressive 38% in Q4 and reported a maiden operating profit.

Fiserv confounded sceptics who question the synergy of running bank and merchant-facing processing under the same roof. It reported 9% revenue growth as “a unified company that is better than the sum of its parts.”

Euronet, operator of 50,000 ATMs, maintains that cash still has a future. Its group turnover was up 7% despite Benidorm Council ordering the removal of its cash machines in a row over excessive DCC fees.

GoCardless – a UK based payment unicorn, reported losses widening to £61m in 2021 on revenue up 44% to £70m. Merchants love the proposition but profitability looks out of reach for the moment.

Corporate activity

Nexi beat Worldline in the auction for Sabadell’s merchant acquiring business. Nexi will take an 80% stake at an enterprise value of €350m with an EBITDA multiple of 11.5. This is good deal for Nexi which brings 16% share of the Spanish market.

The Italian market is also fast consolidating. Unicredit, the second largest bank, is looking for a partner for its payments business although readers may roll their eyes. It’s not the first time this has been announced. Banco BPM is also said to be considering selling its merchant services arm, probably to Nexi.

Goodbox, a UK based charity payment specialist, has exited administration in a rescue deal led by TipTap, the Canadian microdonation business. It’s hard to make money from charitable giving at POS as the amounts are so small. Goodbox has processed just £10m in donations from 6,650 devices set against £2.3m investment from shareholders and £9m of loans from Future Fund, the UK Government’s pandemic business support scheme.

Domestic schemes

Giro, the German debit scheme, is making serious efforts to build its online offer although local experts think it may struggle to cut through the clutter of a typical German checkout page.

Bizum, originally a P2P money transfer service founded by a consortium of Spanish banks, has partnered with Discover to get acceptance at 60,000 POS merchants by the end of 2023. This is great news for Discover and welcome validation of its business model of selling access to it rails to local schemes. At the time of writing, it’s not clear how the Bizum POS customer experience will work.

Blik, the Polish mobile payment standard processed almost $20bn in 2022, accounting for 60% of all eCommerce transactions in that country. Blik is taking share from “pay by links” - local bank transfers - rather than cards. The newly launched Blik POS payment service processed $200m volume in Q4 2022.

New shopping

The store of the future will likely be packed with options for paying through your phone. Payment processors need to be partnering with the new technology vendors making this happen.

This video of Zara’s new flagship store in Madrid shows innovative use cases creating “card not present” transactions even when buying in a physical outlet.

It’s a similar story in grocery. Żabka Group of Poland has opened its 50th checkout free store. And in the US, shoppers will soon be able to use their Instacart app (normally used to order home deliveries) to scan and go inside convenience stores.

Israeli start-up Shopic has a neat way of turning any shopping cart into a smart cart using a clip-on scanner/sensor that detects items entering and leaving the trolley. Shopic has deployed over 2,000 of these devices. It says stores offering the carts are doing 12-15% of revenue through Shopic. That’s 12%-15% less available to the POS.

Amazon was the pioneer of checkout-free stores but now has started offering three ways to pay – scan the QR code to “just walk out”, tap a payment card at the exit or pay at the till in the traditional way. Choice is wonderful for shoppers but underlines the need for a single, underlying payment infrastructure handling POS and mobile transactions.

Direct-to-consumer is also disrupting the old models of payment processing. Unilever reported that DTC now accounts for 15% of sales and is growing at 23% annually. Nike says that direct channels generate 40% of sales and all its revenue growth. Shopify will likely be one of the winners from DTC and announced that Mattel will move all its brands to Shopify Commerce Components, the Canadian platform’s new enterprise service.

Product

BNPL may have become mainstream online but adoption at POS has been slower. Integration issues are always a concern which is why Ingenico’s deal to include SplitIt as an option on its app store is welcome. But many high ticket retailers want to sell their own finance packages from which they earn significant commissions rather than pay high transaction fees to Klarna or its competitors.

Checkout.com reduced its valuation estimates sharply earlier year but has since won two deals which demonstrate the broad attractiveness of its platform. After poaching Sainsbury from Barclaycard, it has added Newday, a credit card issuer, to its client list.

Walmart has launched a “text to shop” service. It’s been built in-house and seems an inelegant way to buy groceries. Techcruch found the technology not ready for prime time.

Reimagination Technologies has launched a service which sends secure payment links from Whatsapp and is available to Cybersource and Nuvei merchants.

SoftPOS

Although we’re seeing regular product announcements, there’s been little hard data yet on sales and volumes. Everyone knows that SoftPOS will be big but it’s not clear how long investors will need to wait for a return.

Rubean, a German software vendor, is one of the early market leaders. Its PhonePOS product forms the basis of Sparkasse POS, sold by the network of German savings banks. Sparkasse SpoftPOS pricing is €19.95 set-up plus 0.89% for Girocard and 2.69% for international cards. The set-up fee is very important otherwise there’s a risk of opening thousands of merchant accounts that never trade.

The Sparkasse are targeting micro-merchants but PhonePOS will also be sold by Computop to its enterprise clients.

Stripe, which launched the first iOS Softpos last year, has now unveiled the same service on Android. The product operates on Stripe Terminal and is not cheap. Tap to Pay transactions are billed at 10c per authorisation in addition to the standard fees of 2.7% + 5c per successful transaction.

Phos, a Bulgarian Fintech claims 19 acquirer connections. Expansion in North America is always tough so the announcement of a first US customer, Thrive Payments, a Massachusetts ISO, is good win.

Openbanking

The UK was the earliest market to adopt open banking payments and transactions are rising swiftly albeit from a very low base. 68m payments were made in 2022. This is a positive start but still tiny in comparison to the 3bn real time payments made each year in the UK. It’s going to be a while until the large field of open banking API aggregators start making a return on their investments.

What will make this market grow? In my view, it needs an industry body to wrap “scheme rules” around the APIs to guarantee a consistent customer experience backed with proper consumer protection. Open banking also badly needs an acceptance mark. But opinions differ and there’s a lively debate between industry parties about whether the market, left to itself, can deliver the best outcome.

Crypto Corner

The UK Financial Conduct Authority revealed that 85% of crypto-asset firms failed its minimum standards for anti-money laundering. These standards are not a high bar to jump as Yevgeny Prigozhin’s mother can testify.

Meanwhile, the British Government still wants to accelerate crypto regulation as a financial asset class. A better bet would be to pass the dossier to the Gambling Commission which might do better than just sending a “warning letter” like those dispatched to Bitcoin ATM operators in Leeds.

The SEC is taking matters more seriously. It has barred Kraken, a crypto exchange, from a practice known as staking which “not only offered investors outsized returns untethered to any economic realities, but also retained the right to pay them no returns at all.” Undeterred by toothless British regulators, Revolut offers an apparently similar service with “up to 11.65%” interest paid.

Despite the chaos, Binance is still trading and still striking deals with established players who should know better than to get mixed up in this boondoggle. In Brazil, Binance is launching a pre-pay Mastercard. What could possibly go wrong? In France, Ingenico has partnered with Binance to offer crypto acceptance at POS which makes a nice headline but probably won’t drive much volume. Consumers want to use crypto for gambling not paying for stuff.

Other news

An 18 year old wins investment in the Dragons Den for his personalised payment card business. The dragons were unaccountably excited by the proposition of cutting the chip from your bank issued card and sticking it on a new one manufacturered with your chosen design.

A wealth of statistics about the Polish payment market from Cashless.pl. Cashfree Poland has overseen the deployment of 562,000 payment devices processing over €12bn so far. Run it through Google translate if you don’t read Polish.

Another great Ben Evans presentation that will help you look clever in front of your boss. This one tackles the reshaping of commerce now that the era of free money is behind us.

Get in touch

You’ll catch me next at MPE in Berlin at the end of March speaking on embedded finance, ISVs and the opportunities for merchant acquirers. In the meantime, get in touch if you’d like to share views on the payment business.

Geoffrey Barraclough

geoff@barracloughandco.com